Key Highlights:

- HEICO Corporation (HEI, Financial) achieves record Q2 financial results with significant growth in operating income and net sales.

- Strategic acquisitions, including Rosen Aviation LLC, are expected to boost earnings.

- Analyst price targets suggest potential stock price movement.

HEICO Corporation (NYSE: HEI) has reported impressive Q2 results, marked by a 19% surge in operating income and a 15% increase in net sales. This growth is attributed to a combination of 14% organic expansion and strategic acquisitions. Notably, the acquisition of Rosen Aviation LLC is poised to positively impact earnings within the next fiscal year.

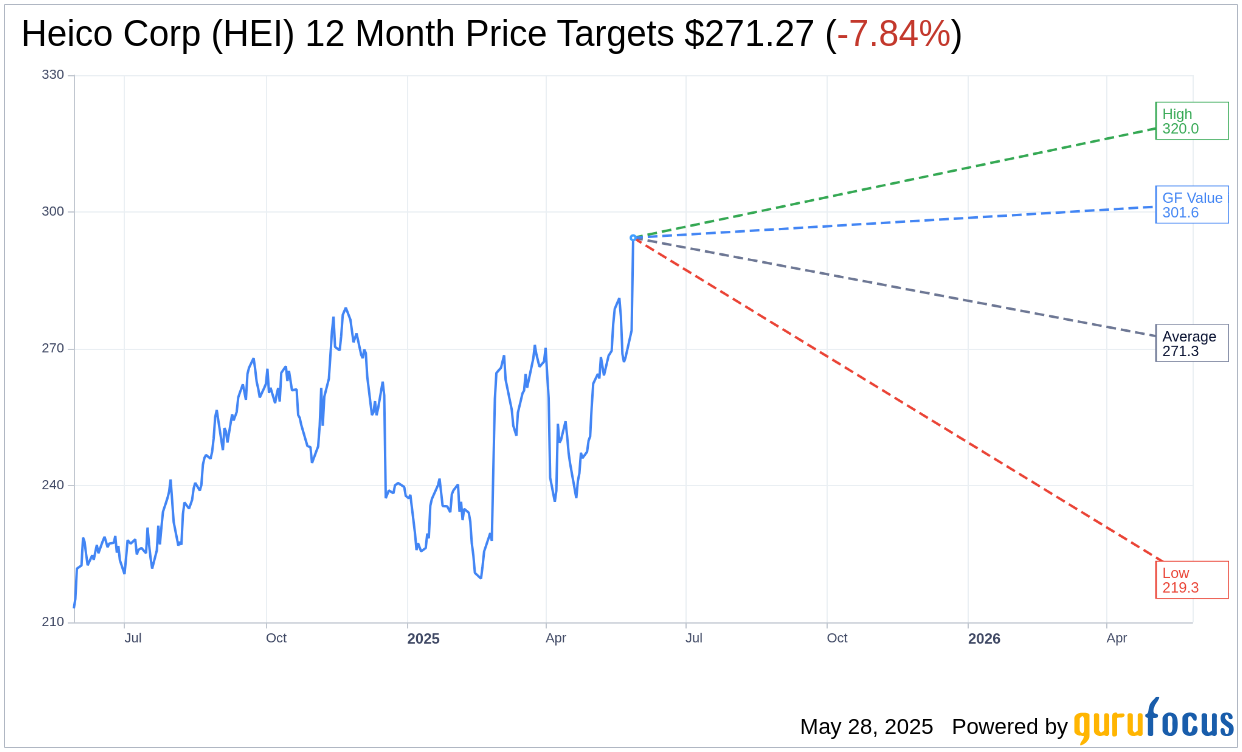

Wall Street Analysts Forecast

According to projections from 16 analysts, the average price target for Heico Corp (HEI, Financial) over the next year is $271.27. This target range includes a high estimate of $320.00 and a low estimate of $219.33. The average target suggests a potential downside of 7.84% from the current stock price of $294.35. For more comprehensive forecast details, visit the Heico Corp (HEI) Forecast page.

Heico Corp's (HEI, Financial) stock is currently rated as "Outperform" by 21 brokerage firms, with an average recommendation score of 2.3. The recommendation scale ranges from 1 (Strong Buy) to 5 (Sell).

On the basis of GuruFocus' proprietary estimates, the GF Value for Heico Corp (HEI, Financial) is projected to be $301.63 in one year. This figure indicates a potential upside of 2.47% from the current price of $294.35. The GF Value is GuruFocus's calculated fair value, derived from past trading multiples, historical business growth, and future performance projections. For additional insights, refer to the Heico Corp (HEI) Summary page.