- NVIDIA (NVDA, Financial) showcases impressive revenue growth despite new U.S. export controls affecting its China market.

- Analysts predict a significant upside potential for NVIDIA's stock based on current price targets.

- GuruFocus estimates indicate substantial growth possibilities with a GF Value suggesting nearly 97% upside.

NVIDIA (NVDA) has reported an extraordinary year-over-year revenue increase of 69%, bringing its annual total to $44 billion. This surge is primarily attributed to a robust 73% rise in Data Center revenue, fueled by the growing demand for AI factory buildouts. However, the company's momentum in China faced hurdles due to new U.S. export controls on the H20 GPU, resulting in a substantial $4.5 billion inventory write-down.

Wall Street Analysts Forecast

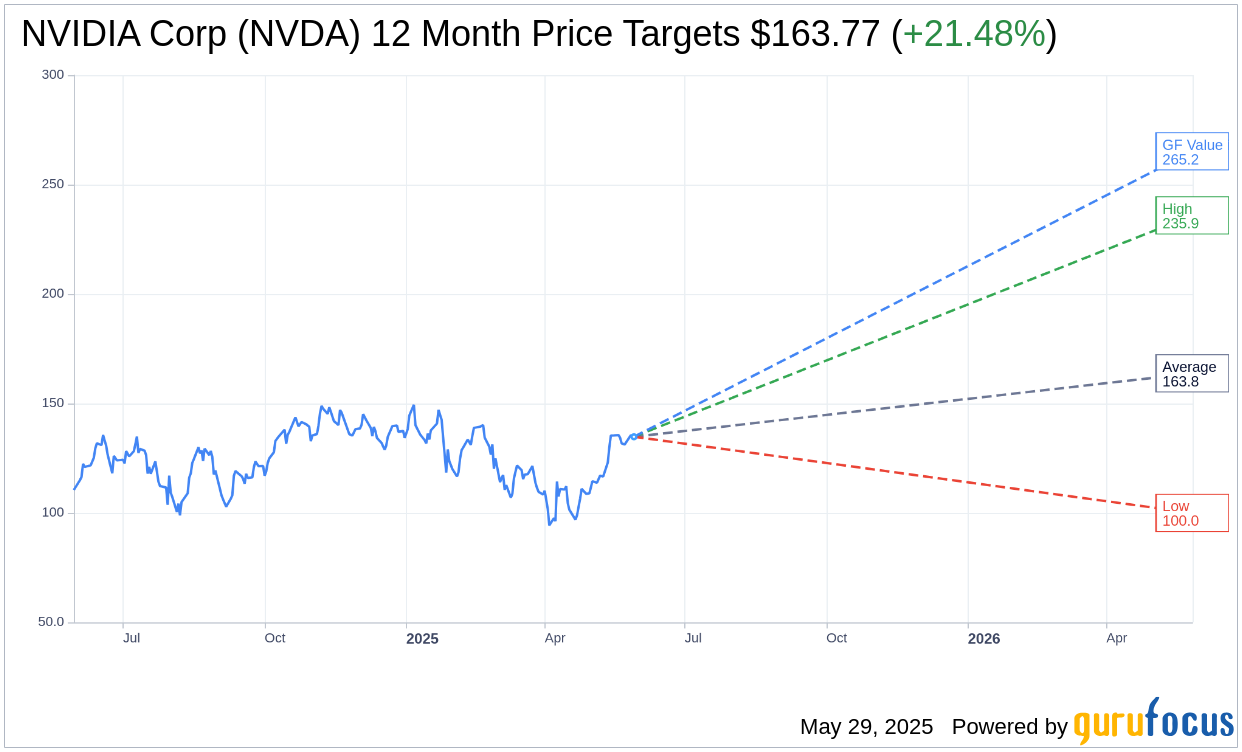

In terms of future prospects, 51 analysts have set a one-year price target for NVIDIA Corp (NVDA, Financial), with an average target price of $163.77. The range spans from a high estimate of $235.92 to a low of $100.00. Notably, this average prediction indicates a potential upside of 21.48% from the current trading price of $134.81. For a more in-depth analysis, visit the NVIDIA Corp (NVDA) Forecast page.

Furthermore, 64 brokerage firms collectively categorize NVIDIA Corp (NVDA, Financial) with an average brokerage recommendation of 1.8, which reflects an "Outperform" status. This rating is part of a spectrum where 1 signifies a Strong Buy and 5 denotes a Sell.

According to GuruFocus estimates, the projected GF Value for NVIDIA Corp (NVDA, Financial) in one year is pegged at $265.22. This suggests a remarkable upside potential of 96.74% from the present price of $134.81. The GF Value represents GuruFocus' appraisal of the stock's fair market value, derived from its historical trading multiples, past business growth, and projected future performance. For additional insights, explore the NVIDIA Corp (NVDA) Summary page.