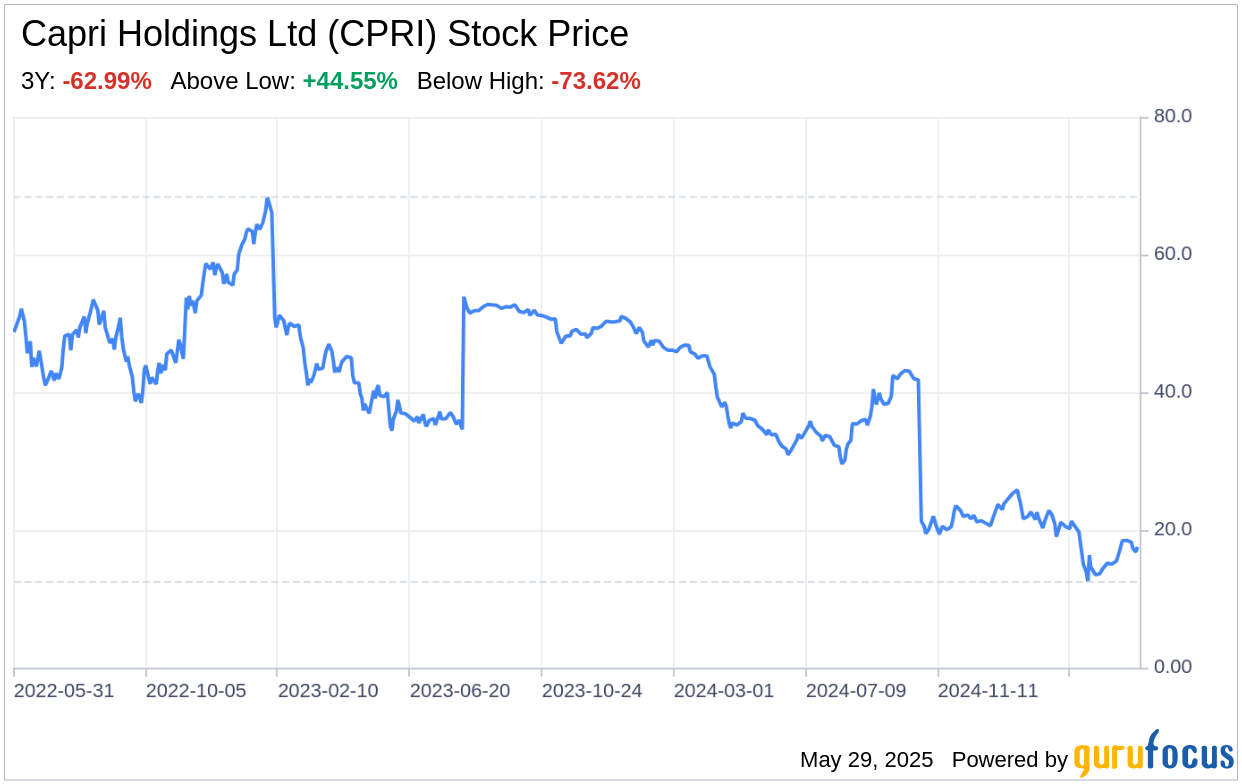

Capri Holdings Ltd (CPRI, Financial), the esteemed parent company of luxury brands Michael Kors, Versace, and Jimmy Choo, has recently filed its 10-K for the fiscal year ended March 29, 2025. This SWOT analysis delves into the financials and strategic positioning of the company, as it faces a dynamic and challenging market environment. The latest filing reveals a concerning financial performance, with total revenue declining from $5,619 million in 2023 to $4,442 million in 2025. This downturn is further accentuated by a substantial net loss of $1,182 million in 2025, compared to a net income of $616 million two years prior. The company's operational struggles are reflected in a gross profit decrease to $2,826 million from $3,724 million, alongside a significant impairment of assets amounting to $797 million. These figures underscore the pressing need for Capri Holdings Ltd to reassess its strategies and operations to return to profitability.

Strengths

Brand Equity and Diverse Portfolio: Capri Holdings Ltd's strength lies in its diverse portfolio of luxury brands, each with a distinct identity and loyal customer base. Michael Kors, the company's flagship brand, continues to be a significant player in the luxury accessories and apparel market, with a global presence in over 100 countries. The brand's focus on premium luxury image and broad customer base through its Michael Kors Collection, MICHAEL Michael Kors, and Michael Kors Mens lines, ensures a consistent appeal across various consumer segments. Jimmy Choo's reputation for women's luxury footwear and accessories further solidifies Capri's market position. Despite the planned divestiture of Versace, the remaining brands provide Capri with a competitive edge in the luxury fashion sector.

Global Distribution Network: Capri Holdings Ltd benefits from a robust global distribution network, including company-operated retail stores, e-commerce platforms, and partnerships with leading department and specialty stores worldwide. This extensive reach enables the company to effectively market and distribute its products, maintaining a strong presence in key fashion cities and ensuring accessibility for a global clientele. The integration of e-commerce strategies also demonstrates Capri's adaptability to evolving retail trends, catering to the growing demand for online luxury shopping experiences.

Weaknesses

Financial Performance and Asset Impairment: The recent financial downturn, as evidenced by the 10-K filing, highlights significant weaknesses in Capri Holdings Ltd's financial health. The stark contrast between the net income of $616 million in 2023 and the net loss of $1,182 million in 2025 raises concerns about the company's profitability and operational efficiency. The impairment of assets worth $797 million indicates potential overvaluation of assets or challenges in certain segments of the business, necessitating a critical evaluation of the company's asset management and investment strategies.

Dependence on Luxury Spending: Capri's business model, heavily reliant on discretionary luxury spending, is vulnerable to macroeconomic fluctuations. The luxury sector is particularly sensitive to changes in consumer confidence and spending power, which can be adversely affected by economic downturns, inflation, and geopolitical instability. This dependence places Capri at risk of experiencing significant revenue volatility in times of economic uncertainty, as reflected in the recent financial results.

Opportunities

Strategic Divestitures and Realignment: The agreement to sell Versace to Prada may present an opportunity for Capri Holdings Ltd to streamline its brand portfolio and focus on its core strengths. This strategic move could free up resources and allow the company to concentrate on expanding and enhancing the Michael Kors and Jimmy Choo brands. By reallocating capital and management attention to these areas, Capri could potentially drive innovation, improve operational efficiencies, and strengthen its market position.

Emerging Markets and Digital Expansion: Capri Holdings Ltd has the opportunity to further penetrate emerging markets, where luxury consumption is growing at a rapid pace. By tailoring its marketing and product offerings to meet the unique preferences of these regions, Capri can tap into new customer segments and drive revenue growth. Additionally, the continued expansion of its digital footprint, including e-commerce and social media engagement, can attract a younger demographic and capitalize on the shift towards online luxury shopping.

Threats

Intense Competition and Market Saturation: The luxury fashion industry is characterized by fierce competition and market saturation, with numerous established and emerging brands vying for consumer attention. Capri Holdings Ltd must continuously innovate and differentiate its products to maintain its competitive edge. Failure to do so could result in loss of market share and declining profitability, as consumers have a plethora of alternatives to choose from.

Operational and Supply Chain Risks: Capri's global operations expose it to various risks, including supply chain disruptions, manufacturing delays, and import restrictions. The imposition of new tariffs or trade restrictions could significantly increase costs and impact the company's ability to import products efficiently. Additionally, reliance on a limited number of distribution facilities and third-party contractors introduces vulnerabilities that could adversely affect Capri's business continuity and financial performance.

In conclusion, Capri Holdings Ltd (CPRI, Financial) faces a challenging period marked by financial setbacks and strategic repositioning. While the company's strong brand equity and global distribution network remain key strengths, its recent financial performance and reliance on luxury spending

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.