Key Takeaways:

- U.S. government halts select technology exports to China affecting GE Aerospace.

- GE stock has mixed analyst forecasts with potential downside.

- GuruFocus estimates a significant deviation from current stock price.

The recent halt in U.S. technology export licenses to China has significant implications for major players like GE Aerospace (GE, Financial). As a supplier of engines for China's COMAC C919 aircraft, GE Aerospace faces potential disruptions amidst escalating trade tensions, particularly as a response to China's curbs on critical mineral exports.

Wall Street Analysts' Insights

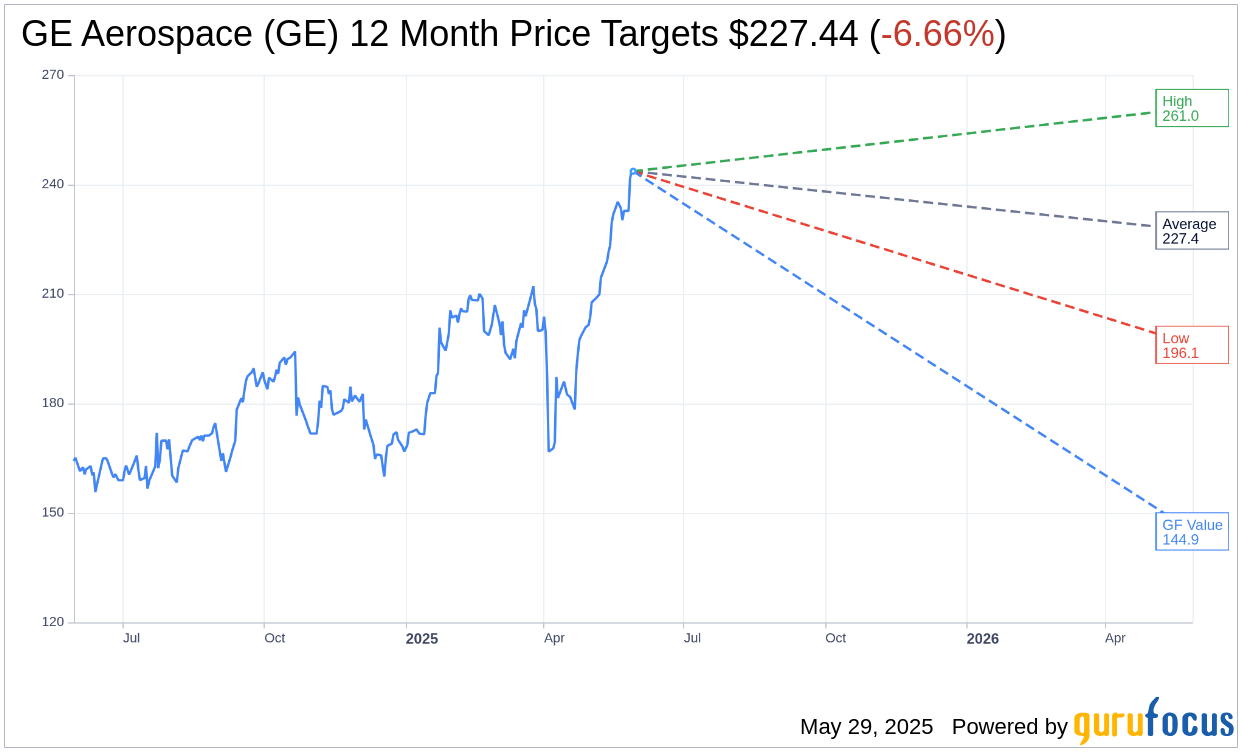

For investors assessing GE Aerospace's future, analysts provide a spectrum of price targets. Over the next year, 16 analysts have projected the stock to average a target price of $227.44. This prediction spans from a high estimate of $261.00 to a low of $196.11, suggesting a potential downside of 6.66% from the current market price of $243.67. For more in-depth estimates, visit the GE Aerospace (GE, Financial) Forecast page.

Investor sentiment remains cautiously optimistic, with 21 brokerage firms assigning GE Aerospace an average recommendation of 1.9. This rating classifies the stock as "Outperform," on a scale where 1 indicates a Strong Buy and 5 signals a Sell.

Understanding GuruFocus' GF Value Estimation

GuruFocus' analysis provides another layer to consider. The estimated GF Value for GE Aerospace in a year's time is $144.93, which implies a more pronounced downside of 40.52% compared to the current trading price of $243.67. The GF Value offers an estimated fair value based on historical trading multiples and projected business performance. For a comprehensive view, access the detailed analysis on the GE Aerospace (GE, Financial) Summary page.

Investors should weigh these insights carefully, balancing the promising outlook suggested by brokerage firms with the cautionary valuation estimates provided by GuruFocus.