Barclays has elevated its price target for First Advantage (FA, Financial) from $15 to $18, while maintaining an Equal Weight rating on the stock. During a recent investor day, the company's distinctive strategic approach was emphasized, according to a research note shared with investors. The firm expresses confidence in First Advantage's ability to consistently implement strategies within its control.

Wall Street Analysts Forecast

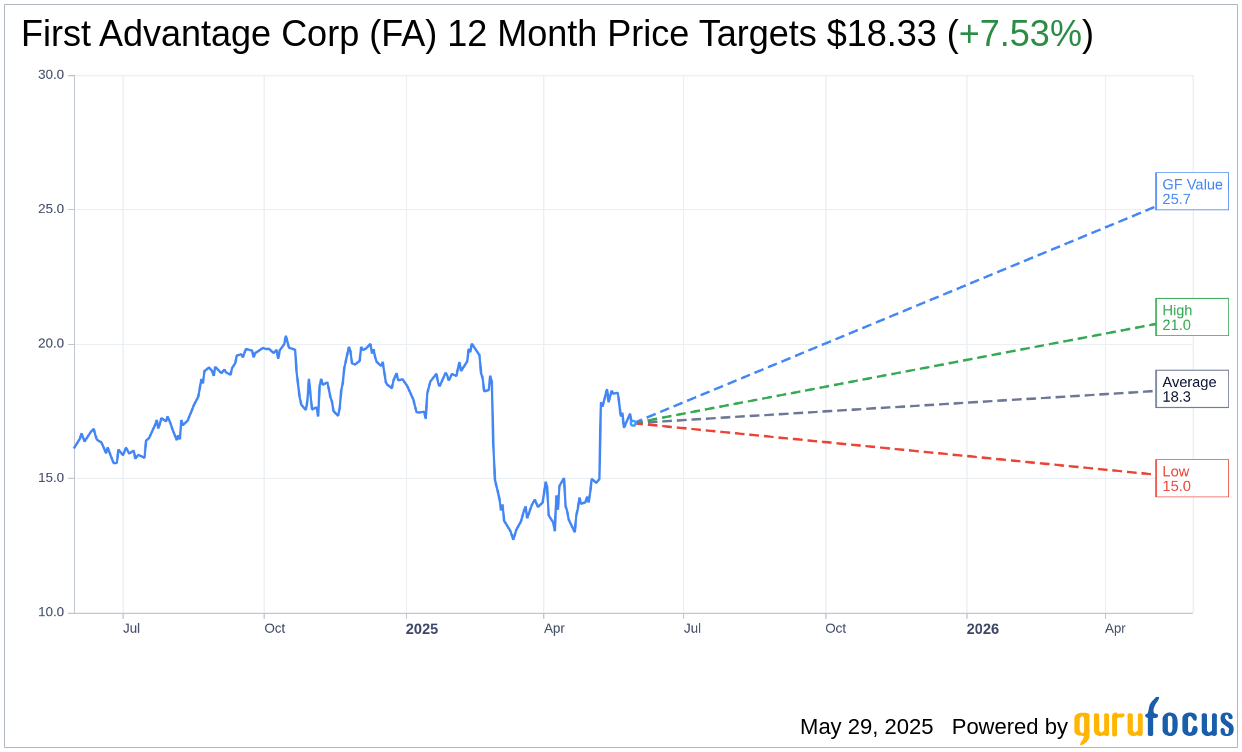

Based on the one-year price targets offered by 6 analysts, the average target price for First Advantage Corp (FA, Financial) is $18.33 with a high estimate of $21.00 and a low estimate of $15.00. The average target implies an upside of 7.53% from the current price of $17.05. More detailed estimate data can be found on the First Advantage Corp (FA) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, First Advantage Corp's (FA, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for First Advantage Corp (FA, Financial) in one year is $25.68, suggesting a upside of 50.62% from the current price of $17.05. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the First Advantage Corp (FA) Summary page.

FA Key Business Developments

Release Date: May 08, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- First Advantage Corp (FA, Financial) exceeded expectations in Q1 2025 with strong revenue performance driven by a robust sales engine and increased scale.

- The company successfully executed on post-closure priorities, integrating the $2.2 billion Sterling acquisition and focusing on customer retention and synergy realization.

- High customer retention rate of 96% was maintained, with significant enterprise bookings and a record quarter for deal value.

- International operations showed strong performance, with 34 consecutive quarters of growth, contributing positively to overall results.

- Innovative product offerings, such as AI-enabled customer care and digital identity solutions, are gaining traction and represent future growth opportunities.

Negative Points

- There is a high degree of macroeconomic and policy uncertainty, causing customers to adopt a 'wait and see' approach, potentially stagnating business volumes.

- Order volumes within the retail and e-commerce verticals have slowed down, impacting overall business performance.

- The company faces challenges from increased debt service due to acquisition-related debt and management incentive plan payments.

- Despite strong Q1 results, the company remains cautious with its guidance due to the uncertain macroeconomic environment.

- Base revenue growth remains a headwind, with expectations of turning neutral and slightly positive only later in the year.