InflaRx (IFRX, Financial) has been downgraded by Raymond James from 'Strong Buy' to 'Outperform'. This decision follows a recommendation from the Independent Data Monitoring Committee to stop the Phase 3 trial of vilobelimab in treating pyoderma gangrenosum, due to insufficient treatment efficacy observed at the interim analysis. Consequently, the price target for IFRX has been adjusted significantly lower, from $13 to $2.

Despite this setback, Raymond James remains optimistic about InflaRx's INF904 programs. However, given the early stage of these initiatives, the firm has adopted a conservative approach by reducing its price target amid greater uncertainty. The focus now shifts to the upcoming proof-of-concept basket study, anticipated to provide a clearer outlook on the potential of these programs.

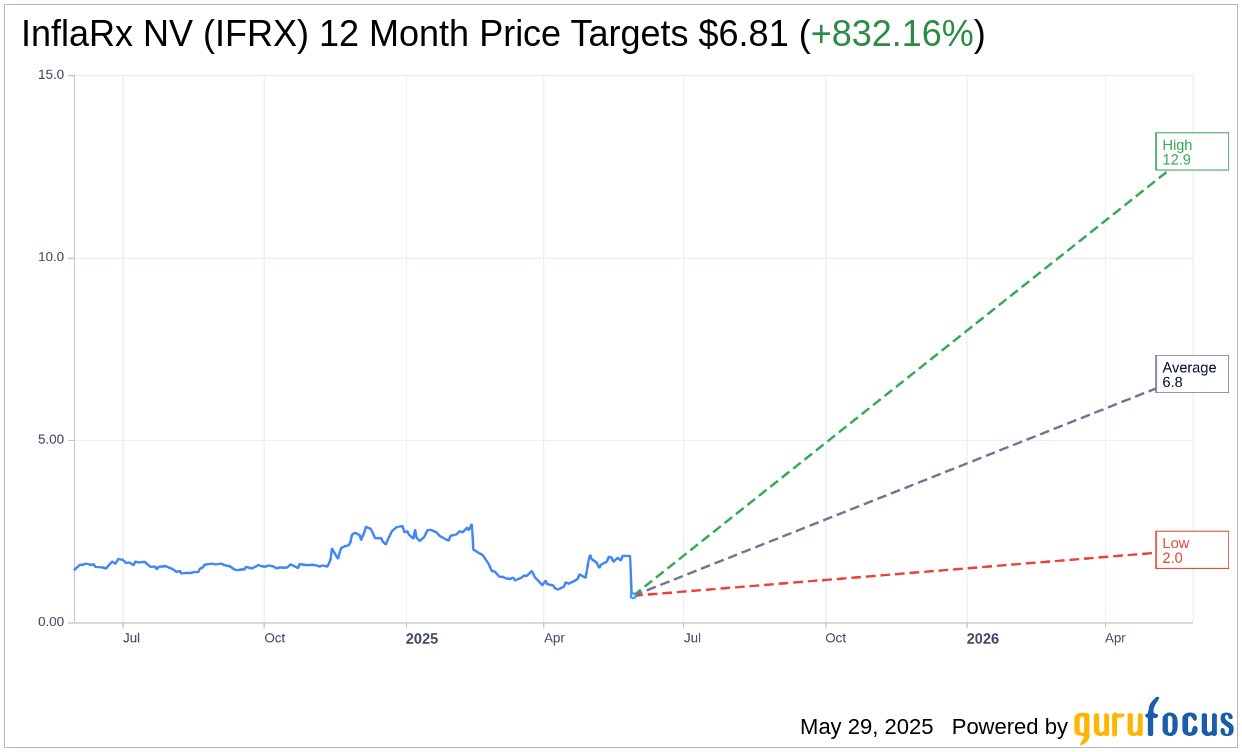

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for InflaRx NV (IFRX, Financial) is $6.81 with a high estimate of $12.91 and a low estimate of $1.99. The average target implies an upside of 832.16% from the current price of $0.73. More detailed estimate data can be found on the InflaRx NV (IFRX) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, InflaRx NV's (IFRX, Financial) average brokerage recommendation is currently 1.6, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.