Citi analyst Atif Malik has increased the price target for Nvidia (NVDA, Financial) to $180 from a previous $150, maintaining a Buy rating on the stock. Nvidia's quarterly results met expectations, and its sales forecast for the upcoming quarter exceeded Citi's projections by $1 billion, effectively navigating the challenges of the China H20 ban adjustment quarter.

Additionally, Nvidia's Blackwell unit reported sales of $24 billion, surpassing Citi's prediction of $20 billion. The company also upheld its target for gross margins in the mid-70% range, benefiting from improved profitability at Blackwell without experiencing significant tariff impacts. Citi is optimistic about Nvidia's margin growth and suggests that the stock is poised to break out from its range-bound trend since the middle of last year, potentially reaching a new 52-week high.

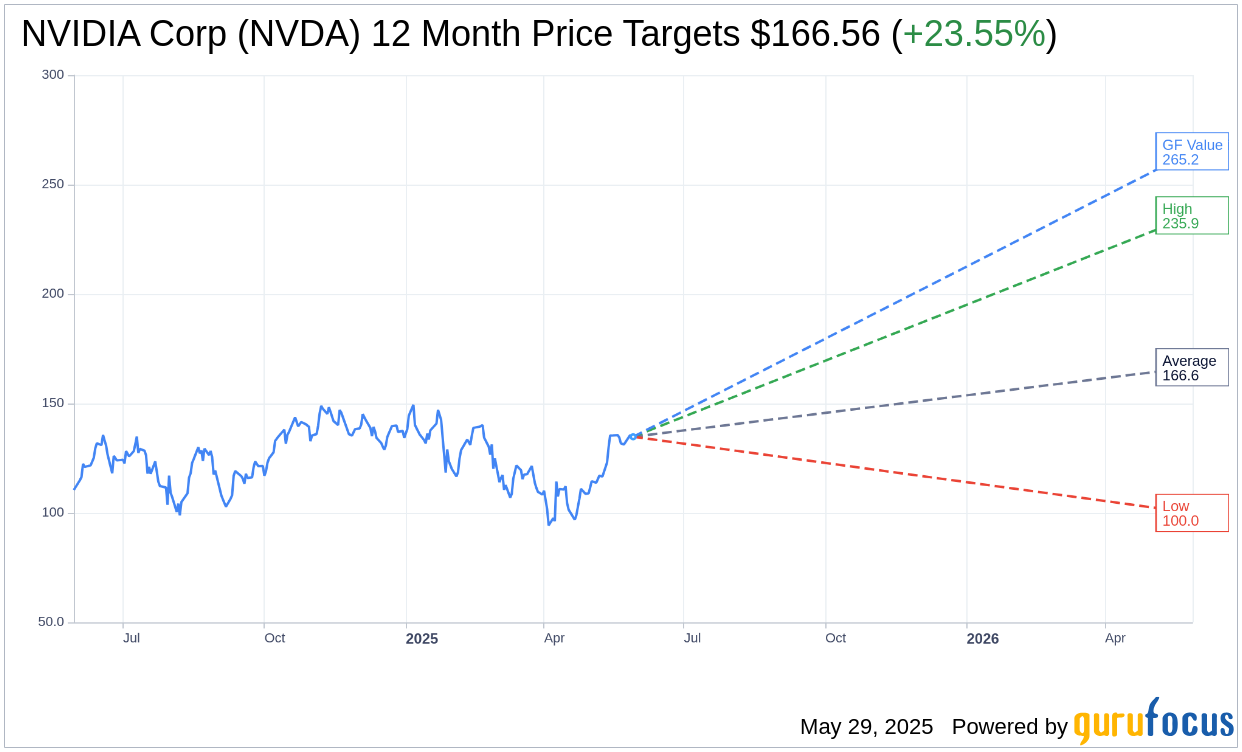

Wall Street Analysts Forecast

Based on the one-year price targets offered by 51 analysts, the average target price for NVIDIA Corp (NVDA, Financial) is $166.56 with a high estimate of $235.92 and a low estimate of $100.00. The average target implies an upside of 23.55% from the current price of $134.81. More detailed estimate data can be found on the NVIDIA Corp (NVDA) Forecast page.

Based on the consensus recommendation from 64 brokerage firms, NVIDIA Corp's (NVDA, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for NVIDIA Corp (NVDA, Financial) in one year is $265.22, suggesting a upside of 96.74% from the current price of $134.81. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the NVIDIA Corp (NVDA) Summary page.