Paramount (PARA, Financial) was downgraded by Citi analyst Jason Bazinet from 'Buy' to 'Neutral', with a revised price target of $12, lowered from $13. Although the firm maintains that the Skydance transaction is likely to conclude by 2025, they perceive the current risk and reward of the equity as balanced. Furthermore, due to the significant cash payment option of $7 per share, Citi anticipates increased volatility in the stock following the transaction, driven by the activities of event-focused investment funds. This adjustment reflects Citi's cautious approach towards Paramount's market performance in the near term.

Wall Street Analysts Forecast

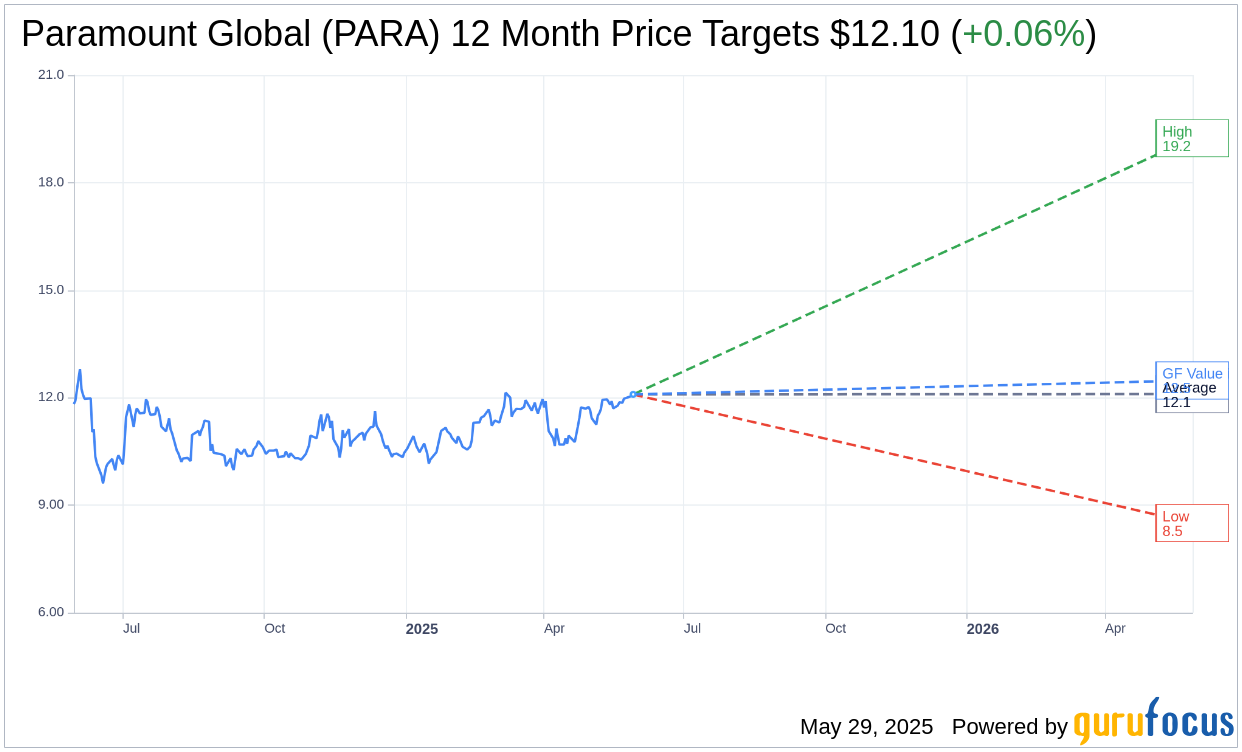

Based on the one-year price targets offered by 18 analysts, the average target price for Paramount Global (PARA, Financial) is $12.10 with a high estimate of $19.24 and a low estimate of $8.50. The average target implies an upside of 0.06% from the current price of $12.09. More detailed estimate data can be found on the Paramount Global (PARA) Forecast page.

Based on the consensus recommendation from 25 brokerage firms, Paramount Global's (PARA, Financial) average brokerage recommendation is currently 3.2, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Paramount Global (PARA, Financial) in one year is $12.48, suggesting a upside of 3.23% from the current price of $12.09. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Paramount Global (PARA) Summary page.

PARA Key Business Developments

Release Date: May 08, 2025

- Total Revenue: $7.2 billion, a 2% year-over-year growth excluding the Super Bowl.

- Adjusted OIBDA: $688 million, with improvements in D2C and filmed entertainment.

- Free Cash Flow: $123 million, including $108 million in restructuring payments.

- Paramount+ Subscribers: 79 million global subscribers, up 11% year-over-year.

- Paramount+ Revenue: Increased 16% year-over-year.

- Pluto TV Viewing Time: Up 26% year-over-year.

- D2C Revenue: $2 billion, up 9% year-over-year.

- D2C OIBDA: Improved by $177 million to a loss of $109 million.

- TV Media OIBDA: $922 million, with a 4% decline in expenses year-over-year.

- Filmed Entertainment Revenue: $627 million, up 4% year-over-year.

- Filmed Entertainment OIBDA: $20 million, compared to a loss of $3 million in the previous year.

- Advertising Revenue (TV Media): Flat year-over-year, excluding the Super Bowl.

- Affiliate Revenue (TV Media): Declined 8.6% due to subscriber declines and recent renewals.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Paramount Global (PARA, Financial) reported a 2% year-over-year revenue growth, excluding the Super Bowl, with significant improvements in DTC OIBDA and free cash flow generation.

- Paramount+ achieved a subscriber base of 79 million globally, marking an 11% increase year-over-year, with a notable 16% revenue growth driven by original content.

- Pluto TV experienced its highest consumption ever, with global viewing time up 26% year-over-year, indicating strong user engagement.

- The Filmed Entertainment segment saw success with Sonic the Hedgehog 3, which generated nearly $500 million in box office sales and performed well on streaming platforms.

- CBS continues to deliver strong audience numbers, with significant viewership for sports events like the NCAA championship and The Masters, contributing to its position as the most-watched broadcast network.

Negative Points

- Paramount Global (PARA) faced challenges in digital advertising, particularly with Pluto TV, due to an influx of supply affecting monetization.

- TV Media advertising revenue was flat year-over-year, excluding the Super Bowl, indicating potential stagnation in traditional advertising streams.

- The company anticipates a decline in Q2 subscribers due to content seasonality and the termination of an international hard bundle partnership.

- Despite improvements, D2C OIBDA still reported a loss of $109 million, highlighting ongoing challenges in achieving profitability in the streaming segment.

- The macroeconomic environment remains uncertain, with potential impacts on advertising revenue, necessitating a focus on cost efficiencies and strategic investments.