On May 29, 2025, U-Haul Holding Co (UHAL, Financial) released its 8-K filing, detailing its financial performance for the fiscal year ending March 31, 2025. U-Haul Holding Co, an American company known for its moving truck, trailer, and self-storage rental services, reported a challenging year with net earnings available to shareholders dropping to $367.1 million from $628.7 million the previous year. The company also faced a quarterly net loss of $82.3 million, a significant increase from the $0.9 million loss in the same quarter last year.

Performance and Challenges

U-Haul Holding Co's fiscal year was marked by increased costs associated with fleet replacements, which significantly impacted its income statement. The company experienced reduced gains on the sale of rental equipment and increased fleet depreciation expenses, which collectively decreased earnings by nearly $260 million compared to fiscal 2024. Joe Shoen, chairman of U-Haul Holding Co, noted, “We are seeing the high prices we paid for fleet replacements over the last thirty months impact the income statement.”

Financial Achievements

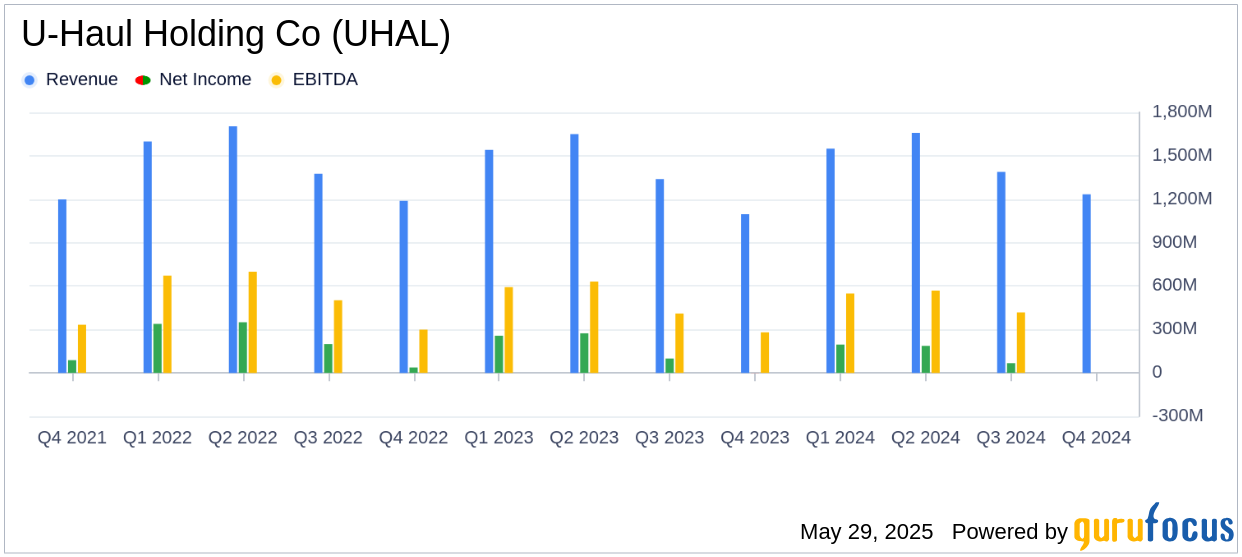

Despite these challenges, U-Haul Holding Co achieved notable growth in its Moving and Storage segment. The segment's earnings before interest, taxes, depreciation, and amortization (EBITDA) increased by $51.7 million to $1,619.7 million for the full year. Self-storage revenues also saw an 8.0% increase, contributing an additional $66.8 million compared to fiscal 2024. This growth is significant for the company, as the Moving and Storage segment is its primary revenue driver.

Key Financial Metrics

U-Haul Holding Co reported consolidated revenues of $5,828.7 million for the fiscal year, surpassing the annual estimate of $5,718.44 million. The company's self-moving equipment rental revenues increased by $100.8 million, or 2.8%, year-over-year, indicating a steady demand for its services. However, the company's earnings from operations decreased significantly, reflecting the impact of increased depreciation and reduced gains from equipment sales.

| Metric | 2025 | 2024 |

|---|---|---|

| Self-moving equipment rental revenues | $3,725.5 million | $3,624.7 million |

| Self-storage revenues | $897.9 million | $831.1 million |

| Consolidated revenue | $5,828.7 million | $5,625.7 million |

Analysis and Outlook

U-Haul Holding Co's fiscal 2025 results highlight the challenges of managing increased fleet costs while maintaining growth in core business areas. The company's ability to increase revenues in its Moving and Storage segment, despite the financial pressures, underscores its resilience and market demand. However, the significant increase in depreciation expenses and reduced gains from equipment sales pose ongoing challenges that the company will need to address to improve profitability.

Overall, U-Haul Holding Co's performance in fiscal 2025 reflects a mixed picture of growth in key segments and financial pressures from fleet management. The company's strategic focus on expanding its self-storage and equipment rental services will be crucial in navigating these challenges and driving future growth.

Explore the complete 8-K earnings release (here) from U-Haul Holding Co for further details.