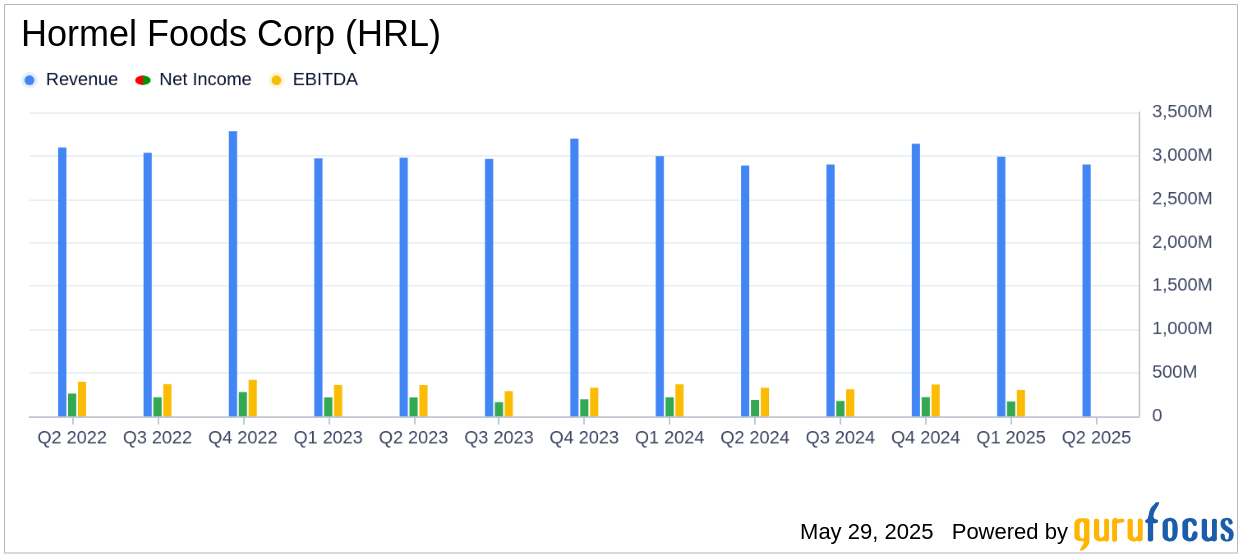

On May 29, 2025, Hormel Foods Corp (HRL, Financial) released its 8-K filing detailing the financial results for the second quarter of fiscal 2025, which ended on April 27, 2025. The company reported a diluted earnings per share (EPS) of $0.33, aligning with analyst estimates, while its revenue of $2.90 billion slightly missed the estimated $2.90672 billion.

Company Overview

Hormel Foods Corp (HRL, Financial), historically known for its meat products, has expanded its portfolio to become a branded food company. It operates through various channels, including US retail (62% of fiscal 2024 sales), US food service (32%), and international markets (6%). The company's product mix consists of 72% perishable food and 28% shelf-stable items. Notable brands under its umbrella include Hormel, Spam, Jennie-O, Columbus, Applegate, Planters, and Skippy, many of which hold leading market positions.

Performance and Challenges

Hormel Foods Corp (HRL, Financial) reported net sales of $2.90 billion for the second quarter, reflecting a 0.4% increase from the previous year. Despite this growth, the company faced challenges such as a 7% decline in retail volume and a 6% decrease in foodservice segment profit. These challenges highlight the impact of reduced commodity shipments and promotional timing, which could pose risks to future profitability.

Financial Achievements

The company achieved an operating income of $248 million and an adjusted operating income of $265 million, with operating margins of 8.6% and 9.1%, respectively. These metrics are crucial for Hormel Foods Corp (HRL, Financial) as they indicate the company's ability to manage costs and maintain profitability in the competitive consumer packaged goods industry.

Key Financial Metrics

Hormel Foods Corp (HRL, Financial) reported a cash flow from operations of $56 million for the quarter. The effective tax rate was 22.0%, slightly lower than the previous year's 22.5%. The company also declared dividends of $0.29 per share, reflecting its commitment to returning value to shareholders.

| Metric | Q2 2025 | Q2 2024 |

|---|---|---|

| Net Sales | $2.90 billion | $2.89 billion |

| Operating Income | $248 million | $252 million |

| Net Earnings | $180 million | $189 million |

| Diluted EPS | $0.33 | $0.34 |

Executive Commentary

“We achieved solid organic top-line growth and delivered second quarter results in line with our expectations,” said Jim Snee, president and chief executive officer. “We anticipate strong second half growth led by our range of consumer-focused, protein-centric products.”

Analysis and Outlook

Hormel Foods Corp (HRL, Financial) has demonstrated resilience in a challenging market environment, maintaining its EPS in line with expectations. The company's strategic initiatives, such as the Transform and Modernize (T&M) initiative, are expected to yield benefits in the coming quarters. However, the decline in retail and foodservice volumes indicates potential headwinds that the company must navigate to sustain growth.

Overall, Hormel Foods Corp (HRL, Financial) remains a key player in the branded food sector, with a diverse product portfolio and strong market positions. Investors will be keen to see how the company leverages its strategic initiatives to drive future growth and profitability.

Explore the complete 8-K earnings release (here) from Hormel Foods Corp for further details.