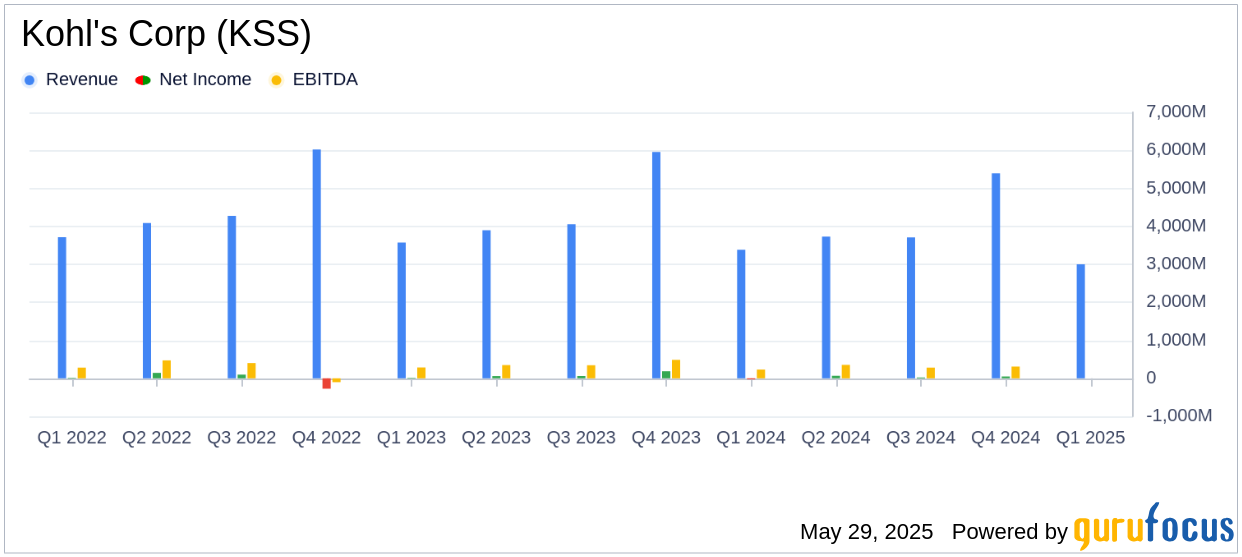

On May 29, 2025, Kohl's Corp (KSS, Financial) released its 8-K filing detailing the financial results for the first quarter of fiscal 2025, ending May 3, 2025. The company reported a diluted loss per share of ($0.13), which is a significant improvement over the analyst estimate of a loss of ($0.37) per share. Despite a 4.1% decrease in net sales to $3 billion and a 3.9% drop in comparable sales, Kohl's managed to increase its gross margin by 37 basis points to 39.9%.

Company Overview

Kohl's Corp (KSS, Financial) operates approximately 1,150 department stores across 49 states, offering a range of moderately priced private-label and national brand clothing, shoes, accessories, cosmetics, and home furnishings. The company also boasts a substantial digital sales operation. Headquartered in Menomonee Falls, Wisconsin, Kohl's opened its first department store in 1962. Women's apparel remains the largest category, contributing 25% to its 2024 sales.

Performance and Challenges

The first quarter results reflect a challenging retail environment, with a notable decline in net sales and comparable sales. However, the improvement in gross margin indicates effective cost management and pricing strategies. The performance is crucial as it highlights the company's ability to navigate through a tough market while maintaining profitability metrics.

Financial Achievements

Despite the sales decline, Kohl's Corp (KSS, Financial) managed to enhance its gross margin, a critical metric in the retail industry, which underscores the company's operational efficiency and pricing power. The affirmation of the full-year 2025 financial outlook suggests confidence in the company's strategic initiatives and market positioning.

Key Financial Metrics

The company's income statement reveals a net sales decrease of 4.1% year-over-year, amounting to $3 billion. The gross margin as a percentage of net sales improved to 39.9%, up by 37 basis points. These metrics are vital as they reflect the company's ability to manage costs and maintain profitability amidst declining sales.

Michael Bender, Kohl’s Interim Chief Executive Officer, stated, “Our first quarter performance was ahead of our expectations and the actions we are taking are starting to make progress with early signs of a positive impact.”

Analysis and Outlook

Kohl's Corp (KSS, Financial) has demonstrated resilience in a challenging retail landscape by improving its gross margin and beating EPS estimates. The company's strategic focus on enhancing customer experience and operational efficiency appears to be yielding positive results. However, the decline in net sales and comparable sales remains a concern that the company needs to address to sustain long-term growth.

Overall, Kohl's Corp (KSS, Financial) has shown promising signs of recovery and strategic alignment, which could appeal to value investors looking for opportunities in the retail sector. The company's ability to maintain its financial outlook for the year further reinforces its potential for stability and growth.

Explore the complete 8-K earnings release (here) from Kohl's Corp for further details.