On May 29, 2025, Foot Locker Inc (FL, Financial) released its 8-K filing detailing its financial performance for the first quarter ended May 3, 2025. The company, a leading retailer of athletically inspired footwear and apparel, operates across North America, Europe, Australia, New Zealand, and Asia, with a significant presence in the Middle East, Europe, and Asia through licensed stores. Foot Locker's brand portfolio includes Foot Locker, Kids Foot Locker, Champs Sports, WSS, and atmos, leveraging omnichannel capabilities to integrate digital and physical retail experiences.

Performance Overview and Challenges

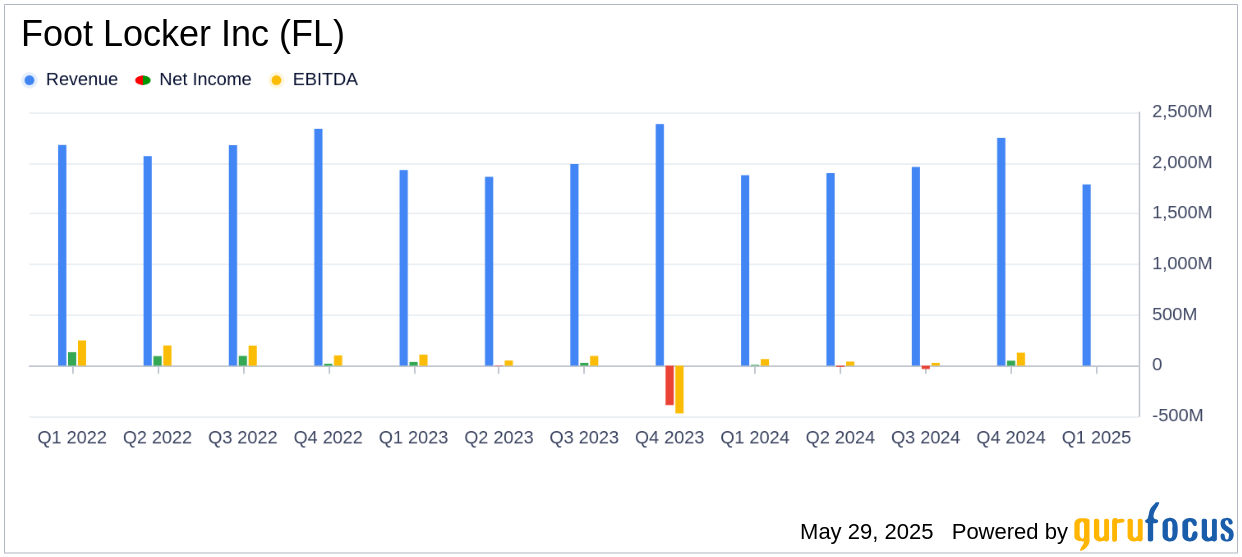

Foot Locker Inc (FL, Financial) reported a 4.6% year-over-year decline in total sales, amounting to $1,788 million, missing the analyst revenue estimate of $1,857.75 million. Comparable sales decreased by 2.6%. North American sales were slightly down by 0.5%. International sales dropped by 8.5%, primarily due to weakness in Foot Locker Europe. The company faced a GAAP EPS loss of $3.81 and a non-GAAP EPS loss of $0.07, both falling short of the estimated EPS of $0.04.

Financial Achievements and Industry Context

Despite the challenges, Foot Locker continued its store modernization efforts, refreshing 69 stores and launching new mobile apps for Champs Sports and Kids Foot Locker. These initiatives are crucial for maintaining competitiveness in the cyclical retail industry, where consumer preferences and technological advancements rapidly evolve.

Key Financial Metrics

The gross margin decreased by 40 basis points, with merchandise margins down by 10 basis points and occupancy costs rising by 30 basis points as a percentage of sales. SG&A expenses increased by 100 basis points due to sales decline and technology investments, despite a 0.7% reduction in SG&A dollars.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Total Sales | $1,788 million | $1,874 million |

| Net Loss | $363 million | $8 million (Net Income) |

| Non-GAAP Net Loss | $6 million | $21 million (Net Income) |

Balance Sheet and Cash Flow

Foot Locker ended the quarter with $343 million in cash and cash equivalents and total debt of $445 million. Merchandise inventories were slightly up by 0.4% year-over-year, though down by 0.7% when excluding foreign currency effects.

Strategic Developments and Future Outlook

Foot Locker's strategic focus remains on enhancing customer engagement and optimizing store experiences through its Lace Up Plan. The company is also navigating an uncertain macroeconomic environment by managing promotions, inventories, and expenses. Notably, Foot Locker has entered into a definitive merger agreement with DICK'S Sporting Goods, which will significantly impact its future operations.

Mary Dillon, Chief Executive Officer, stated, "We are continuing to execute our Lace Up Plan strategies as we look forward to the successful completion of our transaction with DICK'S Sporting Goods. As we noted at the time we reported preliminary first quarter results, we experienced softer traffic trends globally that impacted our performance."

Foot Locker's performance in the first quarter of 2025 underscores the challenges faced by retailers in adapting to changing consumer behaviors and economic conditions. The company's strategic initiatives and pending acquisition by DICK'S Sporting Goods will be pivotal in shaping its future trajectory.

Explore the complete 8-K earnings release (here) from Foot Locker Inc for further details.