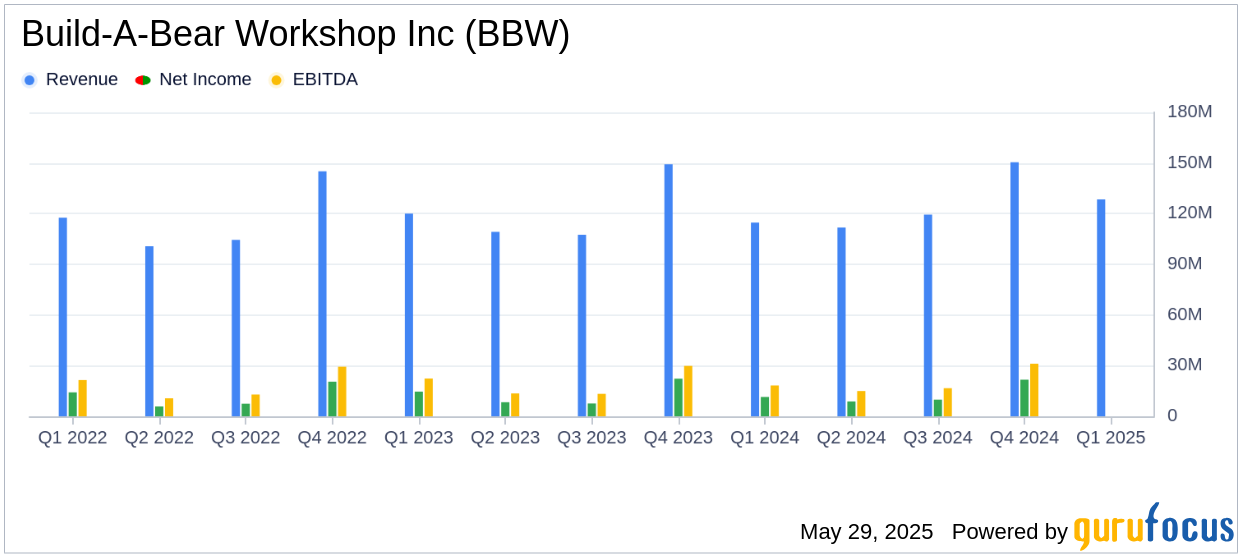

On May 29, 2025, Build-A-Bear Workshop Inc (BBW, Financial) released its 8-K filing, announcing record-breaking results for the first quarter of fiscal year 2025, which ended on May 3, 2025. The company reported total revenues of $128.4 million, marking an 11.9% increase compared to the same period last year. This performance exceeded the analyst estimate of $118.05 million. Additionally, the company achieved a diluted earnings per share (EPS) of $1.17, surpassing the estimated EPS of $0.89.

Build-A-Bear Workshop Inc is a U.S.-based specialty retailer known for its customizable stuffed animals and related products. The company operates through three segments: Direct-to-consumer, International franchising, and Commercial. The Direct-to-consumer segment, which includes e-commerce and retail operations in several countries, is the primary revenue driver.

Record Financial Achievements and Strategic Growth

The first quarter of fiscal 2025 was marked by significant financial achievements for Build-A-Bear Workshop Inc. The company reported a pre-tax income of $19.6 million, a 30.6% increase from the previous year, and a first-quarter record. This robust performance underscores the strength and appeal of the Build-A-Bear brand, as well as the progress in evolving its business model.

Sharon Price John, President and CEO of Build-A-Bear Workshop, commented on the results, stating,

“We had a solid start to 2025 with record first-quarter revenues, pre-tax income, and EPS, highlighting the strength and appeal of the Build-A-Bear brand, as well as the progress we are making in evolving our business model.”

Key Financial Metrics and Balance Sheet Highlights

Build-A-Bear Workshop Inc's financial health remains strong, with cash and cash equivalents totaling $44.3 million at the end of the first quarter, a 16.0% increase from the previous year. The company reported no borrowings under its revolving credit facility, indicating a solid liquidity position.

Inventory levels increased by 12.9% to $72.3 million, reflecting an accelerated purchase of core products. The company remains comfortable with its inventory composition, which is crucial for meeting consumer demand and supporting growth initiatives.

Shareholder Returns and Strategic Outlook

During the first quarter, Build-A-Bear Workshop Inc returned $7.1 million to shareholders through share repurchases and quarterly dividends. The company repurchased 108,502 common stock shares and paid a $2.9 million quarterly cash dividend. With $85.0 million remaining under the board-authorized stock repurchase program, the company continues to prioritize shareholder returns.

Voin Todorovic, Chief Financial Officer, emphasized the company's financial strategy, stating,

“I'm pleased to share that Build-A-Bear posted double-digit revenue growth with continued mid-teens pre-tax margins. Our ongoing strong revenue performance and disciplined expense management have allowed us to continue to return significant capital to shareholders.”

Analysis and Future Prospects

Build-A-Bear Workshop Inc's record-breaking first-quarter results demonstrate its ability to navigate a dynamic retail environment while maintaining strong financial performance. The company's strategic focus on expanding its global retail footprint and enhancing its business model positions it well for future growth. However, challenges such as tariff rates, medical and labor cost pressures, and inflationary challenges remain considerations for the company's outlook.

Overall, Build-A-Bear Workshop Inc's strong financial performance and strategic initiatives highlight its potential as a compelling investment opportunity in the retail sector. Value investors and potential GuruFocus.com members may find the company's growth trajectory and shareholder-friendly policies particularly appealing.

Explore the complete 8-K earnings release (here) from Build-A-Bear Workshop Inc for further details.