The CEO of Burlington Stores (BURL, Financial), Michael O'Sullivan, highlighted growing uncertainties in the current market environment, particularly concerning tariffs. He indicated that these tariffs are likely to affect merchandise margins. However, O'Sullivan expressed confidence that, as long as tariffs remain at current levels, the company can mitigate some of this pressure through other areas in the profit and loss statement. This, along with favorable Q1 earnings, supports their ability to meet initial financial goals.

O'Sullivan also noted that while changing tariffs pose both risks and opportunities, Burlington Stores possesses unique advantages over conventional retailers, allowing for quicker and more flexible responses. Although the upcoming months might present challenges, successfully managing these could potentially lead to superior outcomes.

Looking beyond the immediate tariff disruptions, O'Sullivan believes vendors will eventually adjust, relocating production to minimize costs. He remains positive that tariffs will not alter the fundamental growth dynamics of the retail sector, particularly the expansion of off-price retail, which aligns with Burlington Stores' strategies and long-term objectives for growth and success.

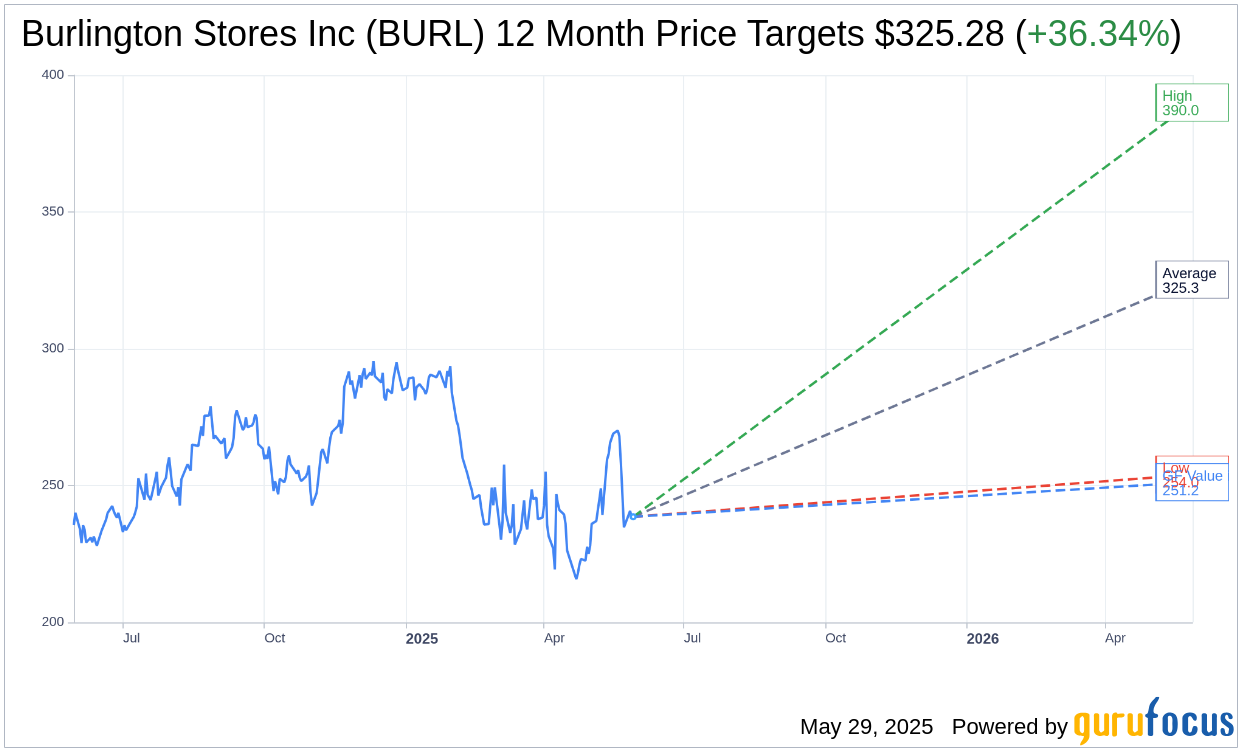

Wall Street Analysts Forecast

Based on the one-year price targets offered by 18 analysts, the average target price for Burlington Stores Inc (BURL, Financial) is $325.28 with a high estimate of $390.00 and a low estimate of $254.00. The average target implies an upside of 36.34% from the current price of $238.59. More detailed estimate data can be found on the Burlington Stores Inc (BURL) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Burlington Stores Inc's (BURL, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Burlington Stores Inc (BURL, Financial) in one year is $251.24, suggesting a upside of 5.3% from the current price of $238.59. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Burlington Stores Inc (BURL) Summary page.

BURL Key Business Developments

Release Date: March 06, 2025

- Comparable Store Sales Growth (Q4 2024): Increased by 6%, exceeding guidance of 0% to 2%.

- Total Sales Growth (Q4 2024): Increased by 10%.

- Gross Margin (Q4 2024): 42.9%, an increase of 30 basis points from the previous year.

- Adjusted EBIT Margin (Q4 2024): Expanded by 10 basis points to 11.1%.

- Adjusted Earnings Per Share (Q4 2024): $4.13, a 12% increase from the prior year.

- Total Sales Growth (Full Year 2024): Increased by 11%.

- Operating Margin Expansion (Full Year 2024): Expanded by 100 basis points.

- New Store Openings (2024): 147 new stores opened, 101 net new stores added.

- Cash and Liquidity (End of Q4 2024): $995 million in cash, $1.8 billion in total liquidity.

- Share Repurchases (Q4 2024): $61 million repurchased, $263 million remaining on authorization.

- 2025 Guidance - Total Sales Growth: Expected to be 6% to 8%.

- 2025 Guidance - Comp Store Sales Growth: Expected to be 0% to 2%.

- 2025 Guidance - Adjusted Earnings Per Share: Expected to be $8.70 to $9.30.

- Capital Expenditures (2025): Expected to be approximately $950 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Burlington Stores Inc (BURL, Financial) reported a strong 6% increase in comparable store sales for the fourth quarter, surpassing their guidance of 0% to 2%.

- The company achieved an 11% total sales growth for the full year 2024, indicating robust performance.

- Burlington Stores Inc (BURL) expanded its operating margin by 100 basis points in 2024, exceeding initial expectations.

- The company successfully opened 101 net new stores in 2024, aligning with its long-term growth strategy.

- Burlington Stores Inc (BURL) demonstrated effective inventory management, with comparable store inventories down 3% year-over-year, contributing to faster inventory turns.

Negative Points

- The first quarter of 2025 started weaker than expected, with sales trends impacted by unfavorable weather and delayed tax refunds.

- Burlington Stores Inc (BURL) provided a conservative guidance for 2025, with expected comp store sales growth of only 0% to 2%.

- The company anticipates a challenging margin comparison in the first quarter of 2025, with potential EBIT margin contraction.

- Higher capital expenditures are expected in 2025 due to the purchase of distribution centers, which may impact debt levels and stock buybacks.

- The uncertain economic and geopolitical environment poses risks to consumer spending and could affect Burlington Stores Inc (BURL)'s performance.