SpartanNash (SPTN, Financial) announced its first-quarter revenue of $2.91 billion, surpassing the expected $2.86 billion. The company's adjusted EBITDA reached $76.9 million, marking an improvement from the previous year's $74.9 million. According to CEO Tony Sarsam, SpartanNash started 2025 on a strong note, achieving another growth period and setting a new record for adjusted EBITDA in the quarter.

The company's strategic initiatives have led to robust Wholesale margins, positive trends in comparable store sales, and boosted sales from new Retail acquisitions. These outcomes bolster SpartanNash's confidence in meeting its 2025 financial goals.

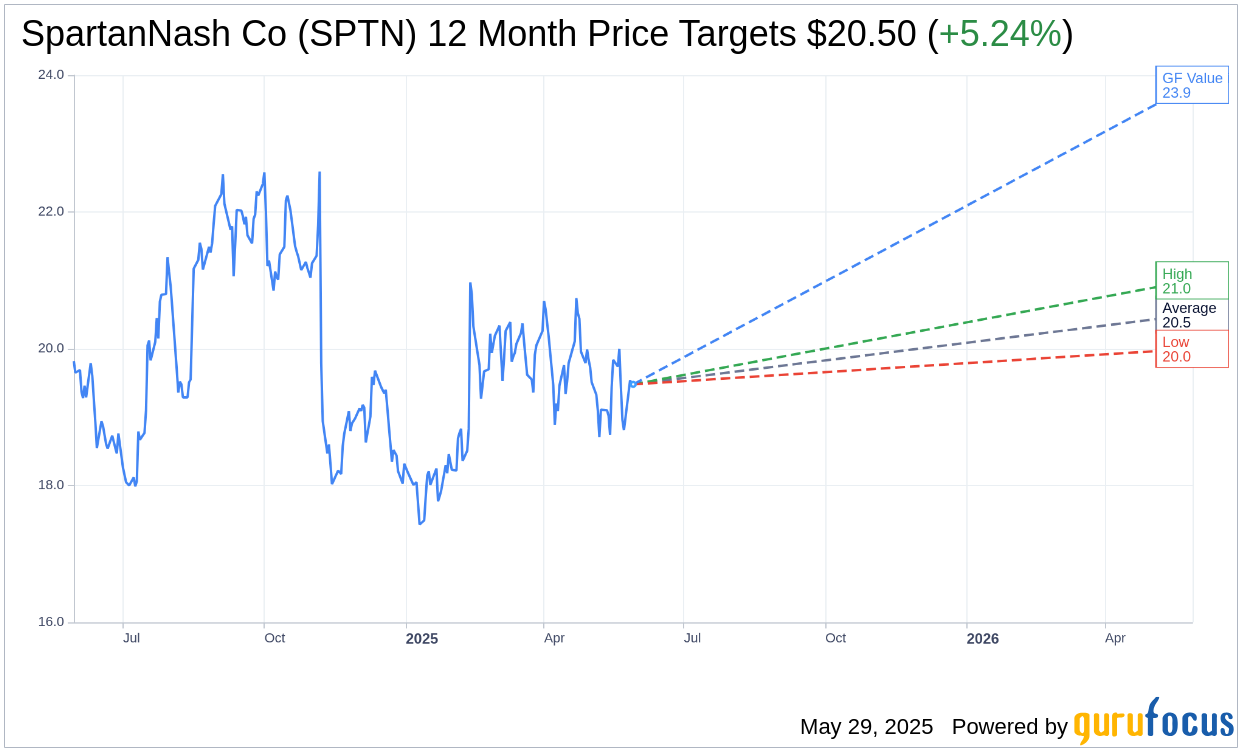

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for SpartanNash Co (SPTN, Financial) is $20.50 with a high estimate of $21.00 and a low estimate of $20.00. The average target implies an upside of 5.24% from the current price of $19.48. More detailed estimate data can be found on the SpartanNash Co (SPTN) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, SpartanNash Co's (SPTN, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for SpartanNash Co (SPTN, Financial) in one year is $23.86, suggesting a upside of 22.48% from the current price of $19.48. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the SpartanNash Co (SPTN) Summary page.