Iridium Communications (IRDM, Financial) has entered into a strategic collaboration with Syniverse to facilitate the launch of its Iridium NTN DirectSM service, aimed at enhancing connectivity for mobile network operators (MNOs) globally. This partnership enables the integration of Iridium NTN Direct with Syniverse’s comprehensive platform, offering MNOs seamless global connectivity solutions. Iridium NTN Direct distinguishes itself in the realm of Non-Terrestrial Network and NB-IoT services by providing exceptional global reach, reliability, and functionality.

The completion of the 3GPP Release 19 standard is anticipated by the end of 2025, with the debut of Iridium NTN Direct-enabled devices slated for 2026. This development marks a significant step in advancing telecommunications technology, ensuring continuous connectivity for MNO customers worldwide.

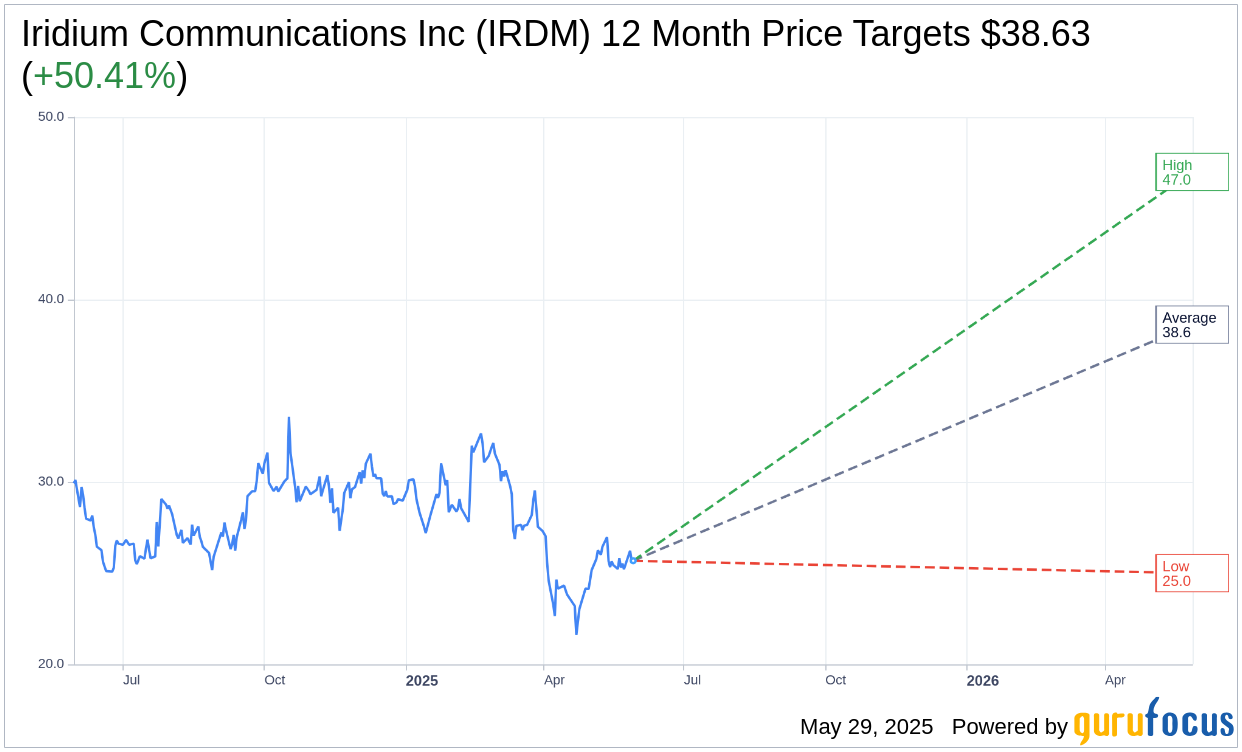

Wall Street Analysts Forecast

Based on the one-year price targets offered by 8 analysts, the average target price for Iridium Communications Inc (IRDM, Financial) is $38.63 with a high estimate of $47.00 and a low estimate of $25.00. The average target implies an upside of 50.41% from the current price of $25.68. More detailed estimate data can be found on the Iridium Communications Inc (IRDM) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Iridium Communications Inc's (IRDM, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Iridium Communications Inc (IRDM, Financial) in one year is $51.59, suggesting a upside of 100.9% from the current price of $25.68. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Iridium Communications Inc (IRDM) Summary page.

IRDM Key Business Developments

Release Date: April 22, 2025

- Operational EBITDA: Increased 6% to $122.1 million in Q1.

- Service Revenue: Up 4% to $127.5 million, driven by IoT and Iridium PNT.

- Voice and Data Revenue: Rose 2% to $55.9 million.

- Commercial IoT Revenue: Increased 11% to $43.8 million.

- Commercial Broadband Revenue: Decreased 6% to $12.9 million.

- Hosting and Other Data Services Revenue: Up 7% to $14.9 million.

- Government Service Revenue: Increased to $26.8 million.

- Subscriber Equipment Sales: $23.1 million, down from Q1 last year.

- Engineering and Support Revenue: Increased to $37.5 million from $30.4 million.

- Cash and Cash Equivalents: $50.9 million as of March 31.

- Share Repurchase: Retired approximately 2.4 million shares at an average price of $29.48.

- Quarterly Dividend: $0.14 per share, with an increase to $0.15 per share starting Q3 2025.

- Capital Expenditures: $24.5 million in Q1.

- Pro Forma Free Cash Flow: Projected at $302 million for 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Service revenue continued to expand with the rollout of new services and subscriber growth.

- Iridium's partner ecosystem remains strong, with partners bullish on new product offerings like Iridium PNT.

- The company has successfully mitigated supply chain risks by avoiding exposure to China and expanding logistics in Europe.

- Iridium's acquisition of Satelles has positioned it well in the PNT market, with growing interest from new customers.

- The company is confident in its ability to leverage its unique network for long-term growth, supported by a strong spectrum position and technology.

Negative Points

- New tariff levels have created uncertainty, potentially impacting equipment costs and operational EBITDA.

- Commercial broadband revenue declined by 6% due to increased use of Iridium as a companion service.

- There is ongoing uncertainty regarding U.S. trade policies, which could result in significant incremental costs.

- Government service revenue growth is modest, with some deactivations related to USAID funding changes.

- The geopolitical environment and potential funding challenges for foreign governments and NGOs could impact business.