UBS has revised its price target for Performance Food Group (PFGC, Financial), raising it to $110 from the previous target of $103. The firm has maintained its Buy rating on the company's shares, reflecting ongoing confidence in PFGC's market potential.

Wall Street Analysts Forecast

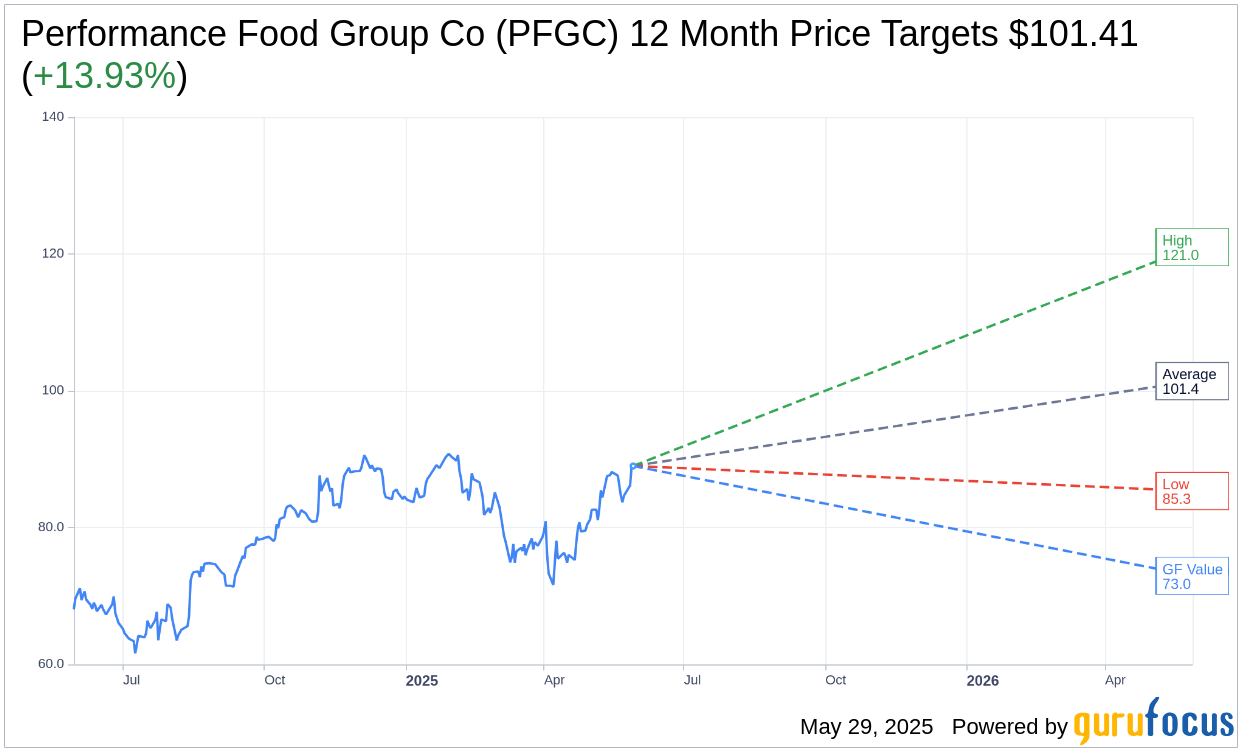

Based on the one-year price targets offered by 13 analysts, the average target price for Performance Food Group Co (PFGC, Financial) is $101.41 with a high estimate of $121.00 and a low estimate of $85.34. The average target implies an upside of 13.93% from the current price of $89.01. More detailed estimate data can be found on the Performance Food Group Co (PFGC) Forecast page.

Based on the consensus recommendation from 17 brokerage firms, Performance Food Group Co's (PFGC, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Performance Food Group Co (PFGC, Financial) in one year is $72.96, suggesting a downside of 18.03% from the current price of $89.01. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Performance Food Group Co (PFGC) Summary page.

PFGC Key Business Developments

Release Date: May 07, 2025

- Total Net Sales Growth: 10.5% increase in the quarter.

- Organic Independent Restaurant Case Growth: 3.4% in the quarter.

- Foodservice Segment Adjusted EBITDA Growth: 29% in the quarter.

- Specialty Segment Adjusted EBITDA Growth: 6.9% in the quarter.

- Net Income: $58.3 million in the third quarter.

- Adjusted EBITDA: Increased 20.1% to $385.1 million.

- Diluted Earnings Per Share: $0.37 in the fiscal third quarter.

- Adjusted Diluted Earnings Per Share: $0.79 in the fiscal third quarter.

- Operating Cash Flow: $827.1 million in the first 9 months of fiscal 2025.

- Free Cash Flow: Approximately $494 million after capital expenditures.

- Capital Expenditures: $332.7 million in the first 9 months of fiscal 2025.

- Guidance for Fiscal 2025 Net Sales: $63 billion to $63.5 billion range.

- Guidance for Fiscal 2025 Adjusted EBITDA: $1.725 billion to $1.75 billion range.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Performance Food Group Co (PFGC, Financial) reported a strong recovery in sales and profit in April, with a record sales week for Foodservice, Convenience, and the total company.

- The company experienced 29% segment adjusted EBITDA growth in the Foodservice segment, driven by favorable mix shift, profitable chain business growth, and procurement synergies.

- PFGC's Convenience segment outperformed the industry, with volume growth of approximately 1% despite a challenging volume backdrop.

- The Specialty segment, despite a difficult top-line environment, produced 6.9% adjusted EBITDA growth.

- PFGC's financial position is strong, with $827.1 million of operating cash flow generated in the first nine months of fiscal 2025, allowing for strategic investments and debt reduction.

Negative Points

- The fiscal third quarter faced challenges due to a difficult macroeconomic environment and adverse weather, particularly in February, which impacted sales and consumer behavior.

- Organic independent case growth was lower than expected in the third quarter, with a 3.4% increase, making the 6% target harder to reach.

- The Specialty segment experienced a low single-digit volume decline, with difficulties in the theater and value channels due to lack of content and consumer challenges.

- PFGC's guidance for fiscal 2025 was narrowed, with the upper end of the net sales and adjusted EBITDA ranges reduced, reflecting cautiousness in the current environment.

- The competitive landscape has become more intense, with increased pressure on pricing and market share gains being harder to achieve.