Key Highlights for Investors:

- Synopsys (SNPS, Financial) shares surged nearly 4% premarket following strong fiscal Q2 results.

- The upcoming Ansys acquisition is generating enthusiasm despite potential hurdles.

- Analyst projections suggest a promising upside potential for SNPS stock.

Shares of Synopsys Inc. (SNPS) experienced an impressive near-4% rise in premarket trading, fueled by the company's robust fiscal Q2 performance and optimistic forecasts. This momentum builds as analysts express confidence in Synopsys' strategic acquisition of Ansys, scheduled for early 2025, despite facing regulatory and geopolitical headwinds that loom over the industry.

Wall Street Analysts' Insights and Projections

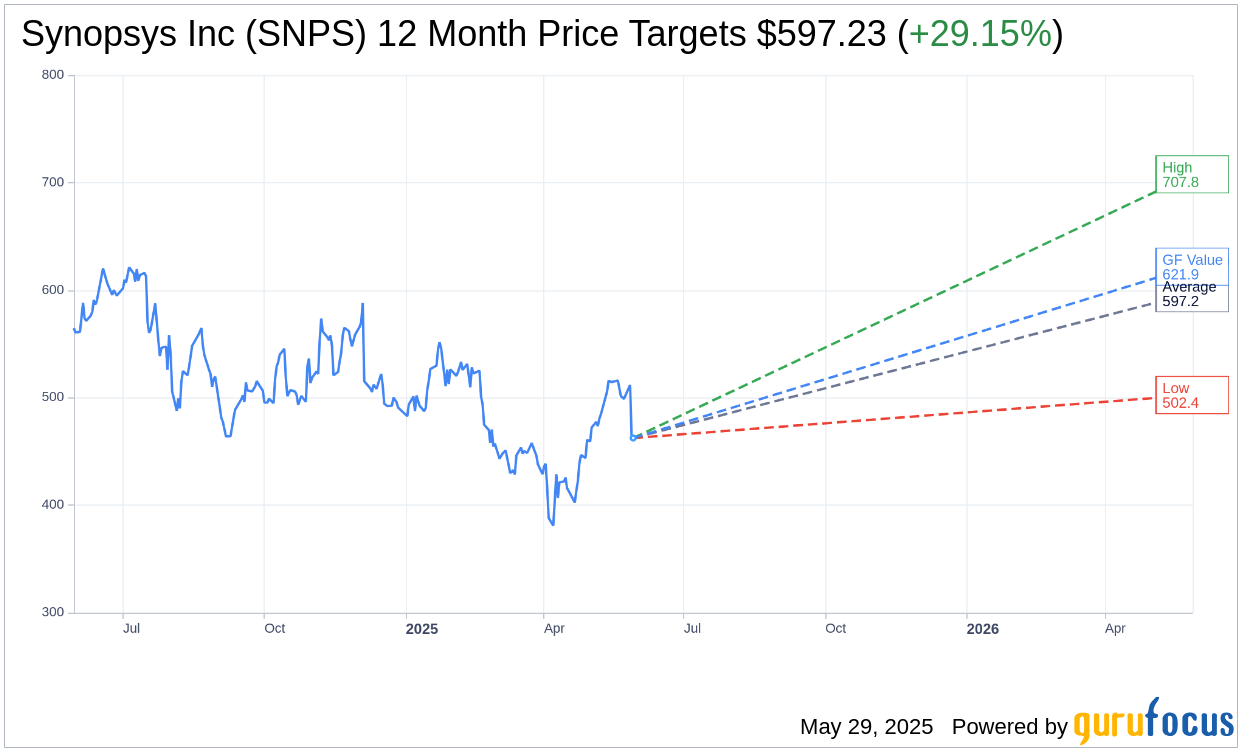

Examining the insights from 20 analysts, the one-year price target for Synopsys Inc. (SNPS, Financial) averages at $597.23. The projections span a high of $707.78 and a low of $502.41, translating to an anticipated upside of 29.15% from its current price of $462.43. For a deeper dive into these estimates, please visit the Synopsys Inc (SNPS) Forecast page.

The consensus from 21 brokerage firms assigns Synopsys Inc. (SNPS, Financial) an average brokerage recommendation of 1.9, signifying an "Outperform" status. This rating is part of a scale where 1 indicates a Strong Buy and 5 denotes a Sell.

According to GuruFocus estimates, the projected GF Value for Synopsys Inc. (SNPS, Financial) in one year stands at $621.85. This projection indicates a potential upside of 34.47% from its current price of $462.43. The GF Value metric represents GuruFocus's fair value estimate, derived from historical trading multiples, past business growth, and future performance forecasts. For more comprehensive information, please refer to the Synopsys Inc (SNPS) Summary page.