Summary:

- Alarum Technologies (ALAR, Financial) beats earnings expectations with Q1 Non-GAAP EPS of $0.16.

- Revenue misses forecast, showing a 15.5% year-over-year decline.

- Analysts project a potential upside for ALAR stock, despite a negative GF Value estimate.

Alarum Technologies (ALAR) reported a strong Q1 performance with a Non-GAAP EPS of $0.16, significantly surpassing analyst estimates by $0.15. Despite this positive earnings surprise, the company faced a revenue shortfall, reporting $7.1 million, a 15.5% decrease from the previous year, and falling short of forecasts by $0.21 million.

Future Outlook and Q2 Projections

Looking forward to the second quarter, Alarum Technologies anticipates revenue to rebound, projecting approximately $7.9 million. Adjusted EBITDA is expected to range between $0.5 million and $0.8 million, showcasing the company's strategic efforts to stabilize its financial performance.

Wall Street Analysts Forecast

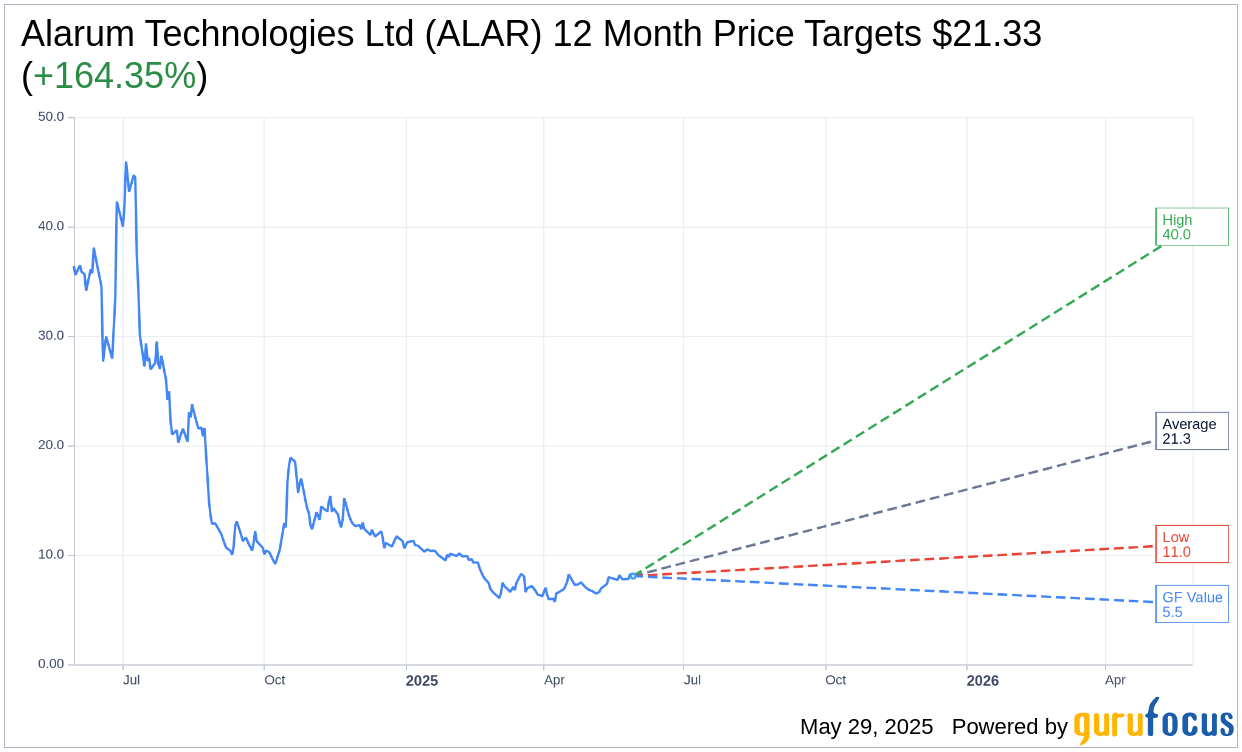

According to projections from three analysts, Alarum Technologies Ltd (ALAR, Financial) has an average target price of $21.33. The high estimate reaches $40.00, while the low is at $11.00. This suggests a substantial potential upside of 164.35% from the current share price of $8.07. For a detailed breakdown, visit the Alarum Technologies Ltd (ALAR) Forecast page.

Consensus among two brokerage firms places Alarum Technologies Ltd (ALAR, Financial) at an average recommendation of 2.0, reflecting an "Outperform" status. This rating is based on a scale where 1 indicates a Strong Buy and 5 signals a Sell.

Value Assessment and Investor Considerations

GuruFocus provides an estimated GF Value for Alarum Technologies Ltd (ALAR, Financial) at $5.52 for the next year. This estimate suggests a potential downside of 31.6% from the current trading price of $8.07. The GF Value is derived from the historical trading multiples, past business growth, and projected future performance. For additional insights, investors can explore the Alarum Technologies Ltd (ALAR) Summary page.