GameSquare (GAME, Financial) Holdings has introduced the latest advancement in its analytics technology through Stream Hatchet's new AI-powered data ecosystem. This cutting-edge platform transforms the way game publishers, international brands, and marketing agencies engage with Gen Z and Millennial audiences. It operates across leading live-streaming and social platforms, including Twitch, YouTube, TikTok, and Instagram.

The proprietary system of Stream Hatchet currently gathers and integrates data from 16 key streaming and social networks. This enables the delivery of real-time and actionable insights, helping clients like Capcom, Riot Games, Scopely, and Bungie to enhance their campaign returns on investment (ROI), identify emerging content creators, and foster genuine interactions with younger, hard-to-reach demographics.

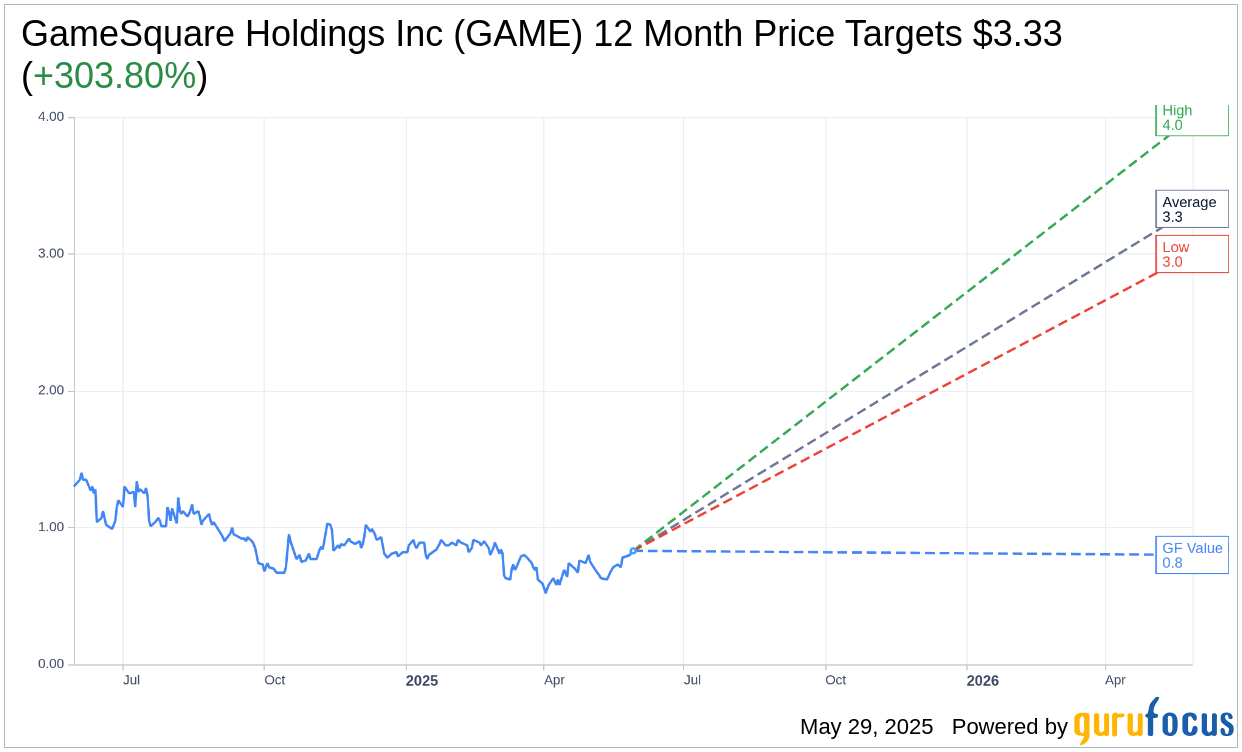

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for GameSquare Holdings Inc (GAME, Financial) is $3.33 with a high estimate of $4.00 and a low estimate of $3.00. The average target implies an upside of 303.80% from the current price of $0.83. More detailed estimate data can be found on the GameSquare Holdings Inc (GAME) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, GameSquare Holdings Inc's (GAME, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for GameSquare Holdings Inc (GAME, Financial) in one year is $0.80, suggesting a downside of 3.09% from the current price of $0.8255. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the GameSquare Holdings Inc (GAME) Summary page.