Key Highlights:

- Nvidia's stocks surged by 6% in premarket following outstanding quarterly results.

- Analysts remain optimistic about Nvidia's prospects, particularly due to growing AI demand.

- Nvidia may once again dominate as the most valuable company by market cap.

Nvidia's Impressive Market Rally

Nvidia (NVDA, Financial) demonstrated remarkable resilience with a 6% rise in premarket trading, buoyed by exceptional quarterly performance. Despite recent export restrictions to China, Nvidia's financials have exceeded expectations. Esteemed analysts have lauded this strong performance and maintain a positive outlook for the company, citing heightened AI demand as a key growth driver. These developments position Nvidia to potentially reclaim its status as the most valuable company by market capitalization.

Wall Street Analysts' Price Targets

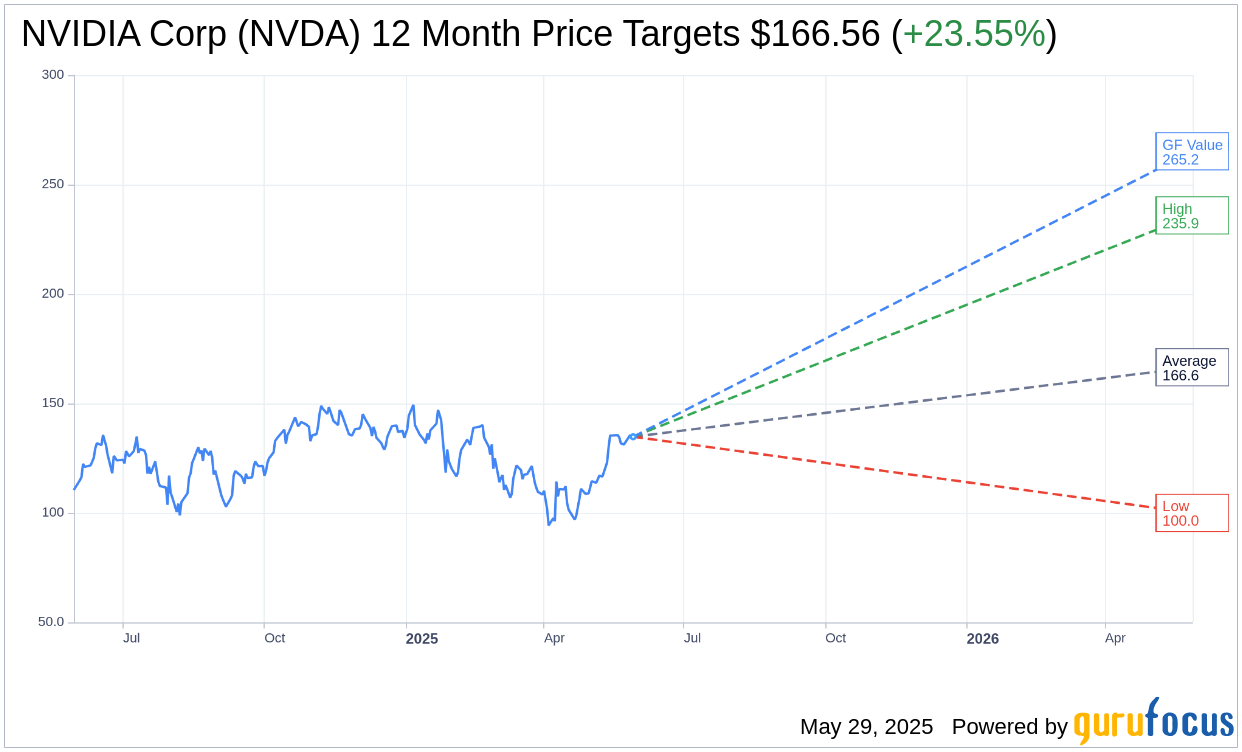

Based on insights from 51 seasoned analysts, the one-year price targets for NVIDIA Corp (NVDA, Financial) present an average target price of $166.56. The projections span a high of $235.92 to a low of $100.00. This average target indicates a potential upside of 23.55% from its existing price of $134.81. For an in-depth analysis, investors can explore the NVIDIA Corp (NVDA) Forecast page.

Brokerage Recommendations

With input from 64 brokerage firms, the consensus recommendation for NVIDIA Corp (NVDA, Financial) stands at 1.8, which translates to an "Outperform" rating. This recommendation scale ranges from 1, representing a strong buy, to 5, indicating a sell.

GuruFocus GF Value Estimation

According to GuruFocus estimates, NVIDIA Corp (NVDA, Financial) is projected to attain a GF Value of $265.22 within a year, marking a substantial 96.74% upside from its current price of $134.81. The GF Value represents GuruFocus's valuation of the stock's fair trade value, determined by analyzing historical trading multiples, past business growth, and prospective business performance estimates. Investors seeking further details can refer to the NVIDIA Corp (NVDA) Summary page.