On May 29, 2025, Citigroup reinstated coverage on Kellanova (K, Financial), marking the company's return to their list of analyzed stocks. The report was issued by analyst Thomas Palmer, who assigned a 'Neutral' rating to the stock.

The announcement included a price target set at $83.50 USD for Kellanova (K, Financial). This marks a significant point of reference for investors monitoring the stock's potential performance in the market. No prior price target or rating was available for comparison, as this marks a fresh assessment by Citigroup.

Kellanova (K, Financial), listed on the NYSE, now finds itself under renewed scrutiny following this rating reinstatement. Investors and market watchers will likely keep a close eye on the stock's trajectory following Citigroup's analysis.

Wall Street Analysts Forecast

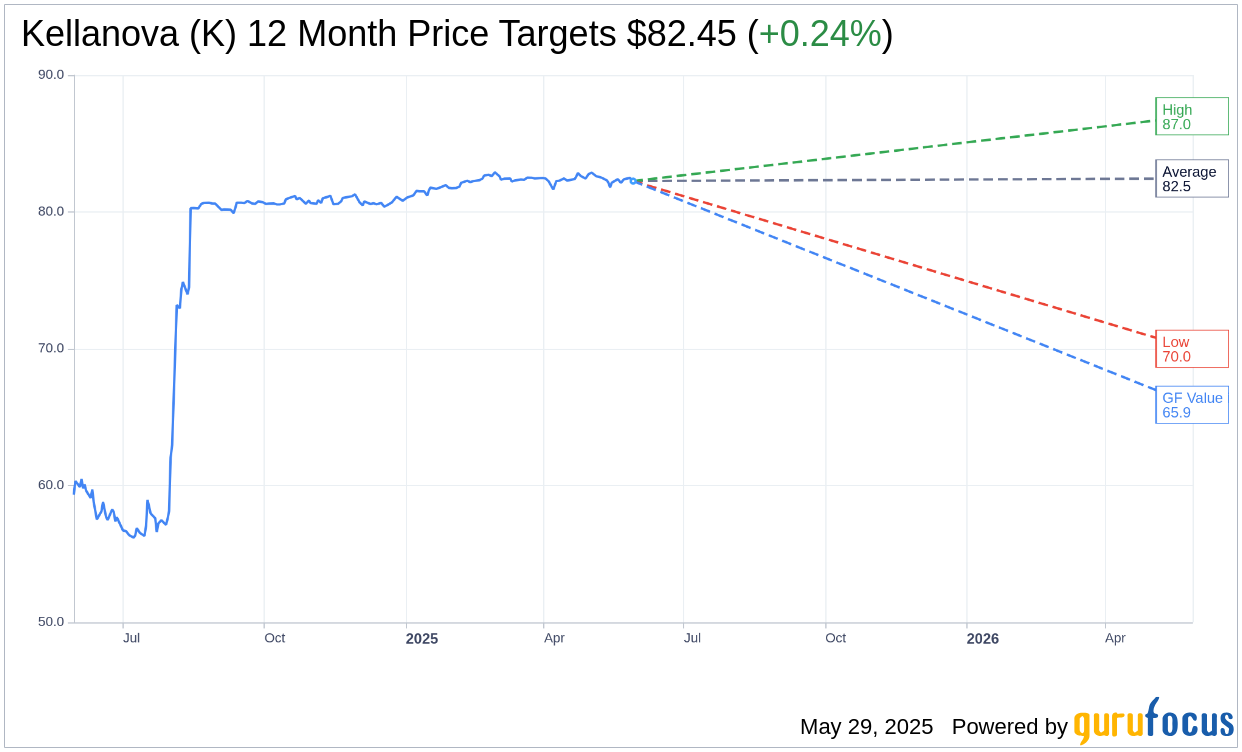

Based on the one-year price targets offered by 16 analysts, the average target price for Kellanova (K, Financial) is $82.45 with a high estimate of $87.00 and a low estimate of $70.00. The average target implies an upside of 0.24% from the current price of $82.26. More detailed estimate data can be found on the Kellanova (K) Forecast page.

Based on the consensus recommendation from 16 brokerage firms, Kellanova's (K, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Kellanova (K, Financial) in one year is $65.91, suggesting a downside of 19.88% from the current price of $82.26. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Kellanova (K) Summary page.