RBC Capital's analyst Ken Herbert has revised the price target for Heico (HEI, Financial) shares, increasing it from $285 to $315 while maintaining an Outperform rating. This decision follows Heico's impressive second-quarter results, showcasing an 11% organic growth rate. Notably, the Flight Support Group (FSG) segment excelled, achieving 14% organic growth during the quarter. The outlook for FSG remains optimistic, as concerns about potential risks from slower airline growth have not come to fruition, according to RBC.

Wall Street Analysts Forecast

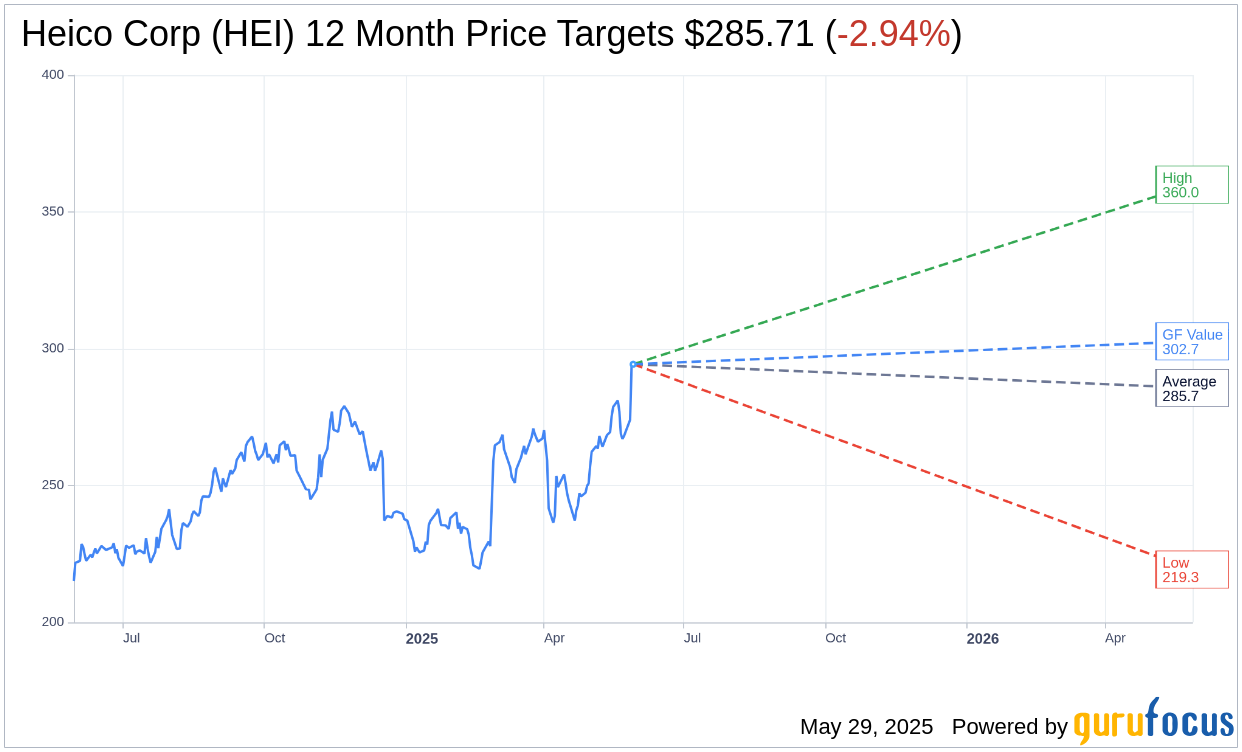

Based on the one-year price targets offered by 16 analysts, the average target price for Heico Corp (HEI, Financial) is $285.71 with a high estimate of $360.00 and a low estimate of $219.33. The average target implies an downside of 2.94% from the current price of $294.35. More detailed estimate data can be found on the Heico Corp (HEI) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Heico Corp's (HEI, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Heico Corp (HEI, Financial) in one year is $302.71, suggesting a upside of 2.84% from the current price of $294.35. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Heico Corp (HEI) Summary page.

HEI Key Business Developments

Release Date: May 28, 2025

- Consolidated Operating Income: Increased by 19% compared to Q2 fiscal '24.

- Net Sales: Increased by 15% compared to Q2 fiscal '24.

- Flight Support Group Operating Income: Increased by 24% compared to Q2 fiscal '24.

- Flight Support Group Net Sales: Increased by 19% to $767.1 million.

- Electronic Technologies Group Net Sales: Increased by 7% to $342.2 million.

- Consolidated Net Income: Increased 27% to $156.8 million or $1.12 per diluted share.

- Cash Flow from Operating Activities: Increased 45% to $204.7 million.

- Consolidated EBITDA: Increased 18% to $297.7 million.

- Net Debt-to-EBITDA Ratio: Improved to 1.86x as of April 30, 2025.

- Flight Support Group Operating Margin: Improved to 24.1%.

- Electronic Technologies Group Operating Margin: 22.8% in Q2 fiscal '25.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Heico Corp (HEI, Financial) reported record consolidated operating income and net sales for the second quarter of fiscal 2025, with increases of 19% and 15% respectively compared to the same period in fiscal 2024.

- The Flight Support Group achieved all-time quarterly operating income and net sales records, with a 24% increase in operating income and a 19% increase in net sales.

- The Electronic Technologies Group experienced strong demand, particularly in space and aerospace products, contributing to double-digit organic net sales growth.

- Consolidated net income rose by 27% to $156.8 million, or $1.12 per diluted share, compared to $123.1 million, or $0.88 per diluted share, in the second quarter of fiscal 2024.

- Cash flow from operating activities increased by 45% to $204.7 million, and the net debt-to-EBITDA ratio improved to 1.86x as of April 30, 2025.

Negative Points

- Heico Corp (HEI) faces risks from potential reductions in defense, space, or homeland security spending by US and/or foreign customers, which could impact sales.

- The company is exposed to competition from existing and new competitors, which could reduce sales.

- Product development or manufacturing difficulties could increase costs and delay sales.

- Cybersecurity events or disruptions in information technology systems could adversely affect business operations.

- Economic conditions, including inflation, could negatively impact costs and revenues across various industries.