- Salesforce (CRM, Financial) demonstrates promising growth prospects, bolstered by its AI initiatives.

- Analysts maintain a positive outlook, with several reiterating "Outperform" ratings.

- Upside potential remains strong, with significant room for growth according to price targets.

Salesforce (CRM) impressed the market by surpassing first-quarter expectations, largely thanks to its strategic focus on AI initiatives. Despite a slight 1% dip in share price, analysts have identified foreign exchange gains as a significant revenue driver. Esteemed financial institutions, Evercore ISI and Morgan Stanley, have reaffirmed their "Outperform" ratings, while simultaneously raising their price targets for the company.

Wall Street Analysts Forecast

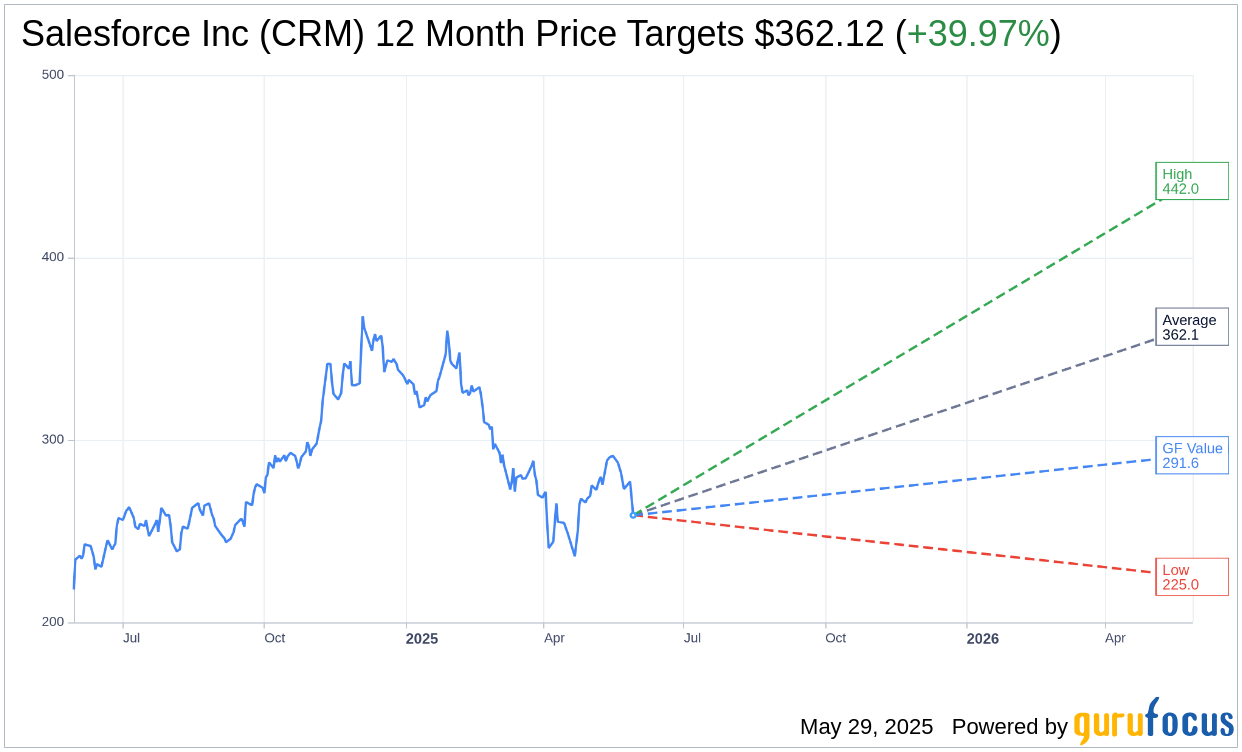

Wall Street's consensus offers an optimistic view for Salesforce Inc (CRM, Financial), with 48 analysts setting an average one-year price target of $362.12. Projections span a high of $442.00 and a low of $225.00, suggesting a compelling upside potential of 39.97% from the current trading price of $258.71. For more in-depth analyses and estimates, visit the Salesforce Inc (CRM) Forecast page.

The consensus recommendation from 54 brokerage firms places Salesforce Inc (CRM, Financial) at an average brokerage rating of 2.0, which corresponds to an "Outperform" status. This rating scale ranges from 1 to 5, where 1 signifies a Strong Buy and 5 denotes a Sell.

According to GuruFocus projections, the estimated GF Value for Salesforce Inc (CRM, Financial) over the next year is $291.64. This estimation implies a promising upside of 12.73% from the current price of $258.7053. The GF Value, a product of historical multiples, past growth trajectories, and future performance estimates, offers a comprehensive view of the stock's intrinsic worth. You can explore further details on the Salesforce Inc (CRM) Summary page.