BofA has adjusted its price outlook for Intellia Therapeutics (NTLA, Financial), reducing it from $43 to $39, while maintaining a Buy recommendation. This change follows the identification of a single grade 4 liver enzyme elevation in the phase 3 MAGNITUDE study of nex-z, targeting transthyretin amyloid cardiomyopathy. Although Intellia had a favorable track record until now, BofA anticipates ongoing concerns regarding the program's safety until more data emerges.

Despite the setback, Intellia is still viewed as having potential for a one-time treatment in the hereditary angioedema and ATTR markets. The firm, however, has revised its estimate of the success probability for ATTR-CM, dropping it from 35% to 30% as they await further safety follow-up for the nex-z study.

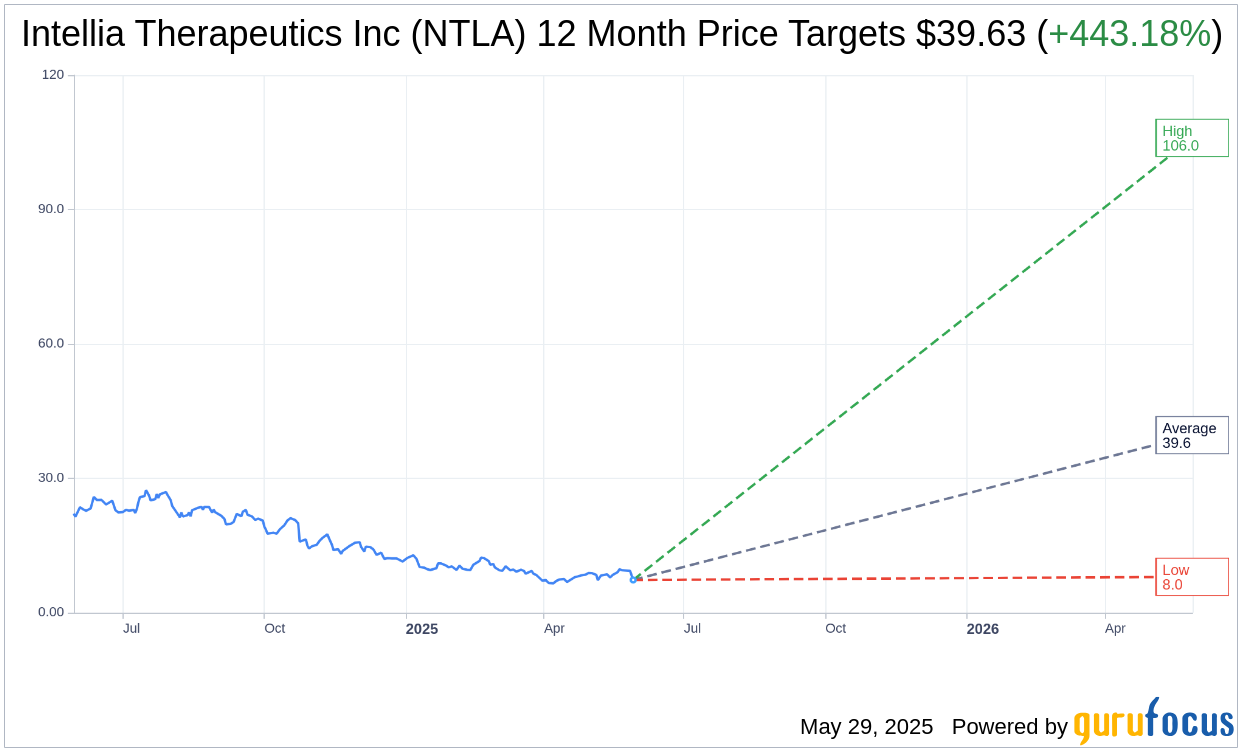

Wall Street Analysts Forecast

Based on the one-year price targets offered by 24 analysts, the average target price for Intellia Therapeutics Inc (NTLA, Financial) is $39.63 with a high estimate of $106.00 and a low estimate of $8.00. The average target implies an upside of 443.18% from the current price of $7.30. More detailed estimate data can be found on the Intellia Therapeutics Inc (NTLA) Forecast page.

Based on the consensus recommendation from 28 brokerage firms, Intellia Therapeutics Inc's (NTLA, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Intellia Therapeutics Inc (NTLA, Financial) in one year is $27.69, suggesting a upside of 279.58% from the current price of $7.295. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Intellia Therapeutics Inc (NTLA) Summary page.

NTLA Key Business Developments

Release Date: May 08, 2025

- Cash, Cash Equivalents, and Marketable Securities: $707.1 million as of March 31, 2025, compared to $861.7 million as of December 31, 2024.

- Collaboration Revenue: $16.6 million during Q1 2025, down from $28.9 million during Q1 2024.

- R&D Expenses: $108.4 million during Q1 2025, compared to $111.8 million in Q1 2024.

- G&A Expenses: $29 million during Q1 2025, compared to $31.1 million in Q1 2024.

- Stock-Based Compensation in R&D: $12.6 million for Q1 2025.

- Stock-Based Compensation in G&A: $9.2 million for Q1 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Intellia Therapeutics Inc (NTLA, Financial) has made significant progress in its clinical pipeline, with the first patients dosed in Phase 3 studies for hereditary angioedema (HAE) and ATTR amyloidosis.

- The company received RMAT designation from the FDA for its Nexi therapy for ATTR with cardiomyopathy, enhancing engagement with the FDA.

- Enrollment in the global Phase 3 Halo study for HAE is progressing rapidly, indicating high unmet need and interest from patients and investigators.

- Intellia Therapeutics Inc (NTLA) maintains a solid balance sheet with $707.1 million in cash, cash equivalents, and marketable securities as of March 31, 2025.

- The company is on track to file its first Biologics License Application (BLA) in 2026, with plans to launch its first product in 2027.

Negative Points

- Intellia Therapeutics Inc (NTLA) experienced a decrease in collaboration revenue, dropping from $28.9 million in Q1 2024 to $16.6 million in Q1 2025.

- The company reported a decrease in cash reserves from $861.7 million at the end of 2024 to $707.1 million by March 31, 2025.

- There are concerns about the regulatory environment due to leadership changes at the FDA, although Intellia has not experienced tangible changes yet.

- Intellia Therapeutics Inc (NTLA) is facing competition in the ATTR market, with other companies like Alnylam Pharmaceuticals not lowering their prices despite label expansions.

- The company has undergone restructuring, including workforce reductions and real estate portfolio adjustments, which may impact operations and morale.