Mativ (MATV, Financial) has achieved a noteworthy development in its collaboration with Miru Smart Technologies. Leveraging its specialized Argotec brand in polymer film solutions, Mativ has successfully obtained an inaugural order for materials essential to Miru’s cutting-edge electrochromic window technology from a prominent glass producer. This milestone represents a significant leap in establishing the supply chain necessary for large-scale production and the worldwide adoption of electrochromic glass by leading automotive manufacturers. The move is in line with Mativ’s dedication to advancing safety, sustainability, and innovative solutions.

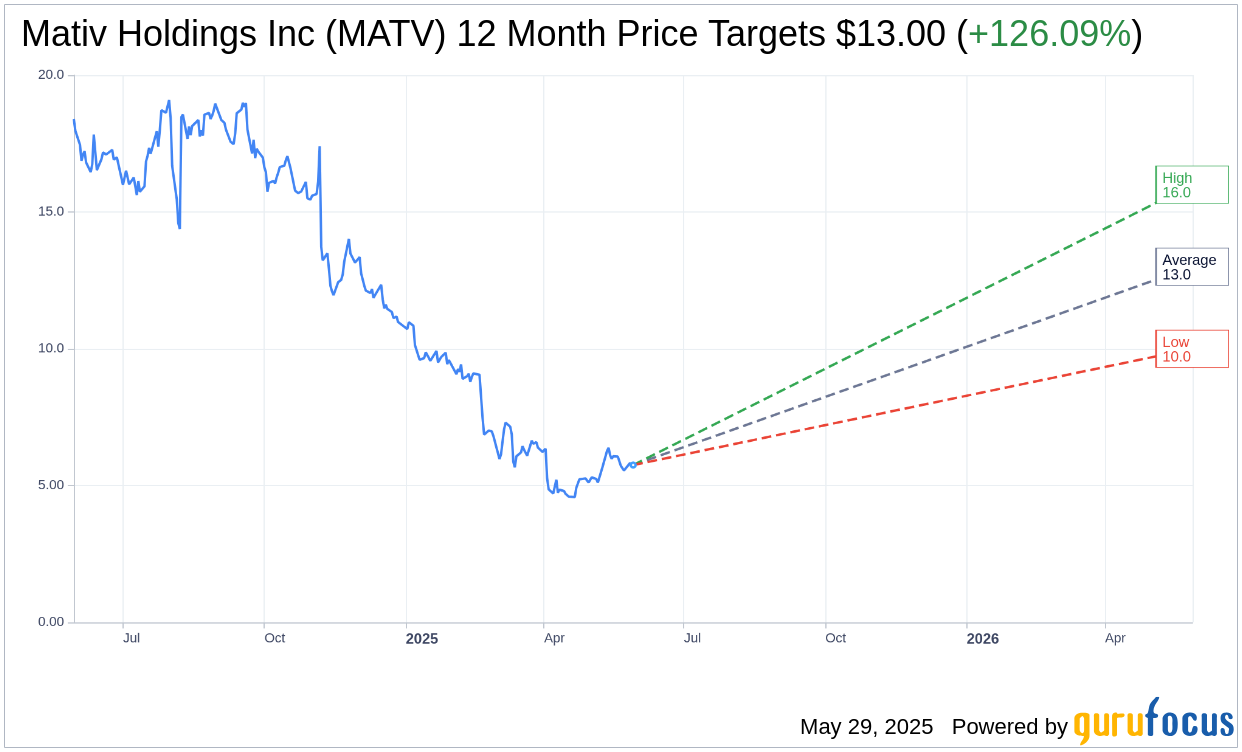

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Mativ Holdings Inc (MATV, Financial) is $13.00 with a high estimate of $16.00 and a low estimate of $10.00. The average target implies an upside of 126.09% from the current price of $5.75. More detailed estimate data can be found on the Mativ Holdings Inc (MATV) Forecast page.

Based on the consensus recommendation from 1 brokerage firms, Mativ Holdings Inc's (MATV, Financial) average brokerage recommendation is currently 1.0, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Mativ Holdings Inc (MATV, Financial) in one year is $16.49, suggesting a upside of 186.78% from the current price of $5.75. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Mativ Holdings Inc (MATV) Summary page.

MATV Key Business Developments

Release Date: May 08, 2025

- Consolidated Net Sales: $485 million, down 3% year over year on a reported basis, flat on an organic basis.

- Adjusted EBITDA: $37.2 million, down 19% from $45.8 million in the prior year.

- FAM Segment Net Sales: $188 million, down more than 7% versus Q1 of 2024.

- SAS Segment Net Sales: $297 million, up almost 6% on an organic basis.

- FAM Adjusted EBITDA: $23 million, down $10 million year over year.

- SAS Adjusted EBITDA: $33 million, up more than 3% year over year.

- Net Debt: $1.04 billion with available liquidity of $407 million.

- Net Leverage Ratio: 4.7 times, with a covenant level of 5.5 times.

- Capital Expenditures: Reduced to $40 million per year from $55 million in 2024.

- Inventory Reduction Target: $20 million to $30 million in 2025.

- Interest Expense: $18 million, decreased by $0.5 million from the prior year.

- Tax Rate: 5.6% for the quarter.

- Goodwill Impairment Charge: $412 million pre-tax, non-cash charge.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Mativ Holdings Inc (MATV, Financial) has established three near-term priorities to drive improved performance: enhanced commercial execution, deleveraging the balance sheet, and conducting a strategic portfolio review.

- The Sustainable and Adhesive Solutions (SAS) segment has shown strong momentum with four consecutive quarters of sales growth and five consecutive quarters of EBITDA and margin growth.

- The company plans to reduce capital spending to $40 million per year, down from $55 million in 2024, to improve free cash flow and accelerate debt reduction.

- Mativ Holdings Inc (MATV) has a comprehensive playbook to mitigate tariff impacts, with less than 7% of annual sales currently subject to tariff exposure.

- The company is focusing on expanding its presence in targeted markets such as medical and optical films, which have shown a noticeable uptick in demand.

Negative Points

- Mativ Holdings Inc (MATV) is facing challenges due to a continuously suppressed demand environment, particularly in the automotive and construction end markets.

- The Filtration and Advanced Materials (FAM) segment experienced a decline in performance, with net sales down more than 7% year over year.

- Adjusted EBITDA from continuing operations decreased by 19% compared to the prior year, impacted by higher manufacturing and distribution costs.

- The company recorded a pre-tax, non-cash goodwill impairment charge of $412 million due to a sustained decline in share price.

- Market demand remains uncertain, and the expected return to pre-pandemic demand levels has not materialized, affecting sales and operating leverage.