Zoominfo Technologies Inc. (GTM, Financial) has witnessed a notable bearish sentiment as put options activity surged to four times the usual levels, with a total of 4,163 contracts traded. The most traded options are the June 2025 $9 and $11 puts, collectively accumulating almost 4,100 contracts. This increased activity reflects a Put/Call Ratio of 2082, suggesting a strong bearish outlook. Additionally, the at-the-money implied volatility has increased by over one point during the day. Investors are eyeing the upcoming earnings report, slated for release on August 4th, which could further influence trading strategies.

Wall Street Analysts Forecast

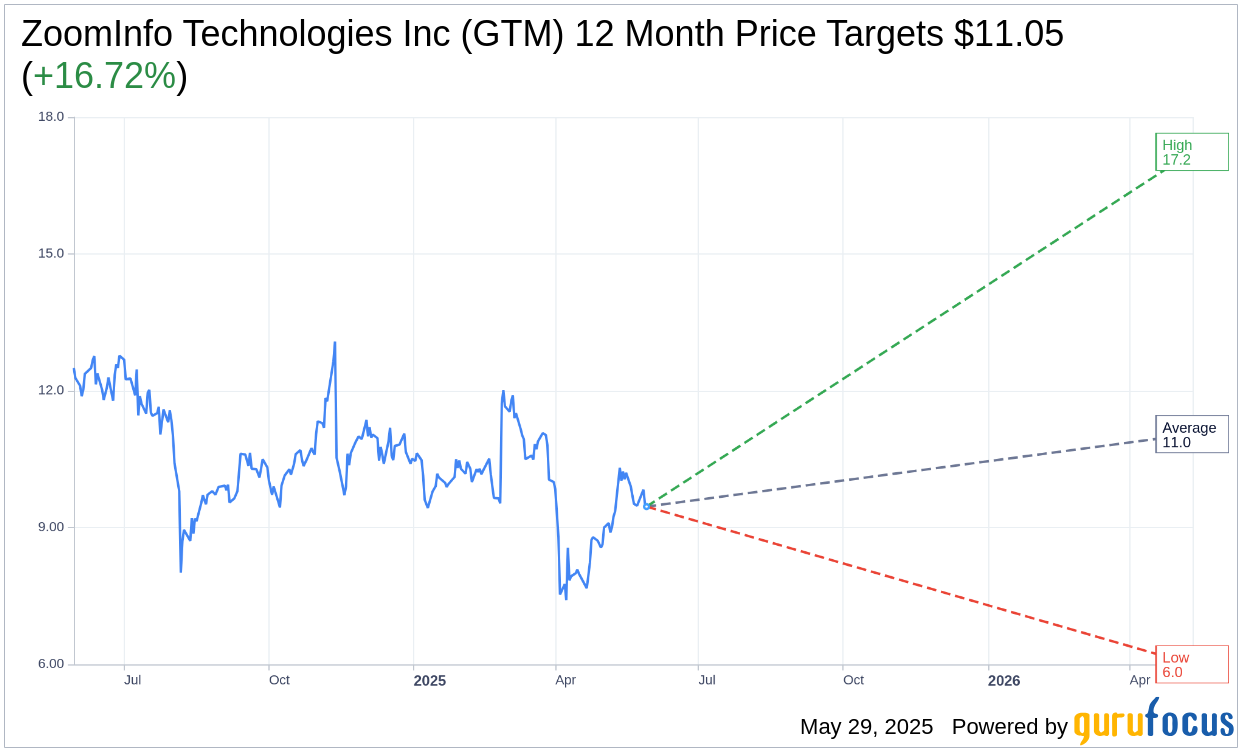

Based on the one-year price targets offered by 22 analysts, the average target price for ZoomInfo Technologies Inc (GTM, Financial) is $11.05 with a high estimate of $17.24 and a low estimate of $6.00. The average target implies an upside of 16.72% from the current price of $9.47. More detailed estimate data can be found on the ZoomInfo Technologies Inc (GTM) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, ZoomInfo Technologies Inc's (GTM, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for ZoomInfo Technologies Inc (GTM, Financial) in one year is $20.36, suggesting a upside of 115.11% from the current price of $9.465. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the ZoomInfo Technologies Inc (GTM) Summary page.