On May 29, 2025, Barclays analyst Manav Patnaik released a new report regarding First Advantage (FA, Financial), maintaining the company's rating while adjusting the price target. Barclays continues to rate First Advantage (FA) as "Equal-Weight."

In the latest update, the price target for First Advantage (FA, Financial) has been raised from $15.00 to $18.00 USD, reflecting a significant increase of 20%. This adjustment indicates the analyst's updated outlook on the stock's potential value.

First Advantage (FA, Financial), listed on NASDAQ, remains under observation by Barclays, with the retained "Equal-Weight" rating suggesting that the analyst expects the stock to perform in line with the broader market average.

Investors interested in First Advantage (FA, Financial) may find the updated price target and consistent rating useful as they consider their positions in the stock. The report highlights Barclays' current perspective on the stock's prospects amidst market conditions.

Wall Street Analysts Forecast

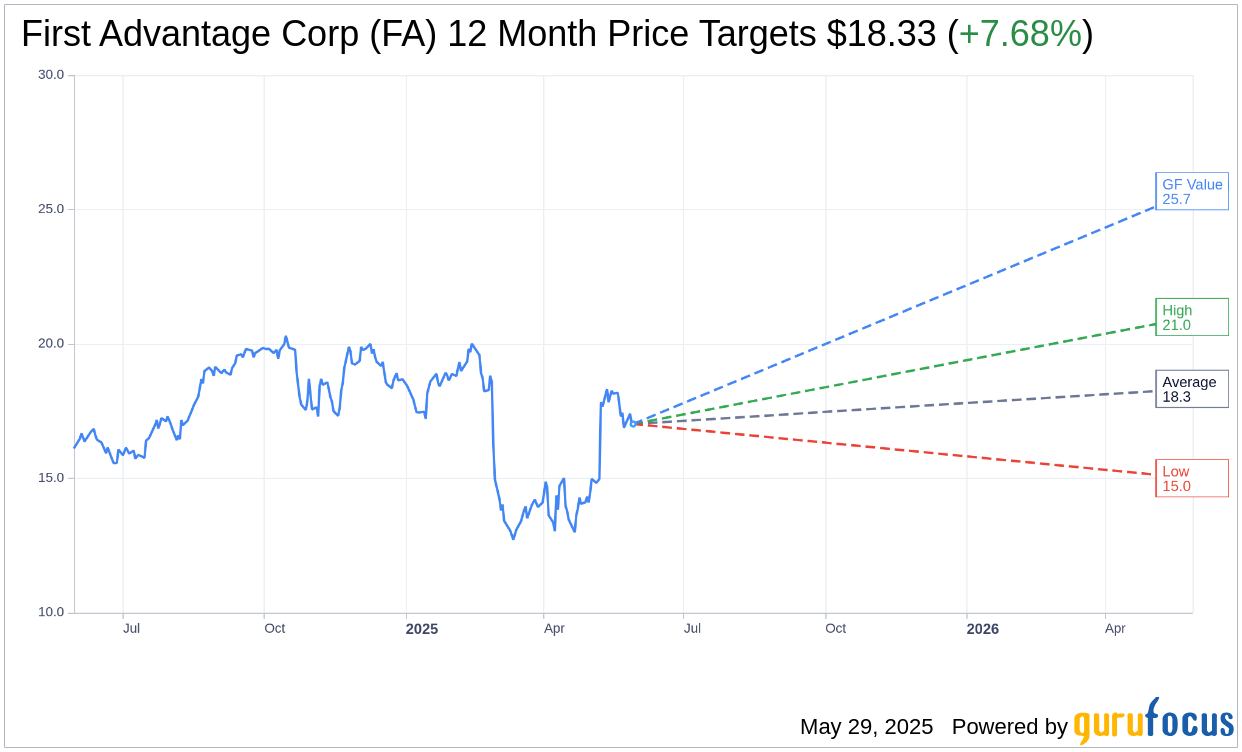

Based on the one-year price targets offered by 6 analysts, the average target price for First Advantage Corp (FA, Financial) is $18.33 with a high estimate of $21.00 and a low estimate of $15.00. The average target implies an upside of 7.68% from the current price of $17.03. More detailed estimate data can be found on the First Advantage Corp (FA) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, First Advantage Corp's (FA, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for First Advantage Corp (FA, Financial) in one year is $25.68, suggesting a upside of 50.84% from the current price of $17.025. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the First Advantage Corp (FA) Summary page.