Key Highlights:

- Bath & Body Works (BBWI, Financial) shares drop by over 7% following conservative guidance.

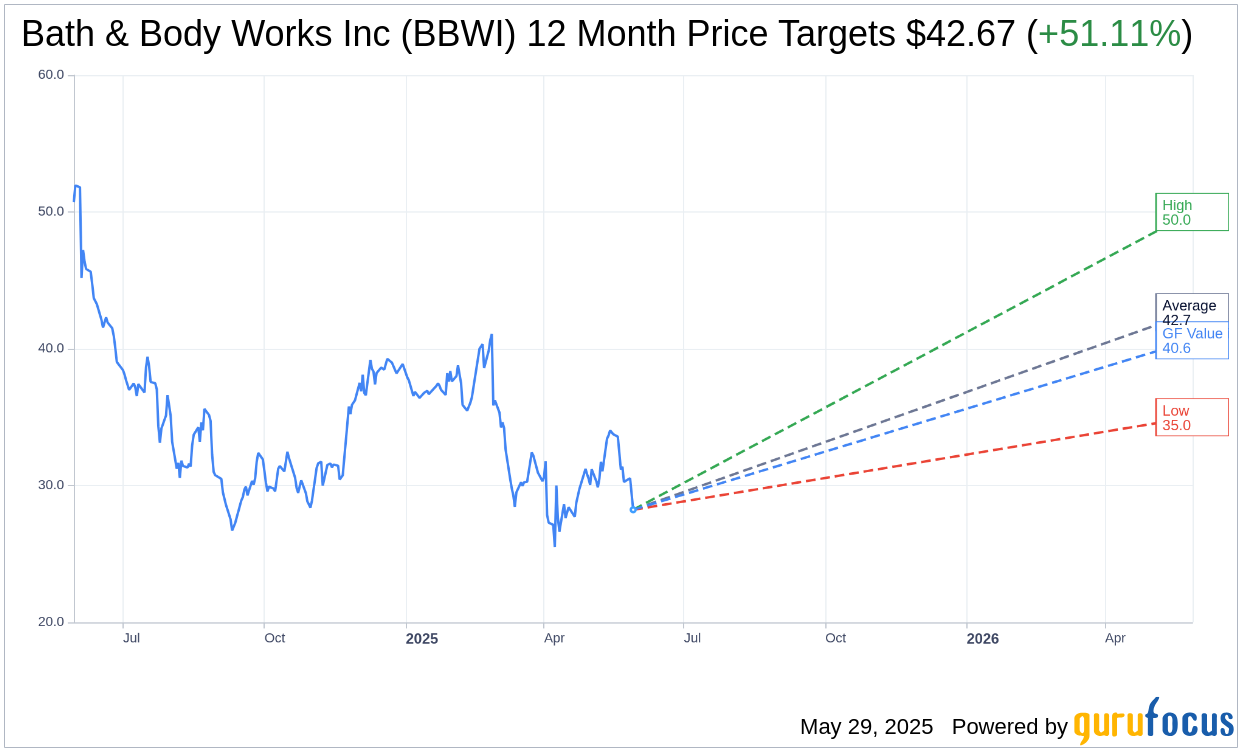

- Wall Street analysts forecast a potential upside of 51.11% from current levels.

- CEO transition announced amidst a significant 40% decline in stock price.

Quarterly Outlook and Guidance

Bath & Body Works (BBWI) has encountered a challenging period, with its share price declining over 7% following the release of its guidance, which signals a slowdown in sales and profitability. The company anticipates Q2 revenue to be in the range of $1.53 billion to $1.56 billion, falling short of the consensus estimate of $1.57 billion. Additionally, the company is navigating a CEO transition during a period marked by a 40% drop in its stock price.

Analyst Price Targets and Recommendations

According to the latest one-year price targets provided by 16 analysts, Bath & Body Works Inc (BBWI, Financial) has an average target price of $42.67. The predictions range from a high of $50.00 to a low of $35.00, indicating a potential upside of 51.11% from the current trading price of $28.24. For a deeper dive into these estimates, investors can visit the Bath & Body Works Inc (BBWI) Forecast page.

The consensus recommendation from 18 brokerage firms assigns Bath & Body Works Inc (BBWI, Financial) an average rating of 2.0, which aligns with an "Outperform" status. This rating operates on a scale from 1 to 5, where 1 indicates a Strong Buy, and 5 suggests a Sell recommendation.

GuruFocus Valuation Insights

Utilizing GuruFocus' proprietary metrics, the GF Value for Bath & Body Works Inc (BBWI, Financial) is projected to be $40.62 over the next year. This valuation suggests a potential upside of 43.86% from the current share price of $28.235. The GF Value represents an estimate of the stock's fair trading value, derived from its historical trading multiples, past business growth, and anticipated future performance. For more comprehensive data, please refer to the Bath & Body Works Inc (BBWI) Summary page.