Key Highlights:

- Nutrien (NTR, Financial) is making strategic moves to boost potash exports in Asia via a new terminal in the Pacific Northwest.

- Wall Street analysts project a notable upside for Nutrien's stock, with a consensus price target suggesting potential growth.

- Despite positive analyst sentiment, the GF Value indicates a potential downside, suggesting a nuanced investment scenario.

Nutrien's Strategic Expansion Plans

Nutrien (NTR) is gearing up for a strategic expansion by planning a pivotal terminal in the Pacific Northwest. This move is aimed at amplifying potash exports to key Indo-Pacific markets such as China, India, and Japan. The terminal location is set to be confirmed by 2025, with operational capabilities expected by 2030. This infrastructure is crucial to meeting the escalating fertilizer demand in these regions.

Wall Street Analysts Forecast

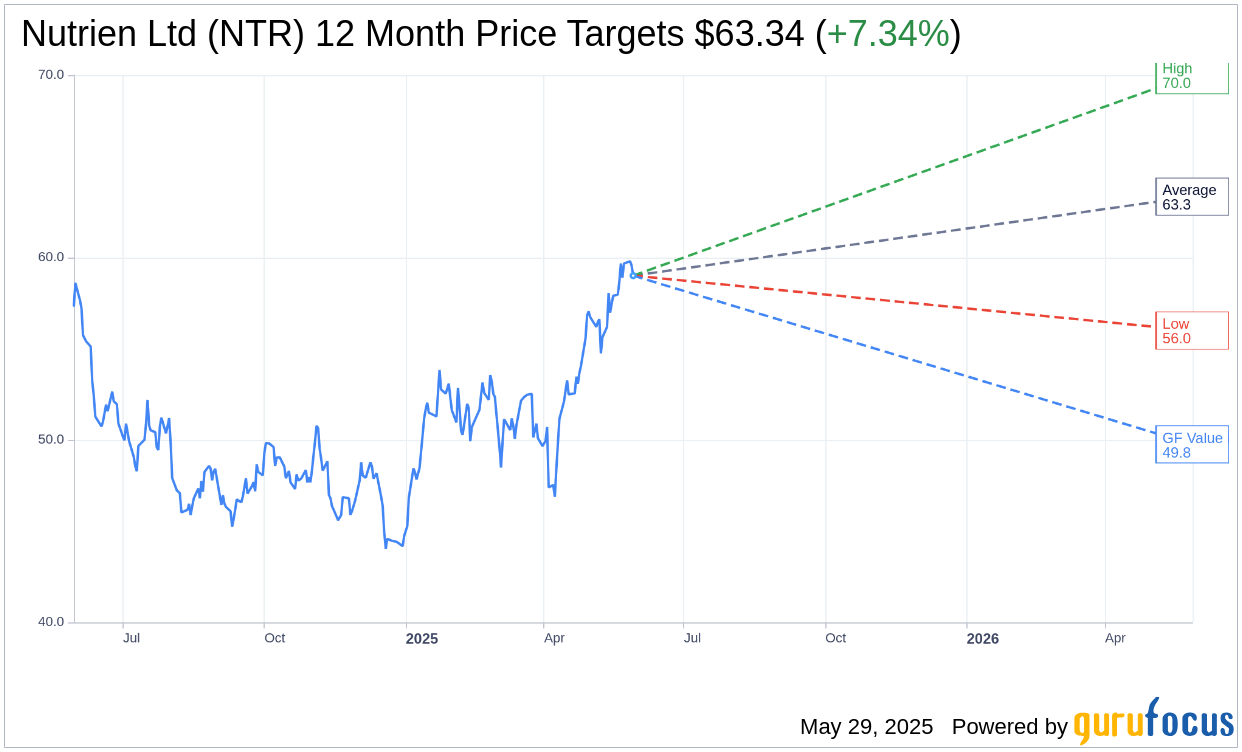

According to projections from 20 analysts, Nutrien Ltd's (NTR, Financial) average price target over the next year is $63.34. This entails a high forecast of $70.00 and a low estimate of $56.00. The average target price suggests a potential upside of 7.34% from its current trading price of $59.01. For more in-depth projections, visit the Nutrien Ltd (NTR) Forecast page.

Brokerage Consensus and Recommendations

An evaluation by 24 brokerage firms has resulted in an average recommendation rating of 2.3 for Nutrien Ltd (NTR, Financial), which equates to an "Outperform" standing. This rating is determined on a scale from 1 to 5, with 1 as a Strong Buy and 5 as a Sell. This insight underscores the positive analyst sentiment towards Nutrien's stock.

GF Value Insight

Per GuruFocus estimates, the projected GF Value for Nutrien Ltd (NTR, Financial) in one year is $49.76. This reflects a potential downside of 15.67% from its current price of $59.005. The GF Value serves as GuruFocus' fair value estimate, derived from historical trading multiples, past business growth, and future performance forecasts. Further details can be accessed on the Nutrien Ltd (NTR) Summary page.