American Eagle Outfitters (AEO, Financial) has reported a 5% reduction in its total ending inventory, bringing it down to $645 million. This decrease is accompanied by a 5% drop in inventory units. This adjustment follows a writedown, which has allowed the company to align its seasonal inventory more closely with current sales patterns. The strategic inventory management indicates a move towards optimizing stock levels to better match market demand. This approach aims to enhance the company's efficiency and responsiveness to consumer trends.

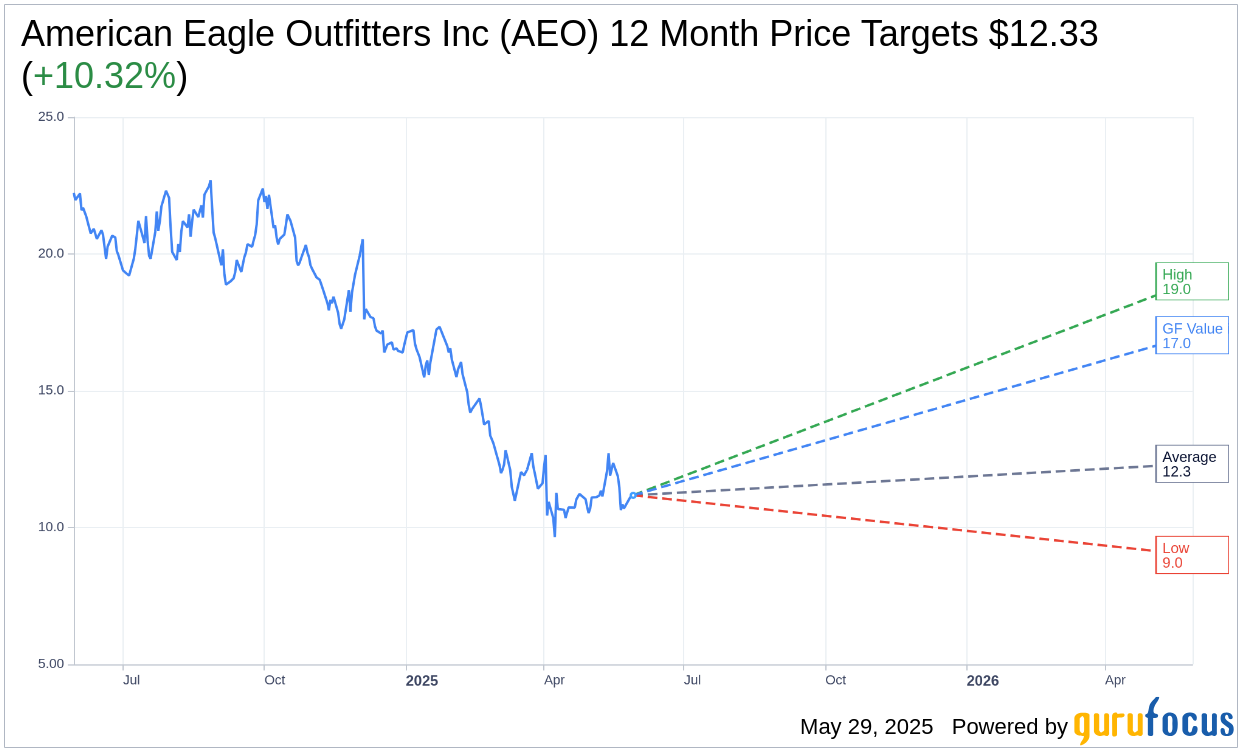

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for American Eagle Outfitters Inc (AEO, Financial) is $12.33 with a high estimate of $19.00 and a low estimate of $9.00. The average target implies an upside of 10.32% from the current price of $11.18. More detailed estimate data can be found on the American Eagle Outfitters Inc (AEO) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, American Eagle Outfitters Inc's (AEO, Financial) average brokerage recommendation is currently 2.9, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for American Eagle Outfitters Inc (AEO, Financial) in one year is $17.03, suggesting a upside of 52.33% from the current price of $11.18. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the American Eagle Outfitters Inc (AEO) Summary page.

AEO Key Business Developments

Release Date: March 12, 2025

- Record Revenue: $5.3 billion, fueled by 4% comparable sales growth.

- Adjusted Operating Profit: $445 million, marking one of the strongest years in history.

- Fourth Quarter Operating Income: $142 million, the highest in over a decade.

- Full Year Cash Flow from Operations: Over $470 million.

- Shareholder Returns: Over $280 million returned through buybacks and dividends.

- Aerie Revenue: Crossed $1.7 billion in 2024.

- Fourth Quarter Revenue: $1.6 billion, down 4% year-over-year.

- Fourth Quarter Comparable Sales: Increased 3%.

- Fourth Quarter Gross Profit: $599 million with a rate of 37.3%.

- Fourth Quarter SG&A: Decreased 6%, leveraging 40 basis points.

- Fourth Quarter Earnings Per Share: $0.54.

- Ending Inventory Cost: Down 1% year-over-year.

- Full Year CapEx: $223 million.

- Share Repurchases: 9.5 million shares repurchased in 2024.

- Cash and Investments: Approximately $359 million at year-end.

- First Quarter Revenue Outlook: Expected decline in mid-single digits.

- Full Year Revenue Outlook: Expected to be down in the low single digits.

- Full Year Operating Income Outlook: $360 million to $375 million.

- 2025 Capital Expenditures: Expected to be approximately $300 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- American Eagle Outfitters Inc (AEO, Financial) achieved record revenue of $5.3 billion in 2024, driven by a 4% comparable sales growth.

- The company reported an adjusted operating profit of $445 million, marking one of its strongest years in history.

- Aerie's revenue crossed $1.7 billion, with strong performance in soft apparel and activewear collections.

- American Eagle maintained its number 1 ranking in denim with its core customer base, achieving its sixth consecutive quarter of positive comp growth.

- The company returned over $280 million to shareholders through buybacks and dividends in 2024.

Negative Points

- 2025 has started off softer than anticipated due to a less robust consumer environment and cold weather.

- The company expects full-year revenue and operating income to be down relative to last year.

- Ongoing consumer uncertainty and changes in the operating landscape, including tariffs and a strong US dollar, pose challenges.

- First quarter revenue is expected to decline in the mid-single digits, with operating income projected to be between $20 million to $25 million.

- The company faces headwinds from higher markdown activity, tariffs, and BOW cost deleverage on the comp decline.