On May 29, 2025, Dell Technologies Inc (DELL, Financial) released its 8-K filing for the first quarter of fiscal 2026, showcasing a robust financial performance. Dell Technologies, a leading information technology vendor, primarily supplies hardware to enterprises, focusing on premium and commercial personal computers and enterprise on-premises data center hardware. The company holds top-three market shares in personal computers, peripheral displays, mainstream servers, and external storage.

Financial Performance and Challenges

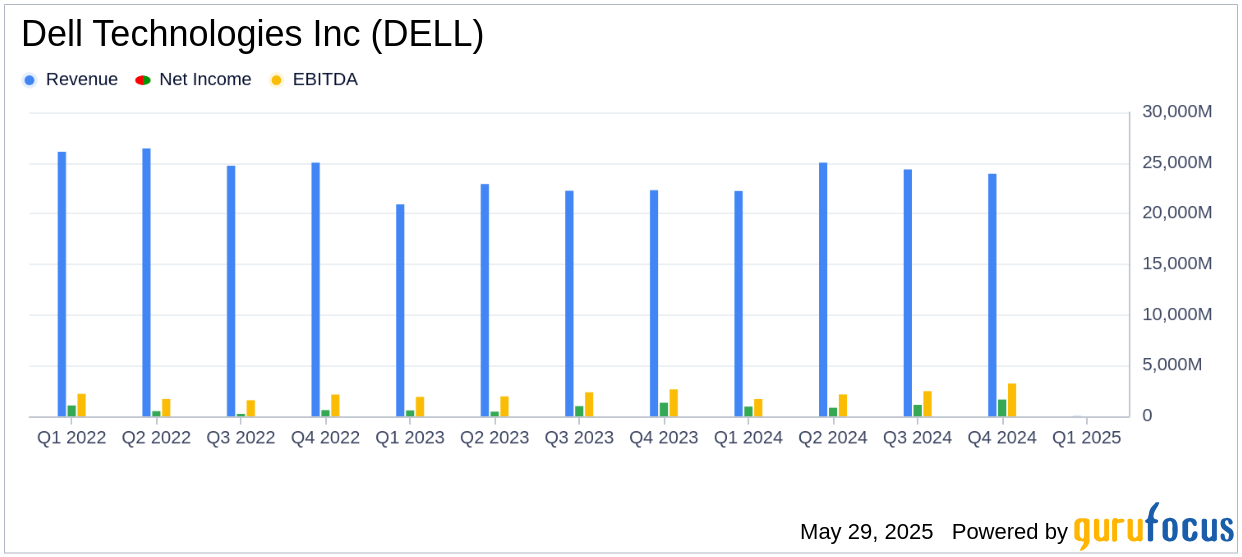

Dell Technologies reported a first-quarter revenue of $23.4 billion, marking a 5% increase year over year, surpassing the analyst estimate of $23,143.34 million. The company's operating income rose by 21% to $1.2 billion, while the non-GAAP operating income increased by 10% to $1.7 billion. Despite these achievements, the net income slightly decreased by 3% to $965 million, indicating potential challenges in maintaining profitability amidst rising costs.

Key Financial Achievements

The company's diluted earnings per share (EPS) remained flat at $1.37, aligning with the previous year but exceeding the estimated EPS of $1.19. The non-GAAP diluted EPS rose by 17% to $1.55, highlighting Dell's ability to enhance shareholder value. Dell Technologies generated a record first-quarter cash flow from operations of $2.8 billion and returned $2.4 billion to shareholders through share repurchases and dividends, more than doubling its quarterly average since FY23.

Segment Performance

The Infrastructure Solutions Group (ISG) reported a 12% increase in revenue to $10.3 billion, driven by a 16% rise in servers and networking revenue, reaching a record $6.3 billion. Storage revenue also grew by 6% to $4.0 billion. The ISG's operating income surged by 36% to $1.0 billion, reflecting strong demand for AI-optimized servers.

Conversely, the Client Solutions Group (CSG) experienced a 5% revenue increase to $12.5 billion, with commercial client revenue up by 9% to $11.0 billion. However, consumer revenue declined by 19% to $1.5 billion, and the CSG's operating income fell by 16% to $653 million, indicating challenges in the consumer market segment.

Financial Statements Overview

| Metric | Q1 FY26 | Q1 FY25 | Change |

|---|---|---|---|

| Net Revenue | $23,378 million | $22,244 million | 5% |

| Operating Income | $1,165 million | $965 million | 21% |

| Net Income | $965 million | $992 million | -3% |

| Cash from Operating Activities | $2,796 million | $1,043 million | 168% |

Analysis and Outlook

Dell Technologies' strong performance in the ISG segment underscores its strategic focus on AI and enterprise solutions, which are crucial for sustaining growth in the competitive hardware industry. The company's ability to generate significant cash flow and return capital to shareholders demonstrates financial resilience. However, the decline in consumer revenue and net income highlights areas that require strategic attention to ensure balanced growth across all segments.

Looking ahead, Dell Technologies has provided guidance for the second quarter of FY26, expecting revenue between $28.5 billion and $29.5 billion, with a midpoint growth of 16% year over year. The company anticipates a GAAP diluted EPS of $1.85 at the midpoint, up 50% year over year, and a non-GAAP diluted EPS of $2.25 at the midpoint, up 15%.

“We achieved first-quarter record servers and networking revenue of $6.3 billion, and we’re experiencing unprecedented demand for our AI-optimized servers,” said Jeff Clarke, vice chairman and chief operating officer, Dell Technologies.

Overall, Dell Technologies Inc (DELL, Financial) has demonstrated a solid start to fiscal 2026, with significant achievements in its core business areas, positioning itself well for future growth in the evolving technology landscape.

Explore the complete 8-K earnings release (here) from Dell Technologies Inc for further details.