On May 29, 2025, Elastic NV (ESTC, Financial) released its 8-K filing detailing the financial results for the fourth quarter and full fiscal year ending April 30, 2025. Elastic, a software company based in Mountain View, California, specializes in search-adjacent products, focusing on enterprise search, observability, and security. The company's search engine processes both structured and unstructured data, providing valuable insights.

Performance Overview and Challenges

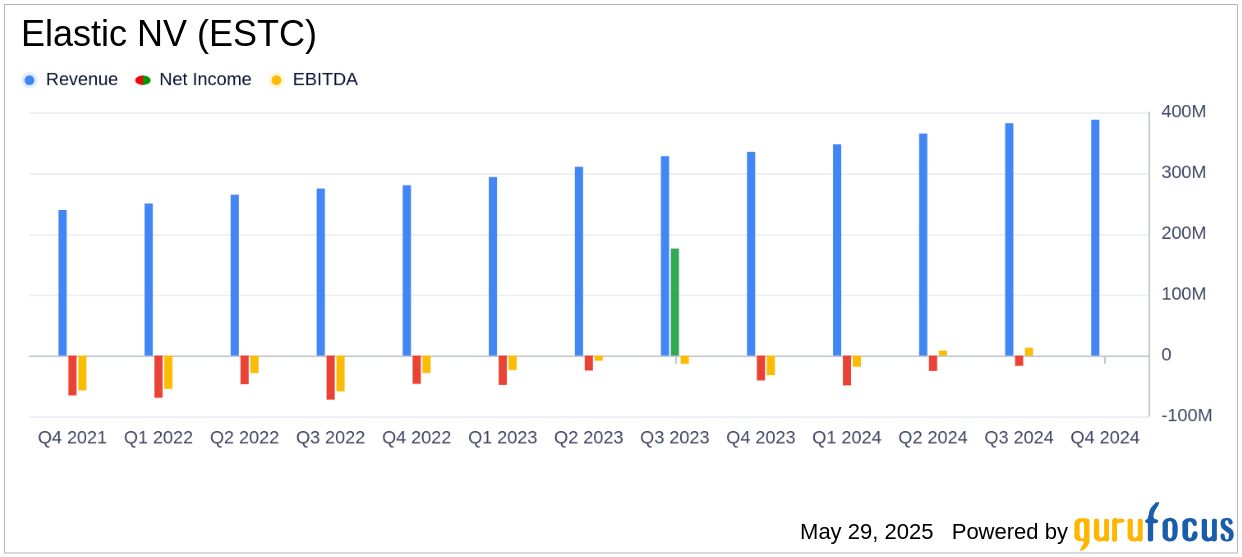

Elastic NV reported a total revenue of $388 million for the fourth quarter, marking a 16% increase year-over-year, surpassing the analyst estimate of $380.36 million. The Elastic Cloud segment contributed significantly with a revenue of $182 million, up 23% year-over-year. Despite these achievements, the company faced a GAAP operating loss of $12 million, reflecting a -3% operating margin. The GAAP net loss per share was $0.16, which is better than the estimated loss of $0.27 per share. However, the non-GAAP diluted earnings per share stood at $0.47, showcasing a strong performance in profitability metrics.

Financial Achievements and Industry Significance

Elastic's financial achievements are noteworthy in the software industry, particularly its robust growth in the Elastic Cloud segment. The company's ability to increase its cloud revenue by 23% year-over-year highlights its successful adaptation to the growing demand for cloud-based solutions. This growth is crucial as it aligns with industry trends towards cloud computing and AI-driven applications.

Key Financial Metrics

Elastic's full fiscal year 2025 revenue reached $1.483 billion, a 17% increase from the previous year. The company reported a non-GAAP operating income of $225 million, with a 15% operating margin. Operating cash flow was $266 million, and adjusted free cash flow was $286 million, indicating strong cash generation capabilities. The company's cash, cash equivalents, and marketable securities totaled $1.397 billion as of April 30, 2025, providing a solid liquidity position.

| Metric | Q4 FY25 | FY25 |

|---|---|---|

| Total Revenue | $388 million | $1.483 billion |

| Elastic Cloud Revenue | $182 million | $688 million |

| GAAP Net Loss per Share | -$0.16 | -$1.04 |

| Non-GAAP EPS | $0.47 | $2.04 |

Analysis and Commentary

Elastic's CEO, Ash Kulkarni, commented on the company's performance, stating,

Elastic achieved a strong quarter, culminating in a solid finish to the fiscal year. We delivered strong growth, fueled by our sales execution and the persistent demand for our solutions, with our innovation velocity thriving."This statement underscores the company's strategic focus on innovation and customer demand, which are pivotal for maintaining its competitive edge in the software industry.

Conclusion

Elastic NV's financial results for the fourth quarter and fiscal year 2025 demonstrate its ability to exceed revenue expectations and deliver strong growth in its cloud segment. While the company faces challenges with GAAP losses, its non-GAAP profitability and cash flow generation remain robust. These results position Elastic well for continued success in the evolving software landscape, particularly in cloud and AI-driven solutions.

Explore the complete 8-K earnings release (here) from Elastic NV for further details.