Palomar Holdings Inc. (PLMR, Financial) has announced the completion of key reinsurance programs that commenced on June 1, which has led to an increase in the company's 2025 adjusted net income guidance. The firm secured roughly $455 million in additional limits to support the expansion of its Earthquake franchise. The reinsurance coverage provided by Palomar now spans $3.53 billion for earthquake events and $100 million for hurricane events within the continental U.S.

Notably, Palomar's per event retention for hurricanes has been reduced to $11 million, down from $15.5 million previously, while earthquake event retention stands at $20 million. These figures fall well within the company's strategic targets, comprising less than one quarter's adjusted net income and under 5% of the stockholders' equity.

As a result of these successful reinsurance placements, Palomar has elevated its full-year 2025 adjusted net income guidance to a range of $195 million to $205 million. This marks an increase from the earlier projection of $186 million to $200 million, driven by favorable pricing and strategic adjustments in risk management.

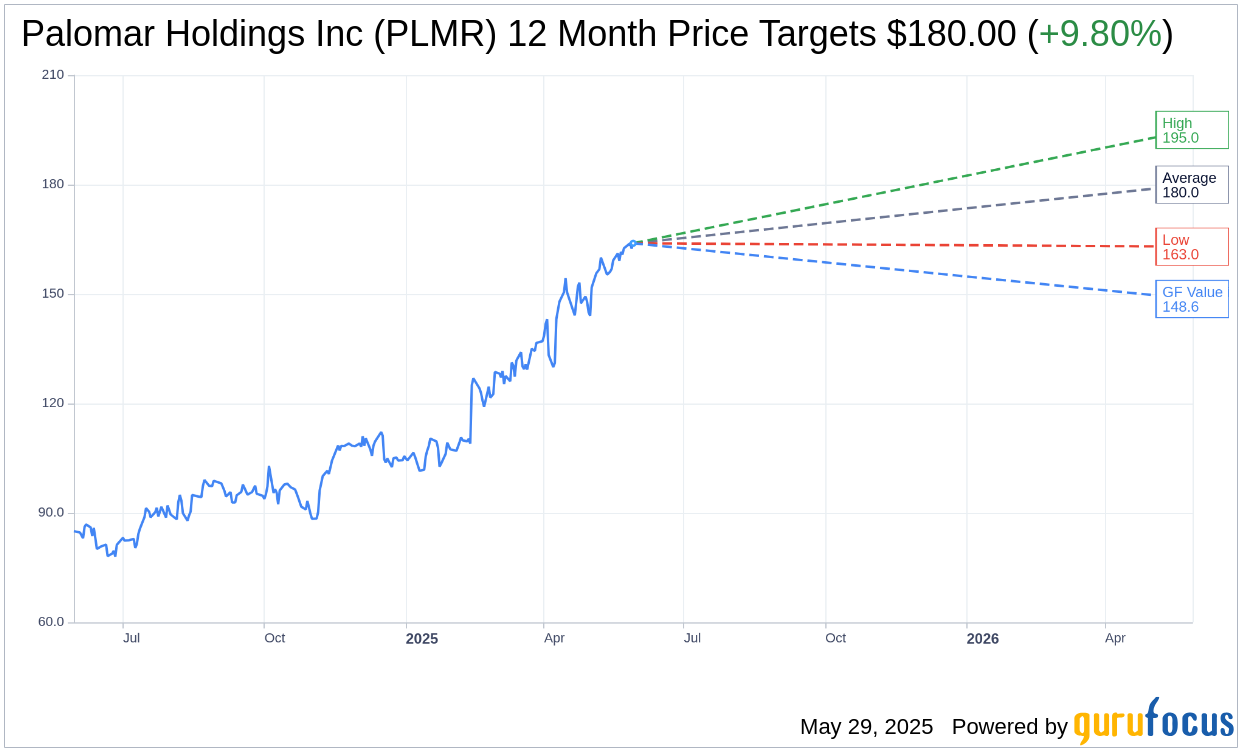

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Palomar Holdings Inc (PLMR, Financial) is $180.00 with a high estimate of $195.00 and a low estimate of $163.00. The average target implies an upside of 9.80% from the current price of $163.93. More detailed estimate data can be found on the Palomar Holdings Inc (PLMR) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Palomar Holdings Inc's (PLMR, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Palomar Holdings Inc (PLMR, Financial) in one year is $148.64, suggesting a downside of 9.33% from the current price of $163.93. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Palomar Holdings Inc (PLMR) Summary page.

PLMR Key Business Developments

Release Date: May 06, 2025

- Adjusted Net Income Growth: 85% increase to $51.3 million.

- Adjusted Combined Ratio: 68.5% for the first quarter.

- Annualized Adjusted ROE: 27% for the first quarter.

- Gross Written Premiums: $442.2 million, a 20% increase year-over-year.

- Net Earned Premiums: $164.1 million, a 52% increase year-over-year.

- Loss Ratio: 23.6% for the first quarter.

- Net Investment Income: $12.1 million, a 69.1% increase year-over-year.

- Stockholders' Equity: $790 million.

- Full Year 2025 Adjusted Net Income Guidance: Raised to $186 million to $200 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Palomar Holdings Inc (PLMR, Financial) reported an 85% growth in adjusted net income for the first quarter of 2025, reaching a record $51.3 million.

- The company achieved a 20% increase in gross written premiums, driven by new products and a balanced mix of residential and commercial property products.

- Palomar Holdings Inc (PLMR) successfully integrated new acquisitions, such as Advanced AgProtection, enhancing their Crop business operations.

- The company secured $525 million of earthquake limit through its largest Torrey Pines Re catastrophe bond issuance, exceeding their target and pricing favorably.

- Palomar Holdings Inc (PLMR) raised its full-year 2025 adjusted net income guidance, reflecting confidence in continued strong performance and strategic execution.

Negative Points

- The company faces competitive pressure in the commercial property market, particularly in large commercial layered and shared accounts.

- There is a noted headwind from the runoff of a fronting partnership, impacting premium growth in the short term.

- The acquisition of Advanced AgProtection will lead to increased expenses in the second quarter without immediate revenue offset.

- Palomar Holdings Inc (PLMR) is experiencing pricing pressure in the excess national property and E&S builders' risk product lines due to increased competition.

- The company anticipates a higher attritional loss ratio in the third quarter, primarily due to the seasonal nature of the Crop business.