Key Highlights:

- Marvell Technology (MRVL, Financial) shares dipped 3% despite robust first-quarter results and positive guidance.

- Q1 revenue soared by 63% year-over-year, driven by a 76% increase in data center sales.

- Analyst forecasts suggest a promising upside potential of over 50% from current price levels.

Marvell Technology (MRVL) experienced a 3% decline in after-hours trading, even though the semiconductor giant unveiled outstanding first-quarter results accompanied by optimistic guidance. The company projects a second-quarter revenue of $2 billion, surpassing analyst expectations. In the first quarter, Marvell achieved a remarkable 63% increase in revenue, reaching $1.895 billion, propelled by a 76% annual surge in data center sales.

Wall Street Analysts Forecast

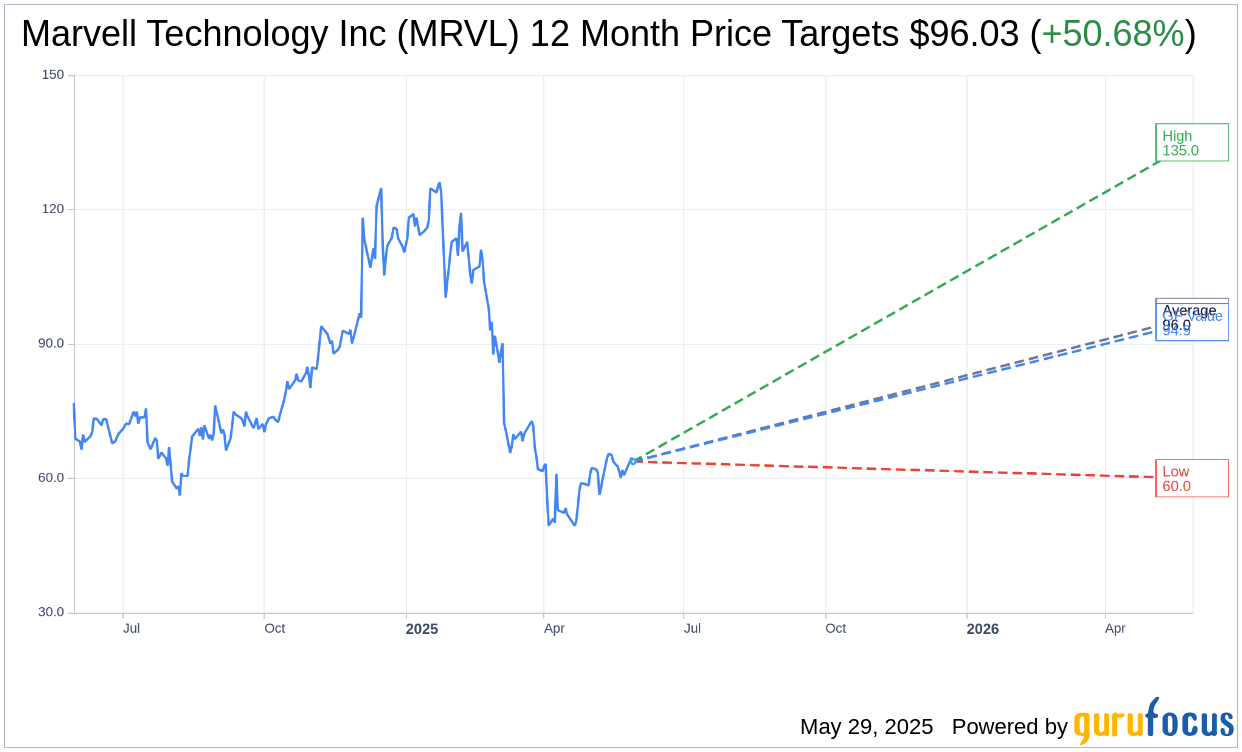

According to projections from 36 analysts, Marvell Technology Inc (MRVL, Financial) has an average price target set at $96.03, with estimates ranging from a high of $135.00 to a low of $60.00. This average target suggests a potential upside of 50.68% from the current stock price of $63.73. Investors seeking more comprehensive estimate data can explore the Marvell Technology Inc (MRVL) Forecast page.

The consensus recommendation from 40 brokerage firms rates Marvell Technology Inc (MRVL, Financial) at an average of 1.9, indicating an "Outperform" status. This rating is part of a scale from 1 to 5, where 1 is a Strong Buy and 5 is a Sell.

Utilizing GuruFocus' GF Value estimates, Marvell Technology Inc (MRVL, Financial) is forecasted to reach a value of $94.86 within one year, hinting at an upside of 48.85% from its present price of $63.73. The GF Value represents GuruFocus' fair value estimation, derived from the stock's historical trading multiples, past business growth, and anticipated future performance metrics. Investors can find additional details on the Marvell Technology Inc (MRVL) Summary page.