- Costco (COST, Financial) continues to outperform Walmart and Target in U.S. markets.

- Analysts attribute its success to a robust pricing strategy and a member-driven business model.

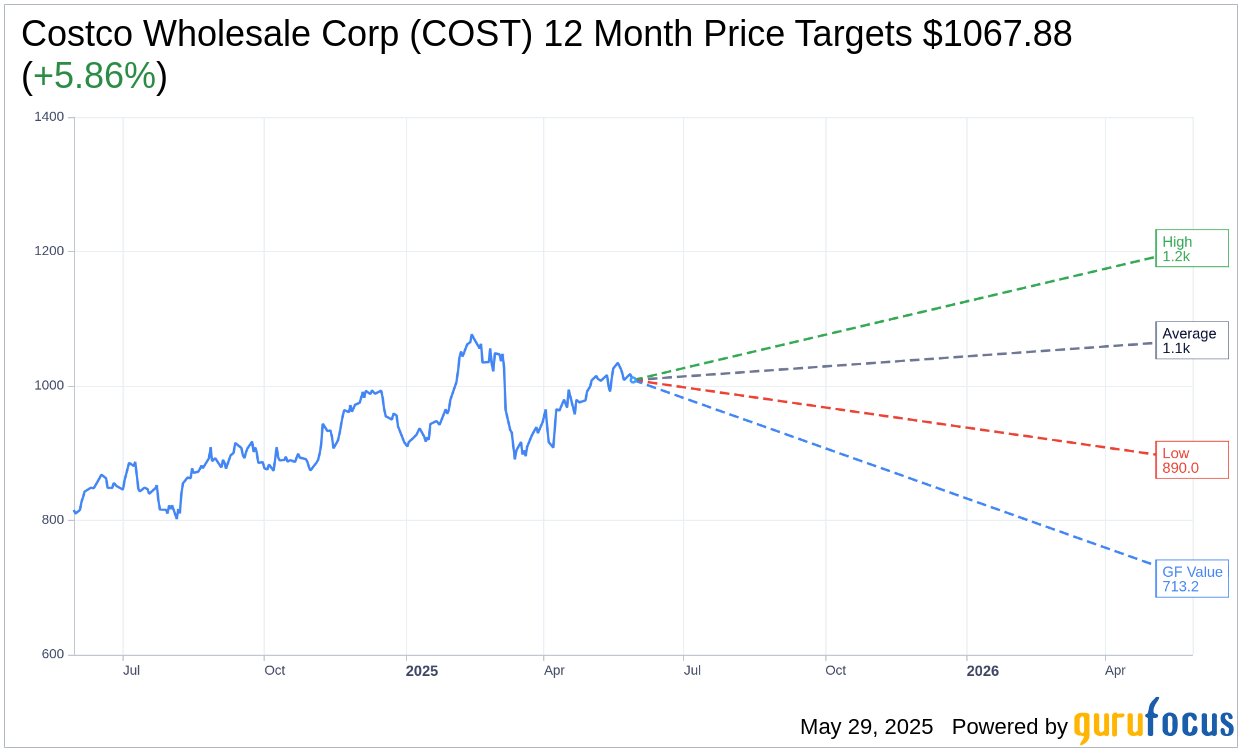

- Costco's stock offers an average price target upside, indicating potential growth opportunities for investors.

Costco's Market Position and Strategy

Costco (COST) is consistently outperforming its competitors, Walmart and Target, in the U.S. market. This achievement is bolstered by robust earnings that highlight Costco's competitive advantage, even amidst economic challenges. Analysts point to the company's strategic pricing and membership model as pivotal factors driving its increased share of consumer spending.

Wall Street Analysts' Forecast

The one-year price targets set by 31 analysts predict an average target price of $1,067.88 for Costco Wholesale Corp (COST, Financial), with $1,205.00 as the highest estimate and $890.00 as the lowest. This average target suggests a potential gain of 5.86% from the current price of $1,008.74. For a more comprehensive breakdown of estimates, visit the Costco Wholesale Corp (COST) Forecast page.

Brokerage Recommendations

Costco Wholesale Corp (COST, Financial) currently holds an "Outperform" status from 39 brokerage firms, with an average recommendation of 2.2. This rating is derived from a scale of 1 to 5, where 1 indicates a Strong Buy and 5 represents Sell, highlighting the favorable outlook among financial analysts.

GuruFocus Value Estimates

According to GuruFocus, the estimated GF Value for Costco Wholesale Corp (COST, Financial) is $713.19 for the coming year. This estimate suggests a potential downside of 29.3% from the current trading price of $1,008.74. The GF Value represents GuruFocus' projection of the fair market value, derived from historical price multiples and anticipated business growth. For more detailed information, visit the Costco Wholesale Corp (COST) Summary page.