Key Takeaways:

- Williams is advancing key pipeline projects to address natural gas supply challenges.

- Analysts forecast a modest price upside for Williams Companies Inc (WMB, Financial).

- The GF Value suggests the stock might be overvalued currently.

Williams (WMB) is reinvigorating efforts to move forward with the Northeast Supply Enhancement and Constitution Pipeline projects. These significant infrastructure initiatives were previously paused due to environmental objections. By collaborating with state officials, Williams aims to address pressing natural gas supply issues and seeks to obtain renewed permits from the Federal Energy Regulatory Commission, marking a strategic move to bolster energy distribution.

Wall Street Analysts' Projections

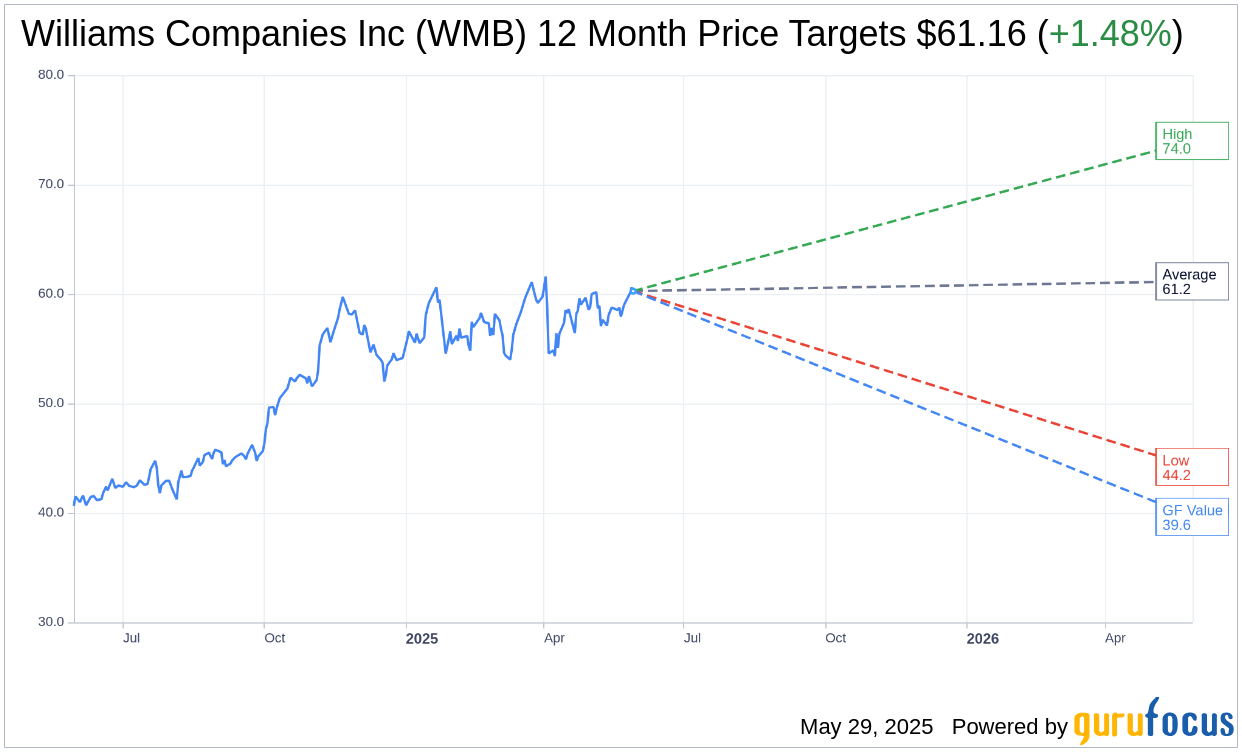

According to insights from 18 Wall Street analysts, the average one-year price target for Williams Companies Inc (WMB, Financial) is set at $61.16. This range includes a high estimate of $74.00 and a low of $44.21. These projections suggest a potential upside of 1.48% compared to the current trading price of $60.27. For a deeper dive into the numbers, visit the Williams Companies Inc (WMB) Forecast page.

The sentiment among 21 brokerage firms is that Williams Companies Inc (WMB, Financial) maintains an average recommendation of 2.2, which corresponds to an "Outperform" rating. This rating scale spans from 1, indicating a Strong Buy, to 5, meaning Sell, underscoring the stock's favorable standing among analysts.

Insights from GuruFocus Metrics

Utilizing GuruFocus metrics, the projected GF Value for Williams Companies Inc (WMB, Financial) over the next year is pegged at $39.64. This estimate highlights a possible downside of 34.23% from the current price of $60.27, suggesting that the stock might be trading above its fair value. The GF Value is a comprehensive assessment that factors in historical trading multiples, past growth trajectories, and projected future performance of the business. For more detailed insights, check out the Williams Companies Inc (WMB) Summary page.