- ARMOUR Residential REIT (NYSE: ARR) continues its trend of stable monthly dividends, offering a significant yield.

- Analysts maintain a cautious outlook with a "Hold" consensus, reflecting limited price movement potential.

- Investors should consider both targeted growth and income potential when evaluating ARR's financial prospects.

Consistent Dividend Payouts From ARMOUR Residential REIT

ARMOUR Residential REIT (ARR, Financial) has declared a regular monthly dividend of $0.24 per share, maintaining its commitment to shareholders. This payout equates to an impressive forward yield of approximately 17.65%, making it an attractive option for income-focused investors. Shareholders can expect to receive this dividend on June 27, provided they are on record by June 16, which is also the ex-dividend date.

Wall Street Analysts' Projections

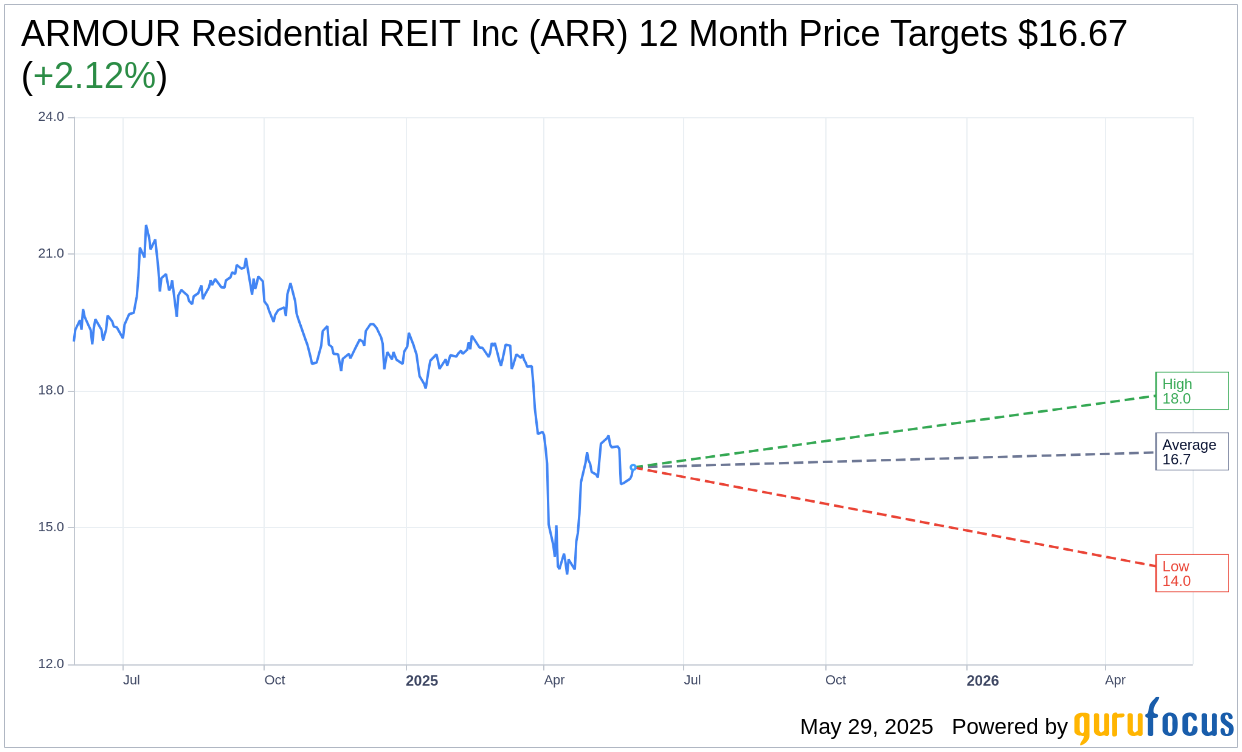

According to price target predictions from three financial analysts, ARMOUR Residential REIT Inc (ARR, Financial) is poised for a modest increase. The average target price stands at $16.67, with projections ranging from a high of $18.00 to a low of $14.00. This average target suggests a potential upside of 2.12% from the current trading price of $16.32. For a comprehensive breakdown of estimates, visit the ARMOUR Residential REIT Inc (ARR) Forecast page.

Analyst Recommendations

The overall sentiment among analysts is cautious. Based on evaluations from seven brokerage firms, ARMOUR Residential REIT Inc's (ARR, Financial) consensus rating is 2.7, indicating a "Hold" recommendation. This rating falls within a scale where 1 signifies a Strong Buy and 5 indicates a Sell. This consensus reflects a balanced view of the stock's potential for growth and income generation.

As investors consider ARMOUR Residential REIT for their portfolios, it's important to weigh the robust dividend yield against the stock's limited price movement potential according to analysts' forecasts.

Become a Premium Member to See This: (Free Trial):