Summary:

- Dentsply Sirona welcomes Matthew E. Garth as its new CFO starting May 30, 2025.

- Analyst consensus places XRAY as a "Hold" with an average price target of $18.04.

- GuruFocus estimates a potential upside of 92.59% based on the GF Value calculation.

Dentsply Sirona Inc. (XRAY) has announced a strategic leadership change with the appointment of Matthew E. Garth as Executive Vice President and Chief Financial Officer, effective from May 30, 2025. Garth, who transitions from his prior role as CFO & Chief Administrative Officer at The Scotts Miracle-Gro Company, brings a wealth of experience and expertise acquired from various multinational corporations.

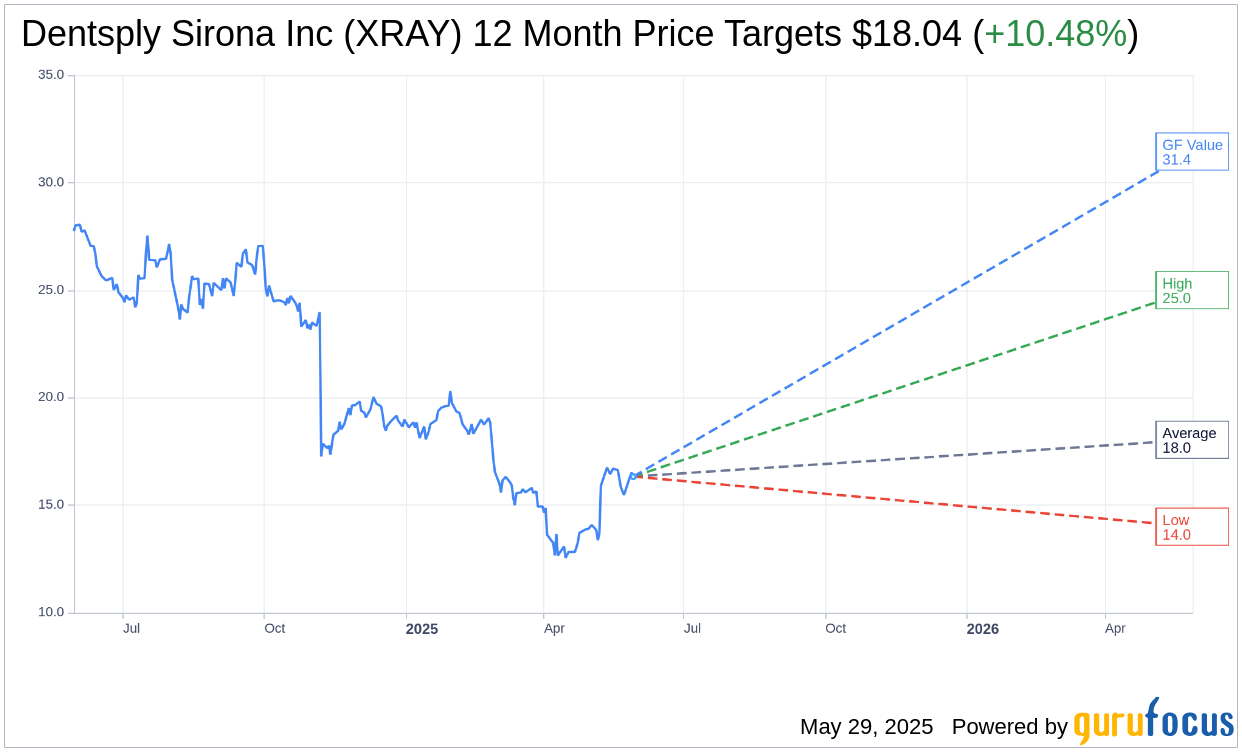

Wall Street Analysts Forecast

In terms of market expectations, 12 analysts have set their one-year price targets for Dentsply Sirona Inc. (XRAY, Financial). The average target sits at $18.04, while projections range from a high of $25.00 to a low of $14.00. This average target indicates a potential upside of 10.48% from the current market price of $16.33. For a deeper dive into these projections, visit the Dentsply Sirona Inc (XRAY) Forecast page.

Brokerage Recommendations

The sentiment among 17 brokerage firms currently pegs Dentsply Sirona Inc.'s (XRAY, Financial) average recommendation at 2.7, which aligns with a "Hold" status. The recommendation scale extends from 1 (Strong Buy) to 5 (Sell), reflecting a cautious yet stable outlook for the stock.

GuruFocus Valuation

According to GuruFocus estimates, the projected GF Value for Dentsply Sirona Inc. (XRAY, Financial) in one year is $31.45, suggesting a substantial upside of 92.59% from the current trading price of $16.33. The GF Value, a GuruFocus proprietary metric, represents the fair valuation of the stock, derived from historical trading multiples, past growth, and future performance forecasts. For more detailed insights, please refer to the Dentsply Sirona Inc (XRAY) Summary page.

- CEO Buys, CFO Buys: Stocks that are bought by their CEO/CFOs.

- Insider Cluster Buys: Stocks that multiple company officers and directors have bought.

- Double Buys: Companies that both Gurus and Insiders are buying

- Triple Buys: Companies that both Gurus and Insiders are buying, and Company is buying back.