- Boeing Co (BA, Financial) reaches a settlement with the U.S. Department of Justice over a criminal fraud charge.

- Wall Street analysts set an average price target 2.51% higher than the current value.

- GuruFocus estimates a potential downside based on the GF Value metric.

The U.S. Department of Justice has taken a pivotal step by moving to dismiss a criminal fraud charge against Boeing (BA) following the company's agreement to a comprehensive settlement. As part of the settlement, Boeing will contribute $444.5 million to a victim fund and allocate an additional $1.1 billion towards fines and compensatory measures, while also enhancing its compliance and safety programs.

Wall Street Analysts Forecast

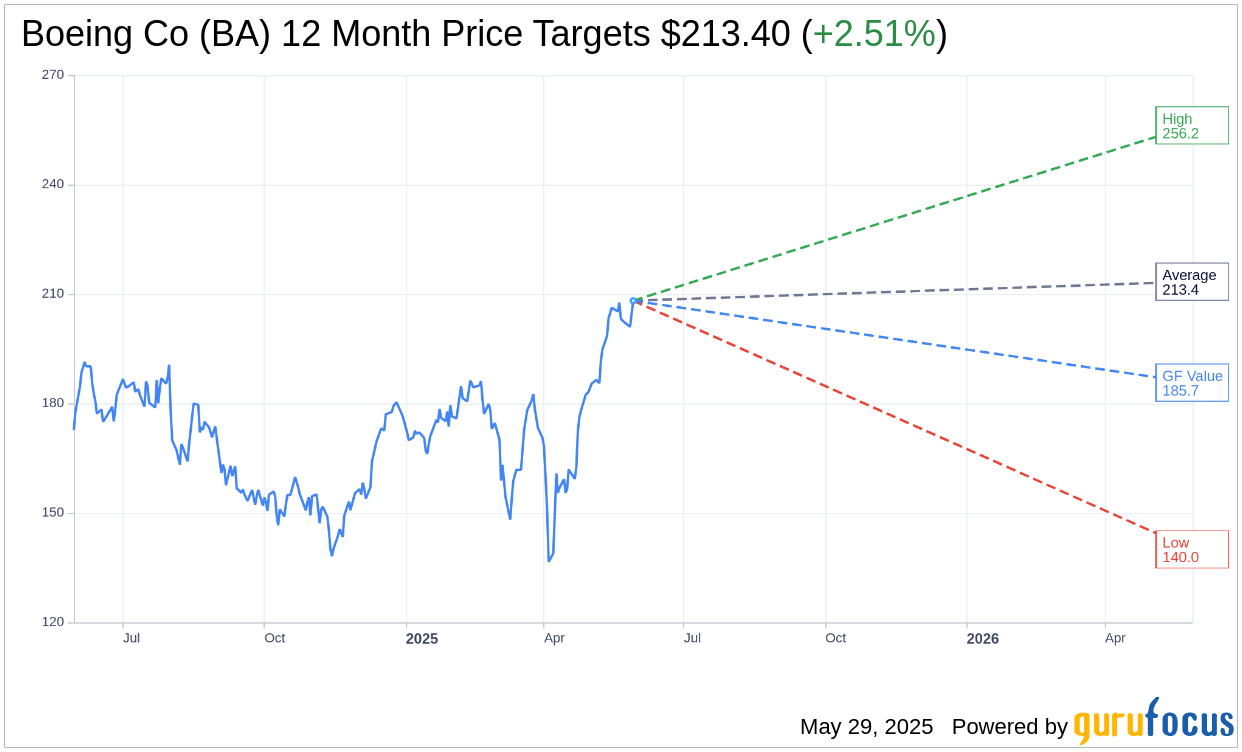

Wall Street analysts have provided a one-year price target for Boeing Co (BA, Financial), with 23 analysts forecasting an average target price of $213.40. The predictions feature a high estimate of $256.24 and a low of $140.00. This average target suggests a potential upside of 2.51% from Boeing's current trading price of $208.18. For more detailed estimates, the Boeing Co (BA) Forecast page offers further insights.

In addition, consensus from 29 brokerage firms places Boeing Co's (BA, Financial) average brokerage recommendation at 2.1. This rating reflects an "Outperform" status, on a scale where 1 indicates a Strong Buy and 5 indicates a Sell.

According to GuruFocus estimates, the anticipated GF Value for Boeing Co (BA, Financial) in one year stands at $185.73, hinting at a potential downside of 10.78% from the current price of $208.18. The GF Value is GuruFocus' assessment of the stock's fair trading value, calculated by considering historical trading multiples, past business growth, and future performance projections. For a deeper dive into this data, visit the Boeing Co (BA) Summary page.