Key Highlights:

- American Eagle Outfitters reports a Q4 non-GAAP EPS miss but surpasses revenue expectations.

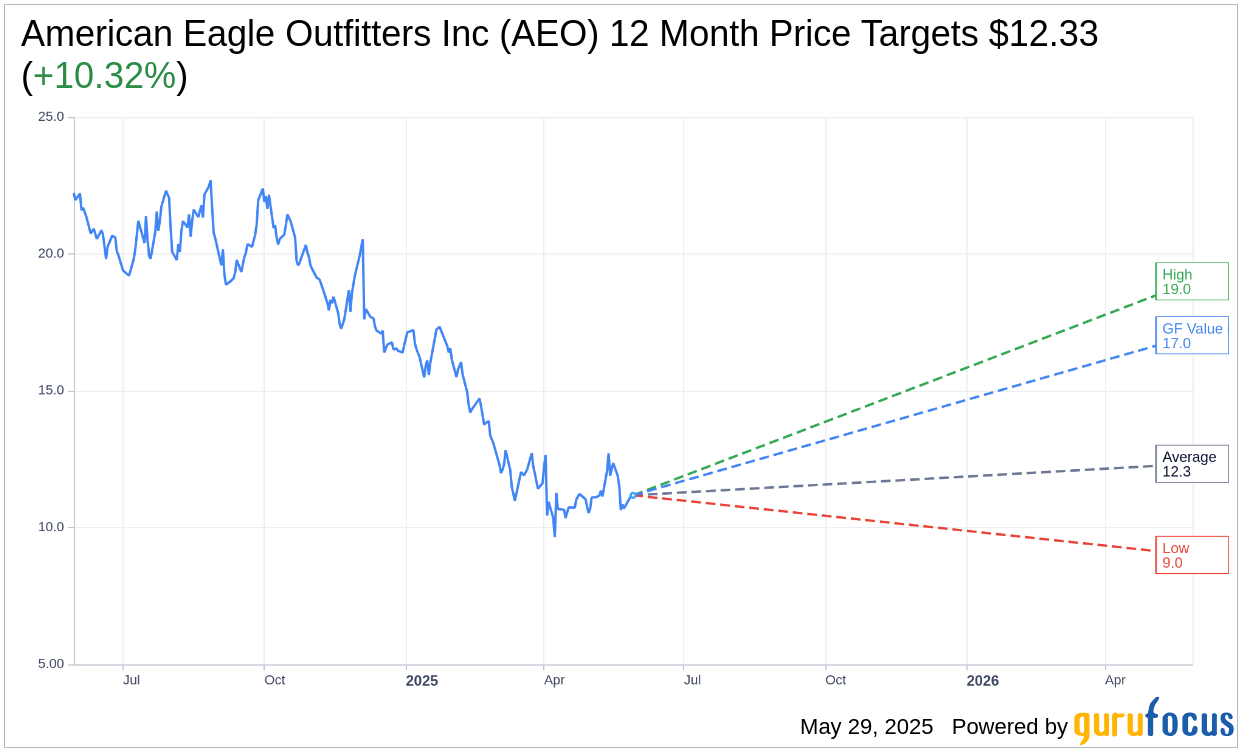

- Analysts predict a modest upside with price targets ranging from $9.00 to $19.00.

- GuruFocus estimates suggest significant potential upside, valuing AEO at $17.03.

American Eagle Outfitters (AEO, Financial) recently released its Q4 financial results, revealing a non-GAAP EPS of -$0.29, falling short of the consensus estimate by $0.07. However, the company's revenue reached $1.1 billion, exceeding expectations by $10 million. Looking ahead to the second quarter, American Eagle anticipates a 5% decrease in revenue and a 3% decline in comparable sales, with operating income expected to range between $40 million and $45 million.

Wall Street Analysts Forecast

According to the one-year price targets provided by nine analysts, the average target price for American Eagle Outfitters Inc (AEO, Financial) is $12.33. The projections span a high estimate of $19.00 and a low of $9.00, suggesting a potential upside of 10.32% from the current stock price of $11.18. For more in-depth estimate data, visit the American Eagle Outfitters Inc (AEO) Forecast page.

Analysts from twelve brokerage firms have given American Eagle Outfitters Inc (AEO, Financial) an average brokerage recommendation of 2.9, indicating a "Hold" status. This rating falls within a scale where 1 denotes a Strong Buy, and 5 indicates a Sell.

From a valuation perspective, GuruFocus estimates that the GF Value for American Eagle Outfitters Inc (AEO, Financial) could reach $17.03 within a year. This estimation reveals a potential upside of 52.33% from the present price of $11.18. The GF Value is an indicator of the stock's fair market value, calculated using the historical trading multiples, past business growth, and future performance projections. For additional data, explore the American Eagle Outfitters Inc (AEO) Summary page.