Key Points:

- Tripadvisor (TRIP, Financial) leverages AI for a consumer-focused travel experience.

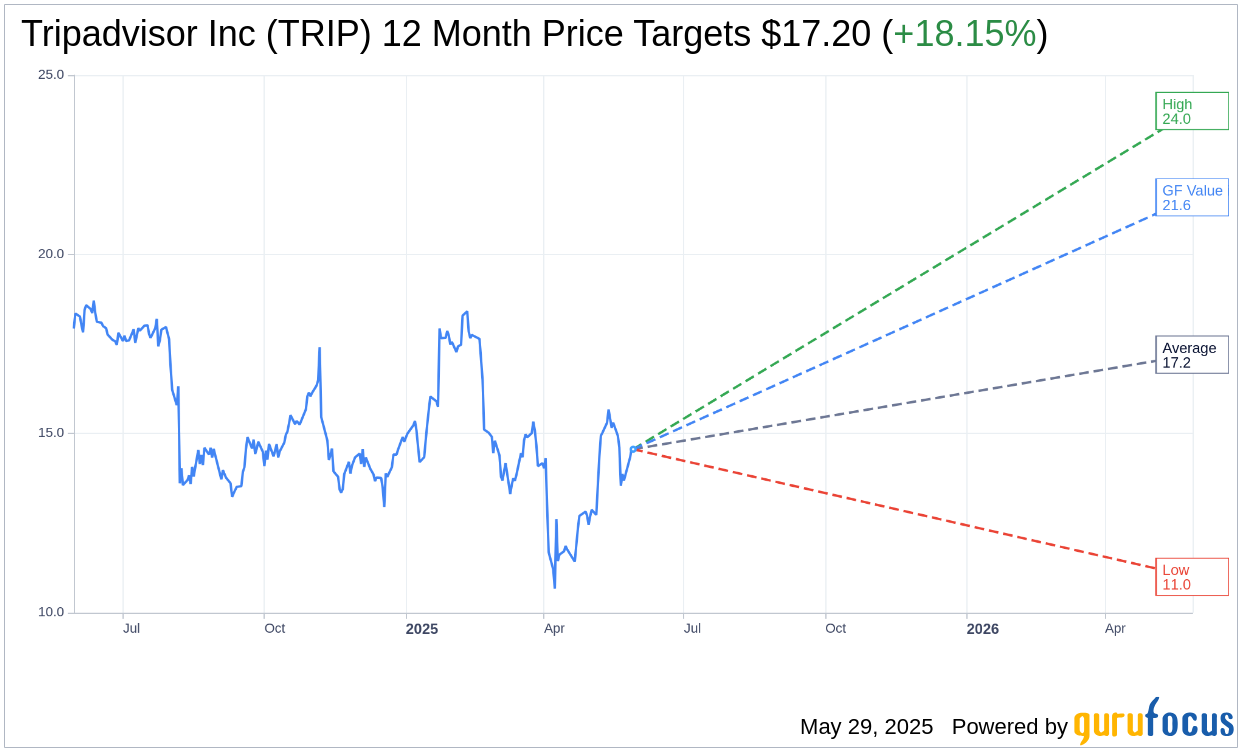

- Wall Street analysts predict a potential 18.15% upside for TRIP.

- The GF Value estimate suggests a significant 48.28% upside.

Tripadvisor (TRIP) is advancing toward a seamless, experience-driven platform by incorporating artificial intelligence and mobile technologies, as highlighted by CEO Matt Goldberg. Prioritizing consistent consumer behavior shifts over fleeting market trends, Tripadvisor is poised to sustain its growth trajectory in the bustling travel sector. The company is strategically positioned to benefit from the robust demand for vacation experiences.

Analyst Insights on Tripadvisor

According to projections from 16 analysts, Tripadvisor Inc (TRIP, Financial) has an average one-year price target of $17.20. The estimates vary, with a high of $24.00 and a low of $11.00. The average target indicates a potential upside of 18.15% from its current price of $14.56. For a more in-depth look at these price predictions, visit the Tripadvisor Inc (TRIP) Forecast page.

Brokerage Firm Recommendations

Based on evaluations from 19 brokerage firms, Tripadvisor Inc's (TRIP, Financial) current average brokerage recommendation is 3.0, suggesting a "Hold" status. This recommendation scale ranges from 1 to 5, where 1 indicates a Strong Buy and 5 suggests Sell.

Understanding TRIP's GF Value

GuruFocus estimates a GF Value for Tripadvisor Inc (TRIP, Financial) at $21.59 within a year, indicating a potential upside of 48.28% from the present price of $14.56. The GF Value is GuruFocus' assessment of the stock's fair trading value. It is computed using historical trading multiples, past business growth, and anticipated future business performance. For further details, explore the Tripadvisor Inc (TRIP) Summary page.