Analyzing the Strategic Moves in the First Quarter of 2025

MS Global Franchise Portfolio (Trades, Portfolio) recently submitted its N-PORT filing for the first quarter of 2025, revealing strategic investment decisions made during this period. Established on November 28, 2001, the Morgan Stanley Institutional Fund Global Franchise Portfolio Class I (MSFAX) is managed by a dedicated investment team. This team employs a disciplined, bottom-up stock selection process, focusing on quality and valuation characteristics. Their approach involves screening companies based on financial metrics indicative of strong franchise businesses, emphasizing sustainable, high unlevered return on invested capital (ROIC). The team prioritizes high-quality businesses with unique intangible assets, sustainable high ROIC, and strong financial management.

Summary of New Buy

MS Global Franchise Portfolio (Trades, Portfolio) added a total of one stock during the first quarter of 2025:

- The most significant addition was Oracle Corp (ORCL, Financial), with 249,682 shares, accounting for 1.31% of the portfolio and a total value of $34.91 million.

Key Position Increases

MS Global Franchise Portfolio (Trades, Portfolio) also increased stakes in a total of 10 stocks, including:

- The most notable increase was in S&P Global Inc (SPGI, Financial), with an additional 79,125 shares, bringing the total to 141,286 shares. This adjustment represents a significant 127.29% increase in share count, a 1.51% impact on the current portfolio, and a total value of $71,787,420.

- The second largest increase was in Booking Holdings Inc (BKNG, Financial), with an additional 5,646 shares, bringing the total to 16,810. This adjustment represents a significant 50.57% increase in share count, with a total value of $77,442,160.

Summary of Sold Out

MS Global Franchise Portfolio (Trades, Portfolio) completely exited two holdings in the first quarter of 2025:

- Constellation Brands Inc (STZ, Financial): The portfolio sold all 310,628 shares, resulting in a -2.51% impact on the portfolio.

- Pernod Ricard SA (XPAR:RI, Financial): The portfolio liquidated all 413,480 shares, causing a -1.71% impact on the portfolio.

Key Position Reduces

MS Global Franchise Portfolio (Trades, Portfolio) also reduced positions in 26 stocks. The most significant changes include:

- Reduced SAP SE (XTER:SAP, Financial) by 118,897 shares, resulting in a -14.59% decrease in shares and a -1.07% impact on the portfolio. The stock traded at an average price of €258.38 during the quarter and has returned 0.14% over the past 3 months and 12.43% year-to-date.

- Reduced Abbott Laboratories (ABT, Financial) by 230,499 shares, resulting in a -29.56% reduction in shares and a -0.95% impact on the portfolio. The stock traded at an average price of $127.27 during the quarter and has returned -3.29% over the past 3 months and 18.62% year-to-date.

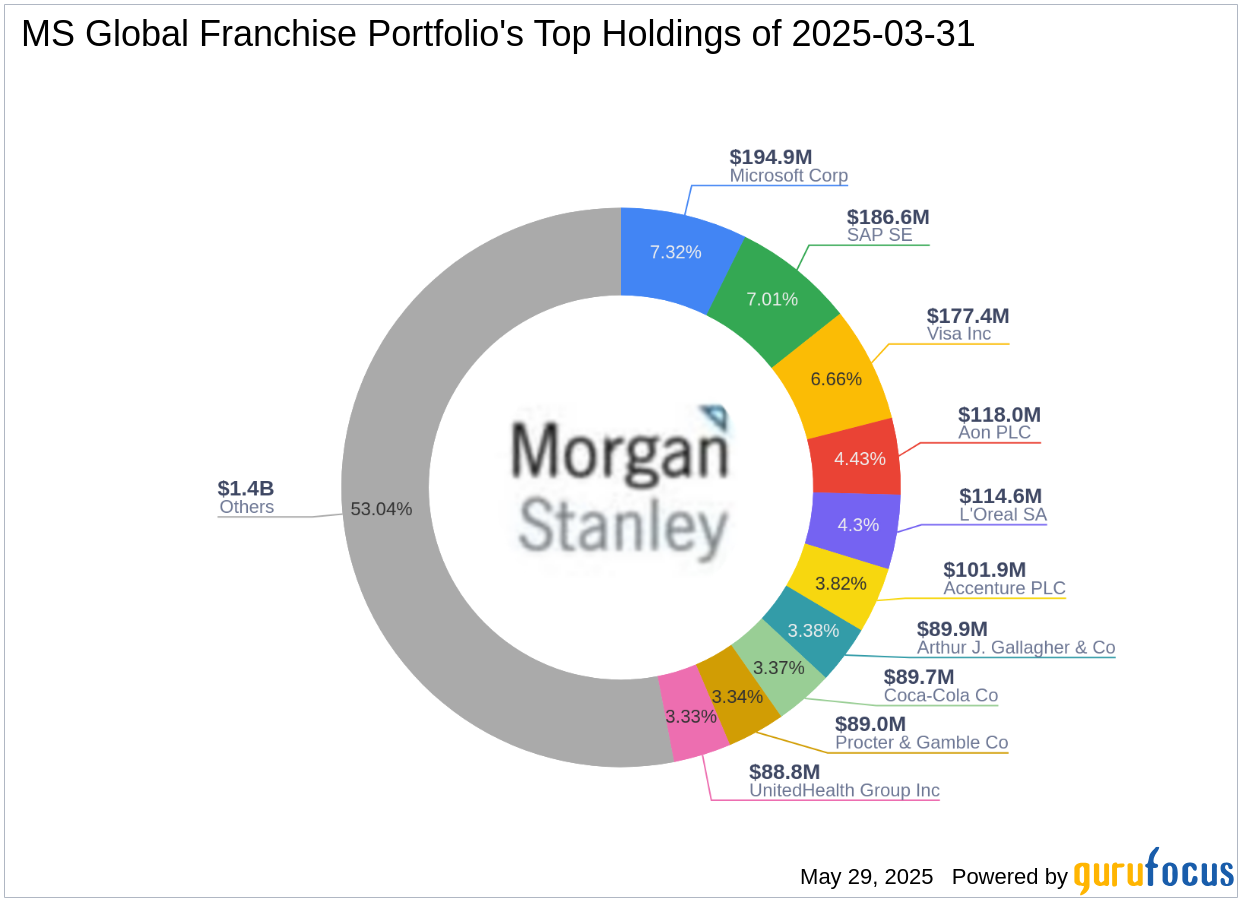

Portfolio Overview

As of the first quarter of 2025, MS Global Franchise Portfolio (Trades, Portfolio)'s portfolio included 37 stocks. The top holdings were 7.32% in Microsoft Corp (MSFT, Financial), 7.01% in SAP SE (XTER:SAP), 6.66% in Visa Inc (V, Financial), 4.43% in Aon PLC (AON, Financial), and 4.3% in L'Oreal SA (XPAR:OR, Financial).

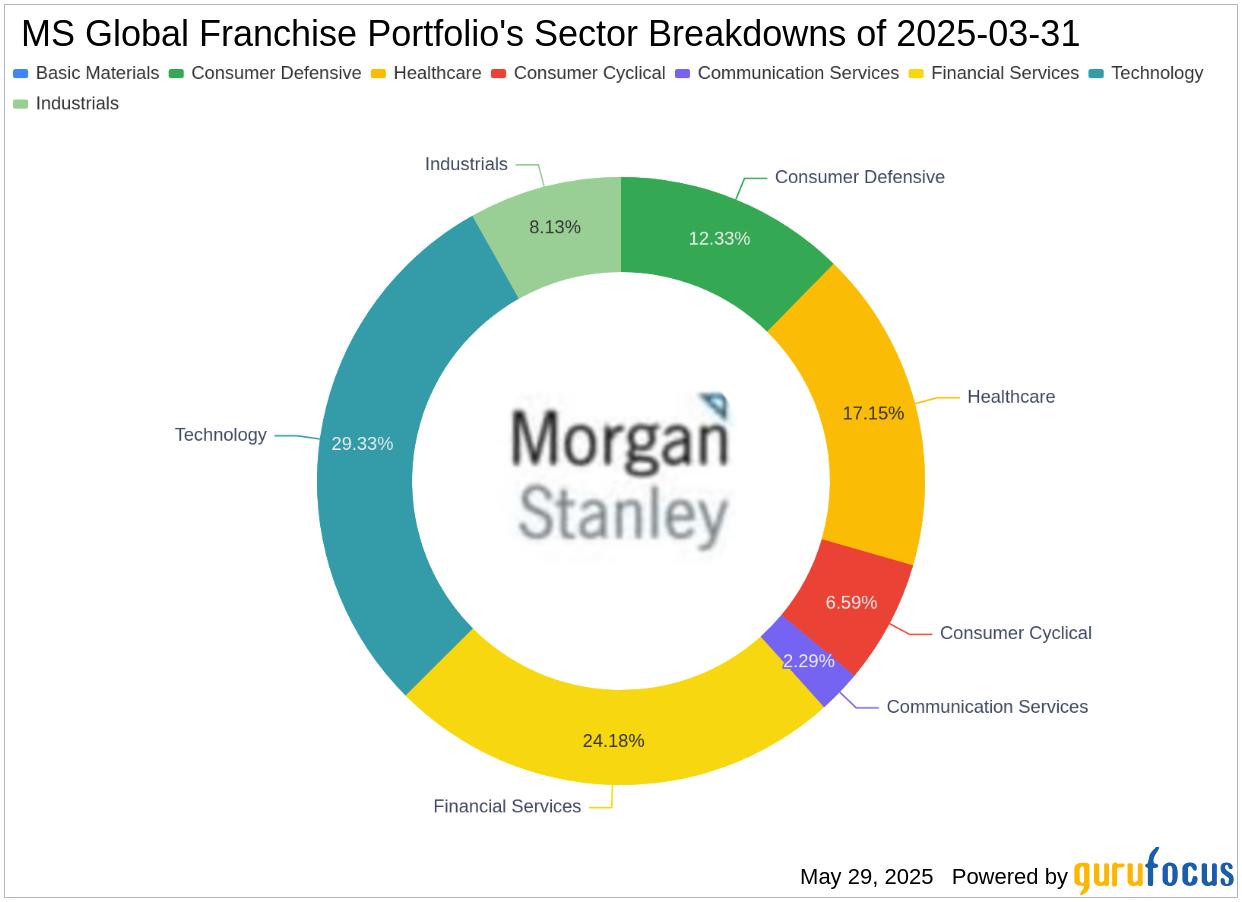

The holdings are mainly concentrated in 7 of the 11 industries: Technology, Financial Services, Healthcare, Consumer Defensive, Industrials, Consumer Cyclical, and Communication Services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.