Key Takeaways:

- The FAA has renewed Boeing's (BA, Financial) program for independent inspections for another three years, reflecting improvements in Boeing's processes.

- Analysts see a potential upside for Boeing's stock, with price targets suggesting moderate growth.

- While the GF Value indicates a possible downside, analyst recommendations lean towards an "Outperform" rating.

The Federal Aviation Administration (FAA) has granted a three-year extension to Boeing's (BA) program allowing the company to independently conduct certain inspections and approvals as of June 1. This move comes on the heels of observable improvements within Boeing, yet the FAA intends to continue stringent oversight. Boeing is planning to ramp up production of the 737 MAX later this year, signaling positive momentum in its operations.

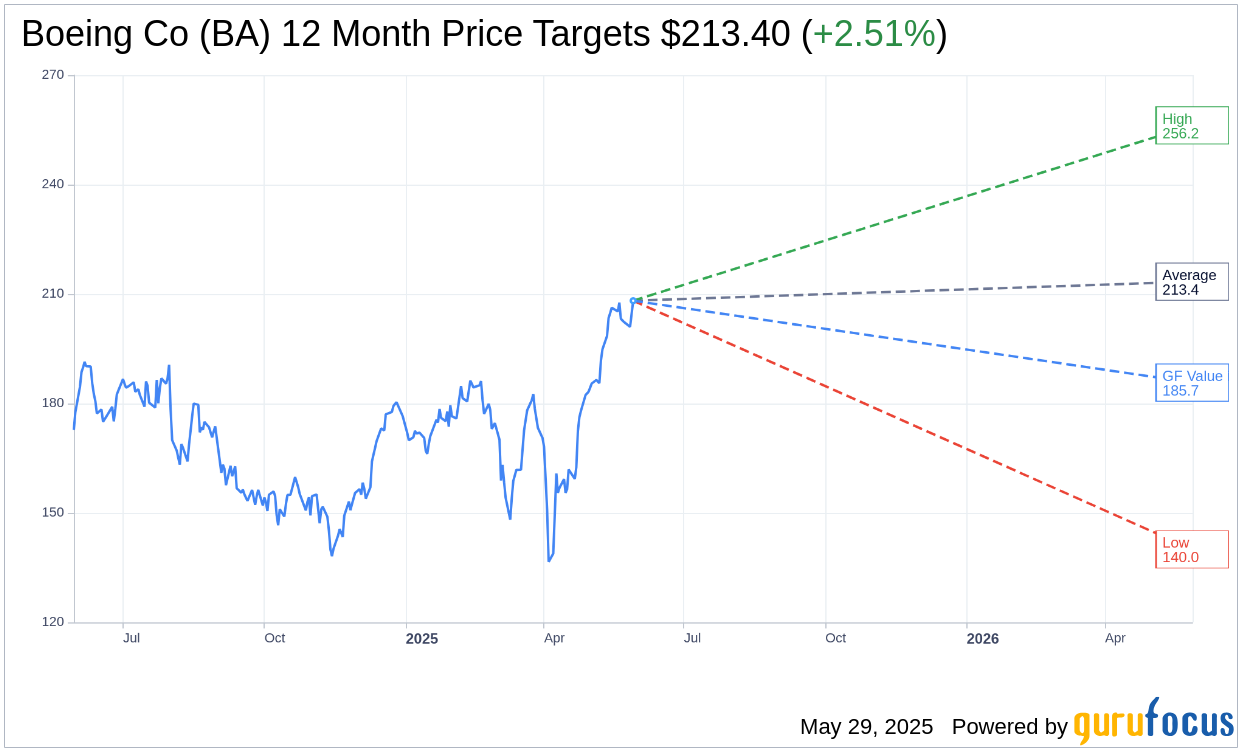

Wall Street Analysts Forecast

Wall Street analysts have set a one-year average price target for Boeing Co (BA, Financial) at $213.40. This includes a high estimate of $256.24 and a low estimate of $140.00. Based on the current trading price of $208.18, these estimates suggest an average potential upside of 2.51%. Investors can explore comprehensive estimate data on the Boeing Co (BA) Forecast page.

The collective insights of 29 brokerage firms have resulted in an average recommendation rating of 2.1 for Boeing, classifying it as "Outperform." The rating scale used ranges from 1, interpreted as Strong Buy, to 5, which indicates a Sell recommendation. This suggests a generally optimistic outlook from analysts.

According to GuruFocus, the projected GF Value for Boeing Co (BA, Financial) in one year is $185.73. This figure implies a potential downside of 10.78% from Boeing's present stock price of $208.18. The GF Value is a proprietary measure by GuruFocus, derived from historical trading multiples, past business growth, and anticipated future performance. Investors seeking further details can find extensive data on the Boeing Co (BA) Summary page.