On May 22, 2025, Saba Capital Management, L.P. (Trades, Portfolio) made a strategic decision to reduce its position in BlackRock Science and Technology Trust II (BSTZ, Financial). The firm decreased its holdings by 839,076 shares, bringing its total shares in the trust to 4,066,572. This transaction was executed at a trade price of $18.90 per share, resulting in a -0.43% impact on Saba Capital's portfolio. The current position of BSTZ in the firm's portfolio now stands at 2.1% of total holdings.

About Saba Capital Management, L.P. (Trades, Portfolio)

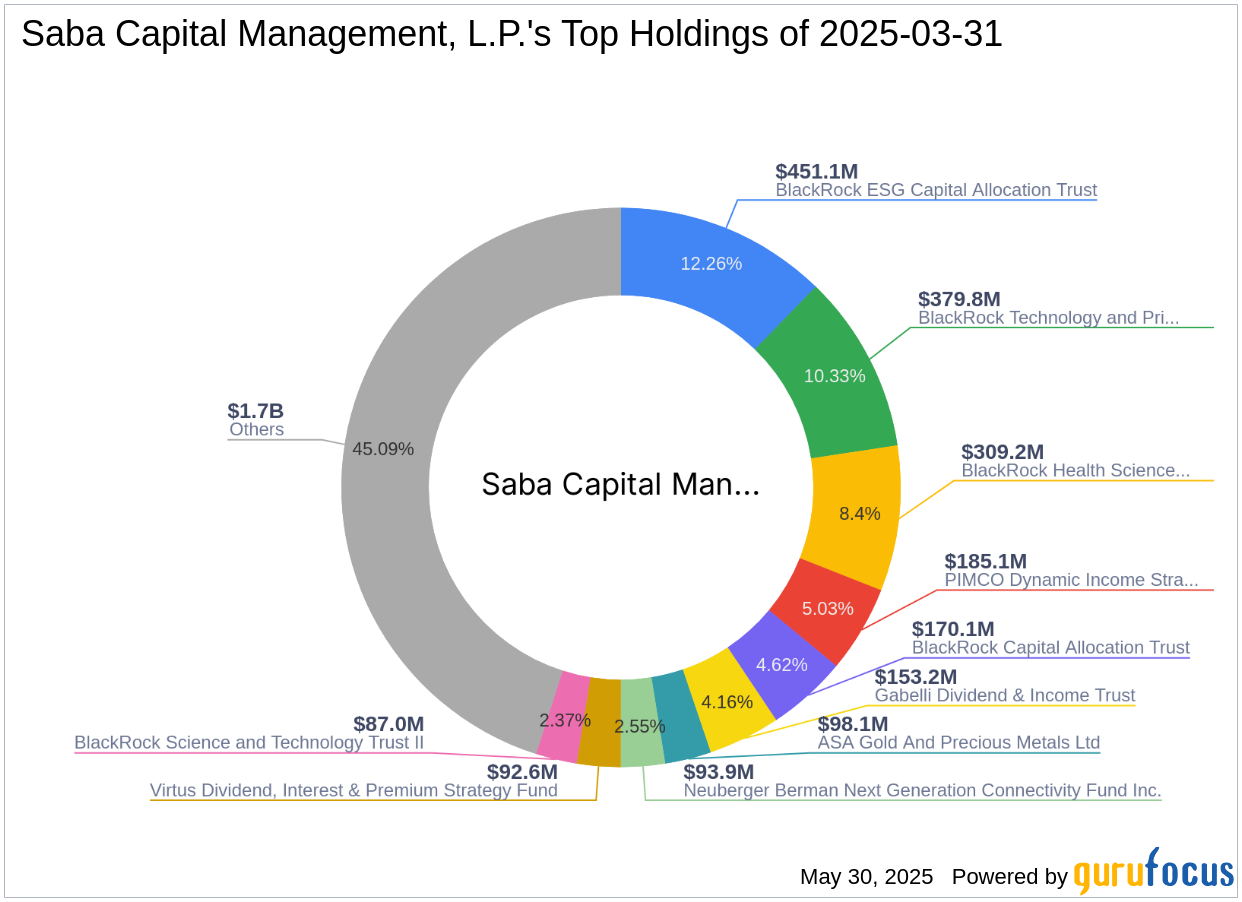

Saba Capital Management, L.P. (Trades, Portfolio), headquartered at 405 Lexington Avenue, New York, NY, is renowned for its focus on value investing. With total equity under management amounting to $3.68 billion, the firm holds significant positions in various funds, including PIMCO Dynamic Income Strategy Fund (PDX, Financial) and BlackRock Capital Allocation Trust (BCAT, Financial). Saba Capital's investment strategy is characterized by a keen eye for undervalued opportunities, primarily within the Financial Services and Consumer Cyclical sectors.

Transaction Details and Portfolio Impact

The recent reduction in BSTZ shares reflects a strategic adjustment in Saba Capital's portfolio. The transaction, executed at $18.90 per share, resulted in a -0.43% impact on the firm's overall portfolio. Despite the reduction, Saba Capital still holds a substantial 4,066,572 shares in BSTZ, which now constitutes 2.1% of its total holdings. This move indicates a recalibration of the firm's investment strategy, possibly in response to market conditions or valuation assessments.

BlackRock Science and Technology Trust II Overview

BlackRock Science and Technology Trust II is a non-diversified, closed-end management investment company. The trust focuses on investing in U.S. and non-U.S. science and technology companies, aiming for total return and income through a combination of current income, gains, and long-term capital appreciation. With a market capitalization of $1.37 billion, BSTZ is currently trading at $19.42 per share. The trust's portfolio includes a diverse range of securities, from equity to corporate bonds, reflecting its broad investment mandate.

Financial Performance and Valuation Metrics

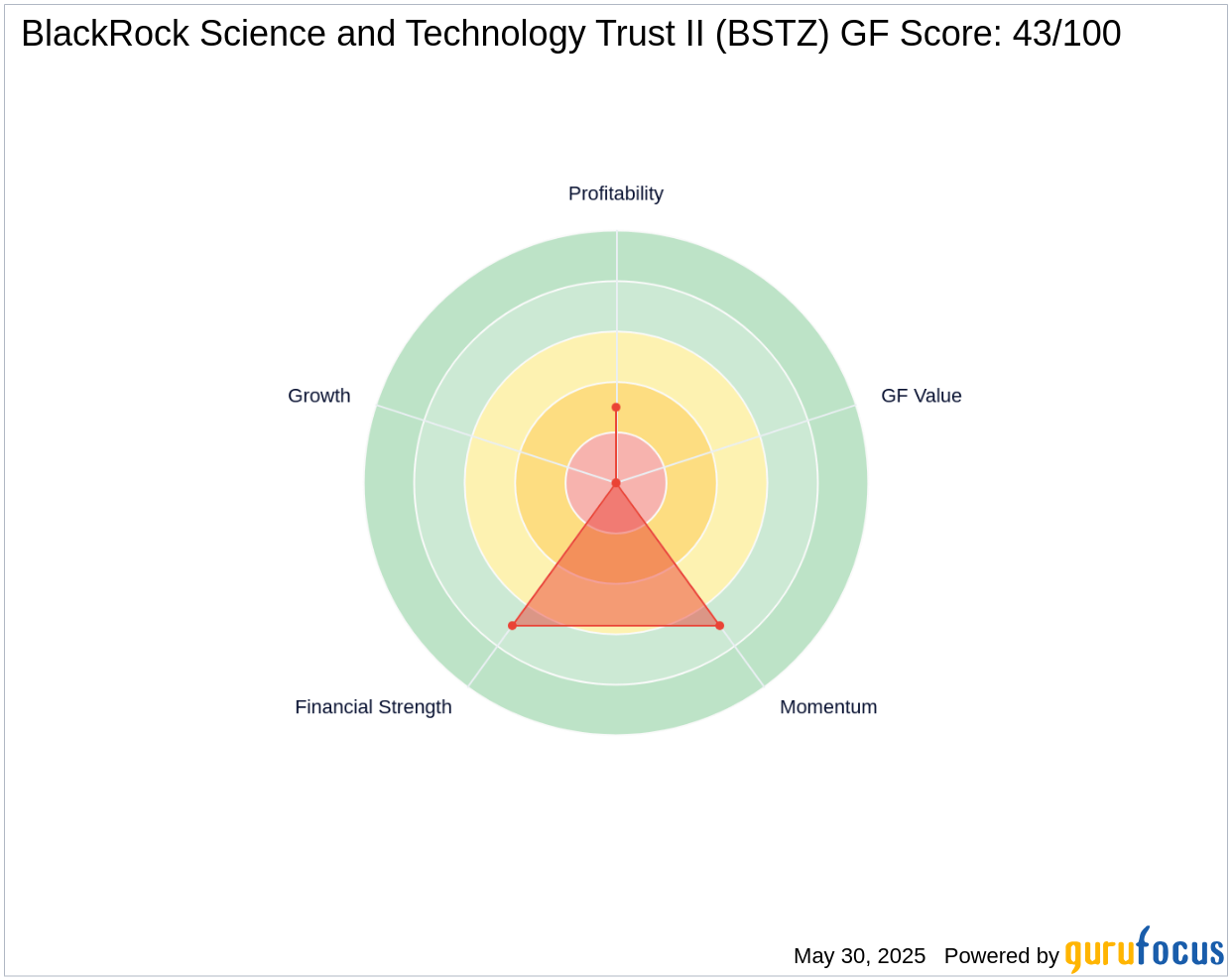

BSTZ's financial performance presents a mixed picture. The trust has a price-to-earnings ratio of 5.32, indicating a potentially undervalued position. However, its year-to-date performance shows a decline of -6.63%. The [GF Score](https://www.gurufocus.com/term/gf-score/BSTZ) of 43/100 suggests poor future performance potential. The trust's [Financial Strength](https://www.gurufocus.com/term/rank-balancesheet/BSTZ) is ranked 7/10, while its [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/BSTZ) is 3/10, highlighting areas for improvement in profitability.

Analysis of Stock Performance

Since the transaction, BSTZ has experienced a price gain of 2.75%. The trust's return on equity (ROE) stands at 16.21%, and return on assets (ROA) is 15.86%, indicating efficient use of assets and equity. Over the past three years, revenue growth has been recorded at 5.70%, reflecting moderate expansion. These metrics suggest that while BSTZ faces challenges, it also possesses strengths that could support future performance.

Market and Sector Context

Operating within the Asset Management industry, BSTZ is influenced by broader market trends and sector dynamics. Saba Capital's portfolio is heavily weighted towards Financial Services and Consumer Cyclical sectors, which may impact its investment decisions. BSTZ's momentum and RSI indicators suggest current market trends, with a 14-day RSI of 63.69, indicating a neutral position in terms of market momentum.

Conclusion

The reduction of Saba Capital's stake in BlackRock Science and Technology Trust II reflects a strategic portfolio adjustment. This move may have implications for both the firm's portfolio strategy and BSTZ's future performance. For value investors, the current financial metrics and market conditions present both challenges and opportunities. As Saba Capital continues to navigate the investment landscape, its decisions will likely be guided by a commitment to value and strategic positioning.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.