On May 30, 2025, Loop Industries Inc (LOOP, Financial) released its 8-K filing, reporting its fourth-quarter and full-year fiscal 2025 results. The company, known for its innovative technology in recycling PET plastic and polyester fiber, achieved a notable milestone by generating $10.8 million in revenue for the quarter ending February 28, 2025. This revenue was primarily driven by the sale of its first technology license to Reed Societe Generale Group and engineering services to its India joint venture.

Company Overview

Loop Industries Inc is a technology and licensing company focused on promoting sustainable plastic solutions. The company utilizes patented technology to depolymerize waste PET plastic and polyester fiber into monomers, which are then repolymerized into virgin-quality PET plastic resin and polyester fiber. This process supports the global shift towards a circular economy by reducing reliance on fossil fuels and enabling consumer goods companies to meet sustainability goals.

Financial Performance and Challenges

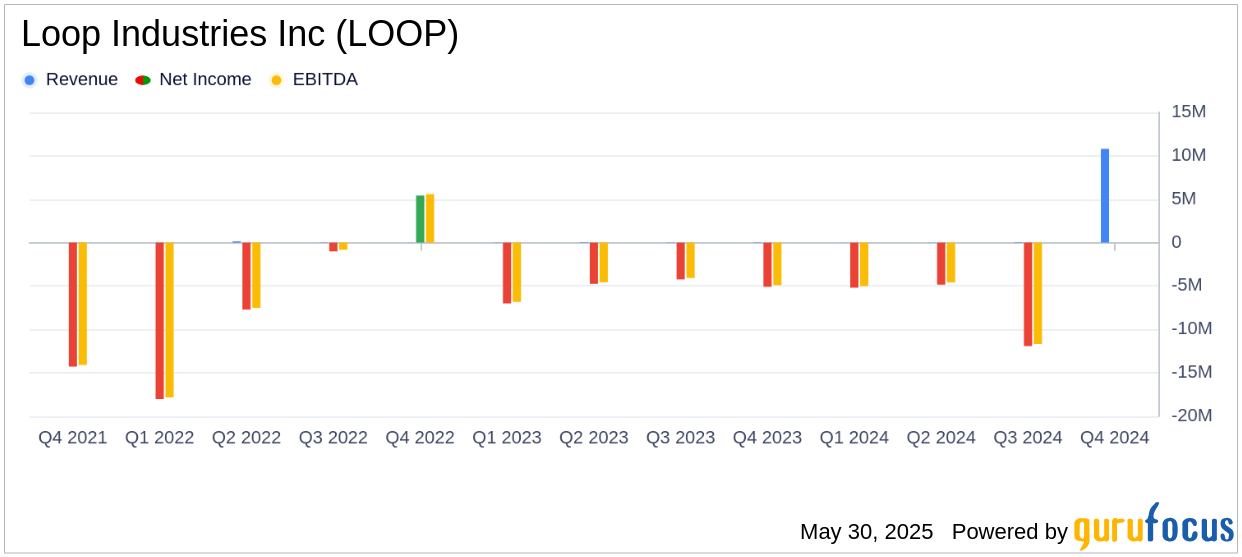

Loop Industries Inc reported a significant increase in revenue, reaching $10.8 million in Q4 2025, compared to just $45,000 in the same period the previous year. This surge was largely due to $10.4 million in licensing revenue from Reed Societe Generale Group and $0.4 million from engineering fees. The company's ability to secure such substantial licensing revenue is crucial for its growth and sustainability in the competitive chemicals industry.

Despite the positive revenue figures, Loop Industries faces challenges, including the need to secure customer off-take contracts for its India project and manage the financial implications of its joint ventures. The company's focus on negotiating these contracts is vital for ensuring the success of its Infinite Loop™ India facility, which is expected to have an annual production capacity of 70,000 metric tons.

Key Financial Achievements

Loop Industries' financial achievements in Q4 2025 include securing $20.8 million through the sale of its technology license and the issuance of Series B Convertible Preferred Stock. The company ended the quarter with $13.0 million in cash and cash equivalents, providing sufficient liquidity to fund operations and future projects. This financial stability is essential for Loop Industries as it continues to expand its technology and commercial capabilities.

Income Statement Highlights

| Metric | Q4 2025 | Q4 2024 | Change |

|---|---|---|---|

| Revenue | $10,809,000 | $45,000 | $10,764,000 |

| Net Income (Loss) | $6,882,000 | $(5,091,000) | $11,973,000 |

The company's net income for Q4 2025 was $6.9 million, a significant improvement from a net loss of $5.1 million in the same period the previous year. This turnaround was driven by increased revenue and reduced research and development expenses, which decreased by $1.7 million.

Analysis and Commentary

Loop Industries' strategic focus on licensing its technology and expanding its global footprint through joint ventures is beginning to yield positive financial results. The company's ability to generate substantial licensing revenue and secure partnerships with major industry players like Reed Societe Generale Group highlights its potential for long-term growth.

Daniel Solomita, Founder and CEO of Loop, stated, "Generating over $10 million this quarter, primarily through the sale of our first technology license, marks a significant financial milestone for Loop. We continue to make advancements in our European partnership with Reed Societe Generale Group, which are enabling us to execute on our technology modularization strategy."

As Loop Industries progresses with its Infinite Loop™ India project and explores opportunities in Europe, its focus on reducing capital expenditures and construction timelines through modular technology implementation will be critical. The company's commitment to sustainability and innovation positions it well to capitalize on the growing demand for recycled plastics and sustainable solutions in the chemicals industry.

Explore the complete 8-K earnings release (here) from Loop Industries Inc for further details.