Morgan Stanley has adjusted its price target for Red Rock Resorts (RRR, Financial), increasing it from $43 to $47 while maintaining an Equal Weight rating on the shares. This decision comes after the firm revised its estimates modestly across the board for its Gaming & Lodging segment, reflecting better-than-expected first-quarter results and guidance in line with expectations. Additionally, adjustments were made to account for higher multiples. Despite the positive revisions, the analyst notes that the market continues to exhibit a short-term pessimistic outlook, as seen in the discounted valuations within the sector.

Wall Street Analysts Forecast

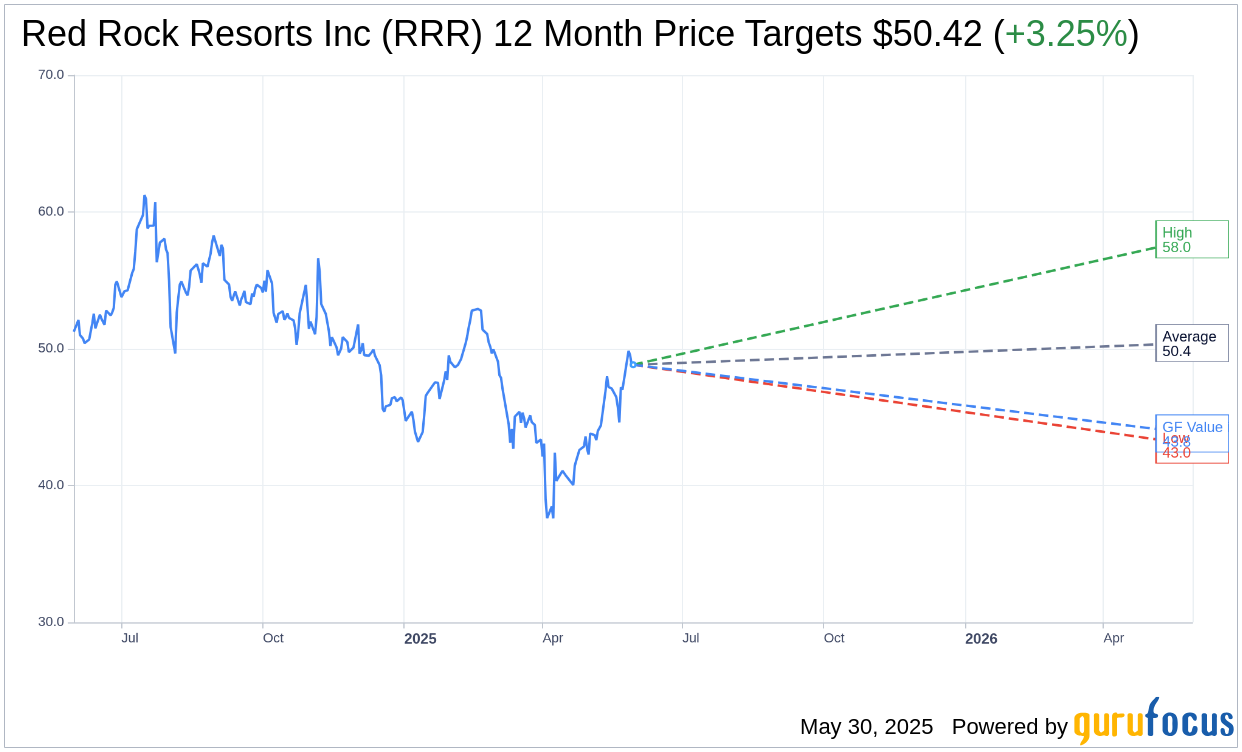

Based on the one-year price targets offered by 12 analysts, the average target price for Red Rock Resorts Inc (RRR, Financial) is $50.42 with a high estimate of $58.00 and a low estimate of $43.00. The average target implies an upside of 3.25% from the current price of $48.83. More detailed estimate data can be found on the Red Rock Resorts Inc (RRR) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Red Rock Resorts Inc's (RRR, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Red Rock Resorts Inc (RRR, Financial) in one year is $43.81, suggesting a downside of 10.28% from the current price of $48.83. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Red Rock Resorts Inc (RRR) Summary page.

RRR Key Business Developments

Release Date: May 01, 2025

- Las Vegas Operations Net Revenue: $495 million, up 1.9% from the prior year's first quarter.

- Las Vegas Operations Adjusted EBITDA: $235.9 million, up 2.7% from the prior year's first quarter.

- Las Vegas Operations Adjusted EBITDA Margin: 47.7%, an increase of 34 basis points from the prior year.

- Consolidated Net Revenue: $497.9 million, up 1.8% from the prior year's first quarter.

- Consolidated Adjusted EBITDA: $215.1 million, up 2.8% from the prior year's first quarter.

- Consolidated Adjusted EBITDA Margin: 43.2%, an increase of 42 basis points from the prior year.

- Operating Free Cash Flow: $93 million or $0.88 per share, converting 43% of adjusted EBITDA.

- Cash and Cash Equivalents: $150.6 million at the end of the first quarter.

- Total Principal Amount of Debt: $3.4 billion, resulting in net debt of $3.3 billion.

- Net Debt-to-EBITDA Ratio: 4.1x at the end of the first quarter.

- Distributions to LLC Unitholders: Approximately $27.6 million, including $16.1 million to Red Rock Resorts.

- Capital Spend: $68.2 million in the first quarter, with $32.2 million in investment capital and $36 million in maintenance capital.

- Full Year 2025 Capital Spend Expectation: Between $350 million and $400 million.

- Special Cash Dividend: $1 per Class A common share, payable on May 21.

- Regular Cash Dividend: $0.25 per Class A common share, payable on June 30.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Red Rock Resorts Inc (RRR, Financial) achieved its highest first-quarter net revenue and adjusted EBITDA in history for its Las Vegas operations.

- The Durango Casino Resort continues to show positive momentum, adding over 95,000 new customers to the database and is on pace to become one of the highest margin properties.

- The company successfully converted 43% of its adjusted EBITDA into operating free cash flow, generating $93 million or $0.88 per share.

- Red Rock Resorts Inc (RRR) announced a special cash dividend of $1 per Class A common share, reflecting confidence in its business model.

- The company has been recognized as a top casino employer in the Las Vegas Valley for the fourth consecutive year and certified as a Great Place to Work for three years running.

Negative Points

- Some cannibalization has occurred at the Red Rock property due to the opening of the Durango Casino Resort.

- Insurance costs are creeping up and are expected to remain a headwind throughout 2025.

- The company is facing challenges with construction disruptions at its properties, particularly at Durango and Green Valley Ranch.

- There are concerns about potential impacts from tariffs on construction materials, which could affect project costs.

- The company has a high net debt of $3.3 billion, resulting in a net debt-to-EBITDA ratio of 4.1x.