Key Highlights:

- Modine (MOD, Financial) to acquire L.B. White for $112 million, boosting earnings and savings.

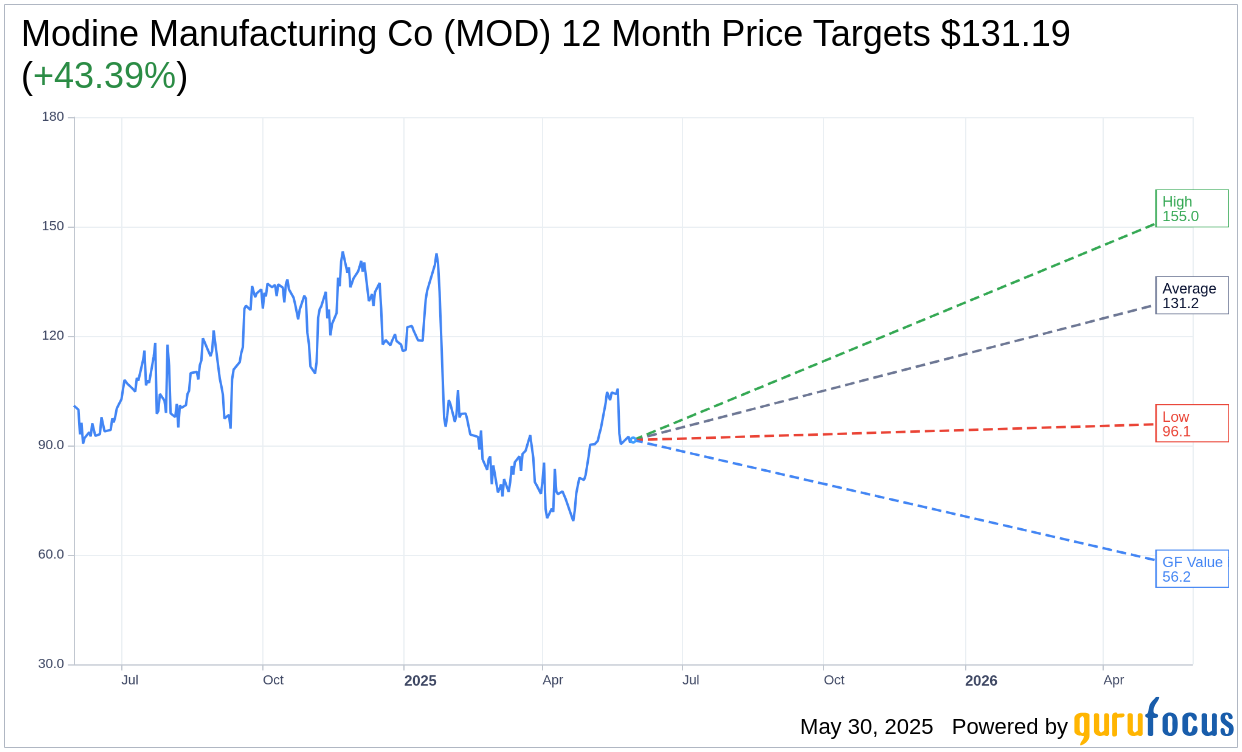

- Analysts predict a 43.39% upside for Modine with an average target price of $131.19.

- Current GF Value suggests a potential downside of 38.54% from current prices.

Modine's Strategic Acquisition

Modine Manufacturing Co (MOD) has signed a definitive agreement to acquire L.B. White for approximately $112 million, with the transaction anticipated to close by May 31, 2025. This strategic acquisition is poised to immediately enhance Modine's earnings. The company's operating model is expected to drive further growth and deliver substantial cost savings. Looking ahead, L.B. White is projecting revenues of $73.5 million for the year 2025.

Wall Street's Perspective on Modine

According to the latest data from six analysts, the average one-year price target for Modine Manufacturing Co (MOD, Financial) stands at $131.19. The range of projections spans from a high of $155.00 to a low of $96.11. This average target price suggests a potential upside of 43.39% compared to the current stock price of $91.49. For more detailed analyst insights, you can visit the Modine Manufacturing Co (MOD) Forecast page.

Analyst Recommendations

The consensus among seven brokerage firms rates Modine Manufacturing Co (MOD, Financial) at an average recommendation score of 1.9, indicating that the stock is expected to "Outperform." This rating scale ranges from 1, which is considered a Strong Buy, to 5, denoting a Sell. Such positive sentiment from analysts underscores a strong belief in Modine's future performance and growth potential.

GuruFocus Valuation

Based on GuruFocus estimates, the GF Value for Modine Manufacturing Co (MOD, Financial) is projected to be $56.23 in one year. This estimation implies a potential downside of 38.54% from the current trading price of $91.49. The GF Value represents GuruFocus' assessment of the fair value of the stock, derived from historical trading multiples, past growth rates, and future business performance estimates. To delve deeper into Modine's valuation, explore the detailed insights available on the Modine Manufacturing Co (MOD) Summary page.