Loop Capital has adjusted its price target for Burlington Stores (BURL, Financial), lowering it slightly from $315 to $305 while maintaining a Buy rating on the stock. This adjustment follows Burlington's better-than-anticipated first-quarter results. Despite the strong performance, the company is experiencing a minor reduction in sales forecasts due to uncertain macroeconomic conditions.

In the long term, Loop Capital remains optimistic about Burlington's prospects, believing that the brand will benefit from market share expansion as department stores continue to close and become less relevant. This perspective supports their continued positive outlook on BURL.

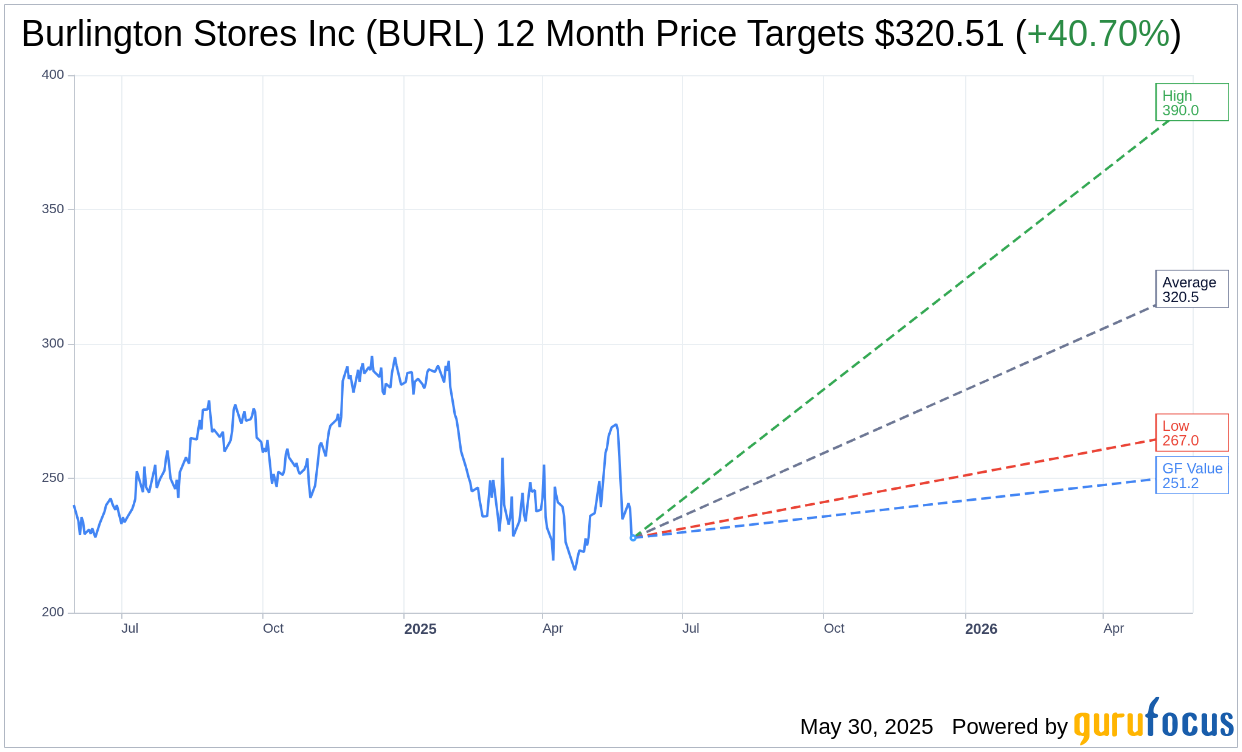

Wall Street Analysts Forecast

Based on the one-year price targets offered by 18 analysts, the average target price for Burlington Stores Inc (BURL, Financial) is $320.51 with a high estimate of $390.00 and a low estimate of $267.00. The average target implies an upside of 40.70% from the current price of $227.80. More detailed estimate data can be found on the Burlington Stores Inc (BURL) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Burlington Stores Inc's (BURL, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Burlington Stores Inc (BURL, Financial) in one year is $251.24, suggesting a upside of 10.29% from the current price of $227.8. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Burlington Stores Inc (BURL) Summary page.

BURL Key Business Developments

Release Date: May 29, 2025

- Total Sales Growth: 6% increase in Q1 2025.

- Comp Store Sales: Flat in Q1 2025.

- Gross Margin Rate: 43.8%, up 30 basis points from last year.

- Adjusted EBIT Margin: 6.1%, 30 basis points higher than last year.

- Adjusted EPS: $1.67, an 18% increase over the prior year.

- Comparable Store Inventories: Down 8% versus Q1 2024.

- Total Liquidity: $1.1 billion, including $371 million in cash.

- Net New Stores: 7 net new stores opened in Q1, total store count at 1,115.

- Share Repurchase: $105 million in common stock repurchased in Q1.

- Full-Year Sales Growth Guidance: 6% to 8% increase expected.

- Full-Year Comp Store Sales Guidance: Flat to 2% increase expected.

- Full-Year Adjusted EPS Guidance: $8.70 to $9.30.

- Capital Expenditures: Expected to be approximately $950 million in fiscal 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Total sales grew by 6% on top of 11% growth last year, indicating strong overall performance.

- EBIT margin increased by 30 basis points, and adjusted EPS was up 18% over last year.

- Burlington Stores Inc (BURL, Financial) is maintaining its full-year 2025 guidance, showing confidence in its strategic plans.

- The company has a robust plan to open 100 net new stores in 2025, with a strong pipeline for 2026.

- Burlington Stores Inc (BURL) has successfully acquired 46 leases from Joanne's fabrics, enhancing its store expansion strategy.

Negative Points

- Comp store sales were flat, indicating a slowdown in growth compared to previous periods.

- The impact of tariffs and the state of the consumer are major sources of uncertainty, potentially affecting future performance.

- There is concern about macroeconomic indicators, with increased probability estimates for a recession later this year.

- The company faces potential risks from inflation, which could impact consumer spending, especially among lower-income customers.

- The volatility in imports could lead to increased ocean freight expenses, posing a risk to maintaining contracted rates.