In the latest analyst activity concerning Columbia Sportswear (COLM, Financial), Needham has initiated coverage on the stock. The initiation comes with a "Hold" rating, as announced by analyst Tom Nikic on May 30, 2025.

This move by Needham brings Columbia Sportswear (COLM, Financial) into focus, as the firm provides new investment perspectives on this NASDAQ-listed company. Although no price target has been disclosed, the "Hold" rating implies a neutral outlook from Needham, suggesting that investors should neither buy nor sell the stock at this time.

Columbia Sportswear, renowned for its outdoor and active lifestyle apparel, will be closely monitored by stakeholders as this new rating potentially impacts future trading decisions. Keep an eye on further updates and professional analyses related to Columbia Sportswear (COLM, Financial) as the investment landscape for this company continues to evolve.

Wall Street Analysts Forecast

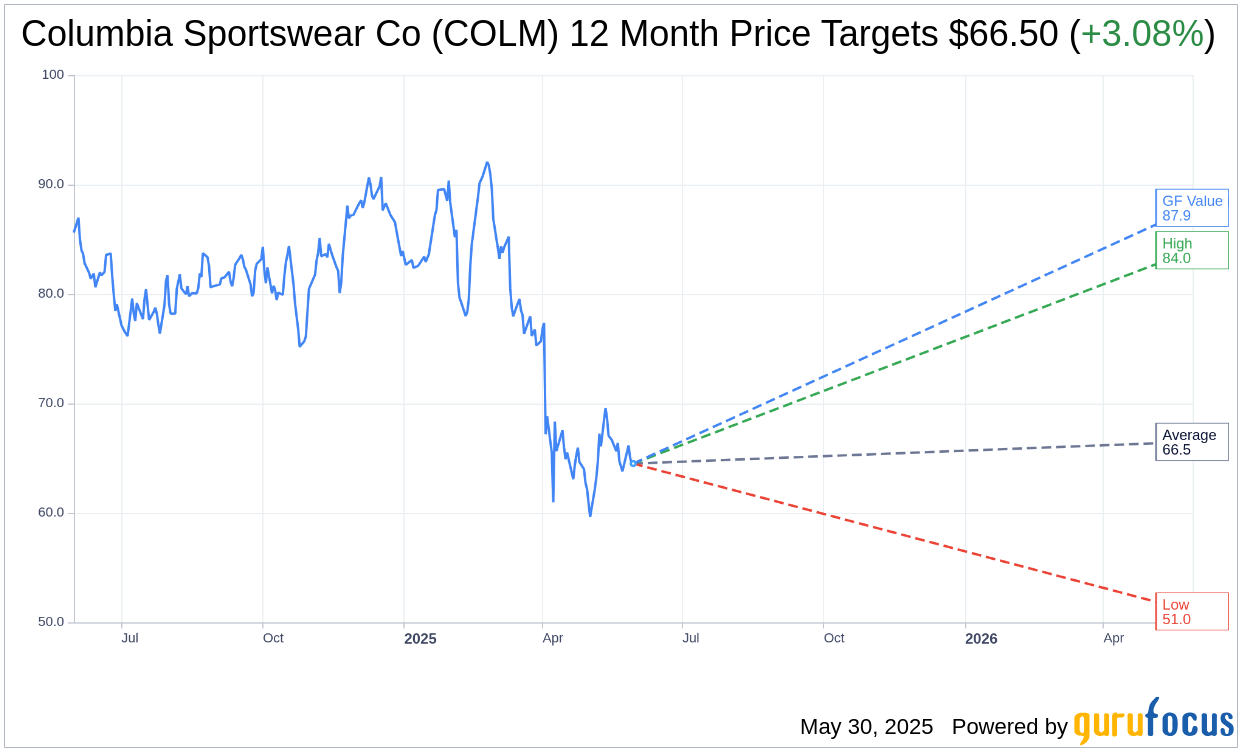

Based on the one-year price targets offered by 8 analysts, the average target price for Columbia Sportswear Co (COLM, Financial) is $66.50 with a high estimate of $84.00 and a low estimate of $51.00. The average target implies an upside of 3.08% from the current price of $64.51. More detailed estimate data can be found on the Columbia Sportswear Co (COLM) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Columbia Sportswear Co's (COLM, Financial) average brokerage recommendation is currently 2.9, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Columbia Sportswear Co (COLM, Financial) in one year is $87.88, suggesting a upside of 36.23% from the current price of $64.51. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Columbia Sportswear Co (COLM) Summary page.